Crypto.com has been at the center of the media spotlight since its creation in June 2016.

Among other things, the company has:

- Burned through approximately 70 billion CRO in circulation before launching the mainnet Crypto.org chain in March 2021

- Launched the sidechain Cronos

- Bought the 20-year naming rights to the NBA Lakers’ home arena for $700 million.

These strategies have seen its CRO price rise multiple times and raised awareness about the company, and cryptocurrencies more broadly, among the general public.

But then there was a setback.

On Jan. 17, it was revealed that the network was attacked, with users losing about $35 million. This caused the price of CRO to fall again.

What happened since then and what the future might hold for Crypto.com?

About Crypto.com

Crypto.com is a platform with 10 million users that lets users buy, sell and trade over 250 cryptocurrencies and enjoy lower transaction fees compared to doing so on Ethereum. In addition, the platform offers cryptocurrency credit cards, standalone crypto wallets, decentralized exchanges, and supports NFTs based on Ethereum.

What is CRO?

CRO is a native token issued by Crypto.com with a total supply of 100 billion before burning and over 25.3 billion currently in circulation. The platform offers a variety of services that are essentially performed by CRO, including applying for a CRO Visa card, staking, Crypto Earn, liquidity mining, and sale and purchase NFTs.

- Visa Card: Users can stake a certain number of CROs and apply for different levels of Visa cards after 180 days of staking. Eligible transactions after spending are immediately rewarded with a 1% to 8% CRO rewards.

- Crypto Earn: More similar to traditional bank fixed deposits, but Crypto Earn earns much higher returns than banks. Depending on the number of CROs staking, you can enjoy a coin deposit rate of 10% to 14%.

- Payment transaction fees: CRO can be used as a payment fee within the Crypto.com exchange and receive a fee discount. Crypto.com will be lower compared to Ethereum fees.

While there are a number of benefits for users to staking CRO, there is a risk of devaluation should the CRO currency price be on the downside. It is usually not recommended to store too much currency on the platform.

Three Turning Points for CRO

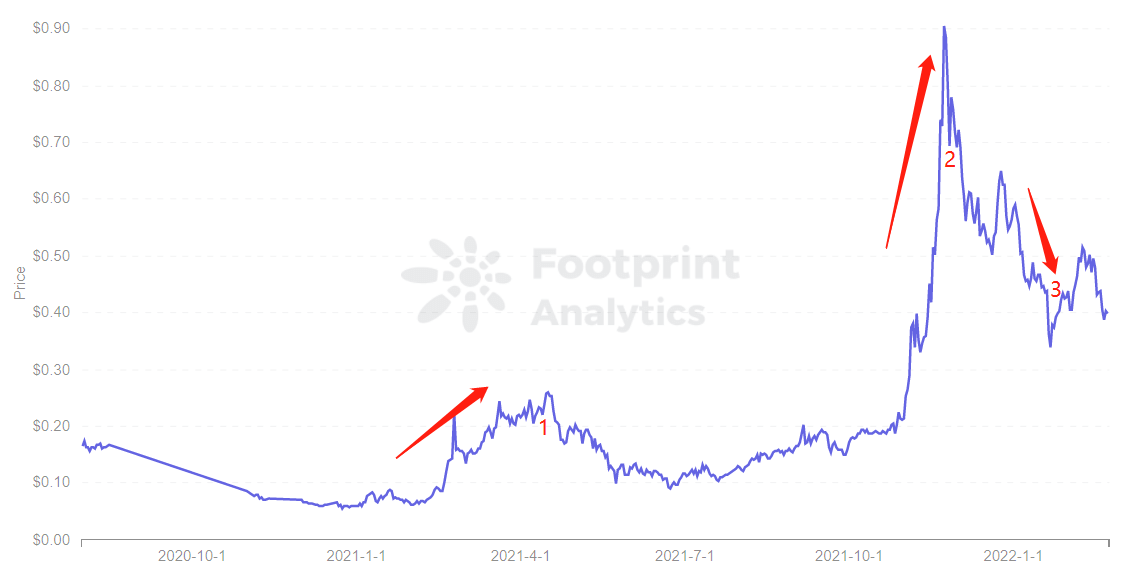

Footprint Analytics data shows the price of CRO at $0.40 as of Feb. 22, up 81% YoY.

Three major events affected its price action:

- By March 2021, Crypto.com burned 70 billion CROs in preparation for full decentralization, which also increased the circulation rate of CRO from 24% to 83%. On March 25, Crypto.com launched its main Crypto.org Chain, pushing CRO from $0.16 to $0.26, an increase of 62.5%.

- In Nov. 2021, Crypto.com launched EVM-compatible Cronos and a marketing partnership with various teams and celebrities, and paid $700 million for the 20-year naming rights to the NBA Lakers’ home arena (Staples Center). This pushed the CRO price to an all-time high of $0.9. Compared to the beginning of January 2021, the increase is 1451%.

