Terra has recently made many headlines due to its meteoric gains. Unfortunately, this can occasionally lead to confirmation bias in how we view the stats behind our most beloved crypto assets.

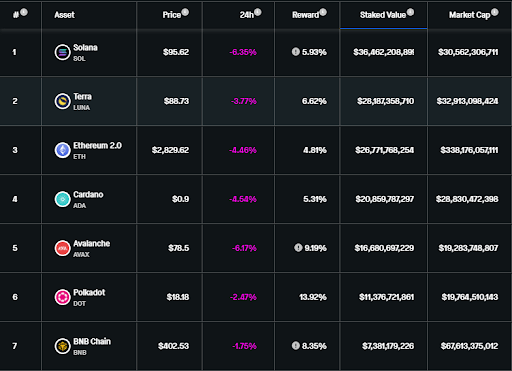

If you’ve been reading around the cryptosphere this week, you will be forgiven for believing that Terra is now the second-largest asset by staking value. For example, stakingrewards.com tweeted this week how Terra has overtaken Ethereum 2.0 staking.

Terra $LUNA is now the 2nd largest PoS network by Staking market cap having overtaken Ethereum 2.0 $ETH

Source: https://t.co/R9BVR4Ce4W pic.twitter.com/33CgPrr99a

— Staking Rewards (@StakingRewards) March 1, 2022

Whilst it is true that Terra has seen an increase in the staked value in $USD over the past few weeks, this does not tell the whole story.

Staked Luna down 416 million from ATH

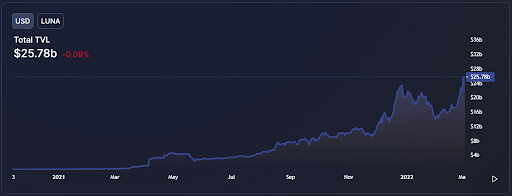

Most people only look at crypto charts in $USD, making it easier to understand in ‘real world’ terms. However, if we look at the current value of Terra staked in $USD, we are currently at an all-time high of around $25 billion. This paints a picture that investors are more bullish than ever on staking Terra.

However, when we look instead at the actual amount of Terra staked, we get a completely different story.

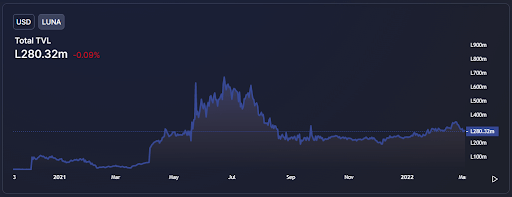

The all-time high for the amount of Terra staked was back in July 2021 at around 667 million Terra whilst today’s TVL sits at just 280 million Terra. If we zoom in further, it worsens as we are not even at a local high, with the locked value dropping 19% since February 18.

This does not instill the confidence that other headlines focusing only on the $USD value are purporting. However, whether investors are unstaking to take profits from the recent 78% gains is anyone’s guess at this stage.

Has Luna overtaken ETH2.0?

Now, let’s look at the data that supports the theory that Terra has overtaken ETH2.0 staking. As we can see, this first chart from stakingrewards.com does in fact show Terra ahead of ETH2.0 and second only to Solana.

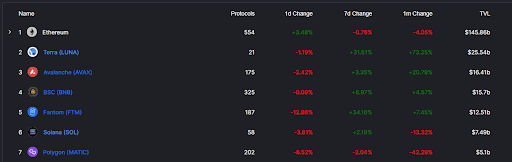

However, a similar chart from defillama.com suggests that Ethereum has over $100b more in locked value and, in fact, Terra is ahead of Solana by quite some margin.

So. How can this be? Perhaps, there is a conspiracy to make Ethereum look inferior by some interested parties? Is one dashboard more reliable than the other?

The short answer is no. DeFI Llama looks at more than Eth2.0 staking when calculating TVL figures. For example, the than its counterpart, which likely explains the difference in reported total staking value.

It is essential to look beyond just the $USD value when assessing crypto assets. A pump such as that experienced by Luna will cause a correlating surge in staking values for the asset in question. As a result, staking outflows can hide from the untrained eye. Furthermore, not all dashboards use the same data, so there can be a lot to be learned by exploring different platforms.

The post Total amount of Luna tokens staked down 62% from ATH even amid massive price rally appeared first on CryptoSlate.