- In mid-January 2022, Crypto.con was exposed to a cyber attack that cost users nearly $35 million. The platform has fixed the vulnerability and compensated all affected users. The price of CRO was expected to exceed $1 per coin, but after the attack, it dropped again and again to $0.4.

Therefore, even if Crypto.com gains popularity through burning mechanisms and marketing partnerships, the coin price will be affected to some extent once there are issues with the security of funds.

Price Impact for the Sidechain Cronos

On Nov. 8, 2021, Crypto.com launched its own ethereum-compatible Cronos, a sidechain to Crypto.org, with both running simultaneously.

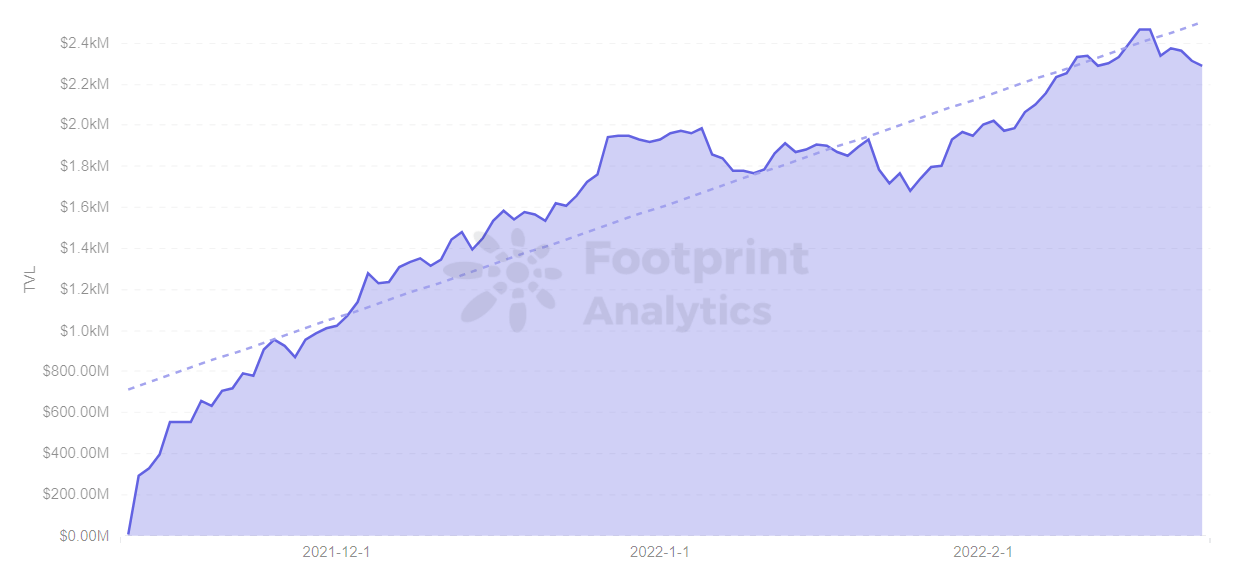

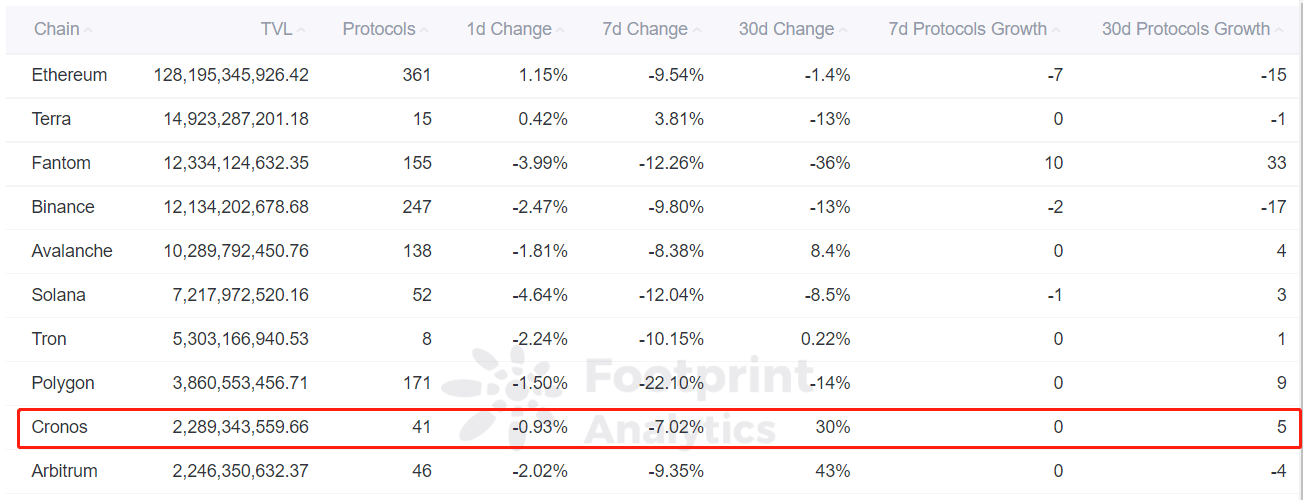

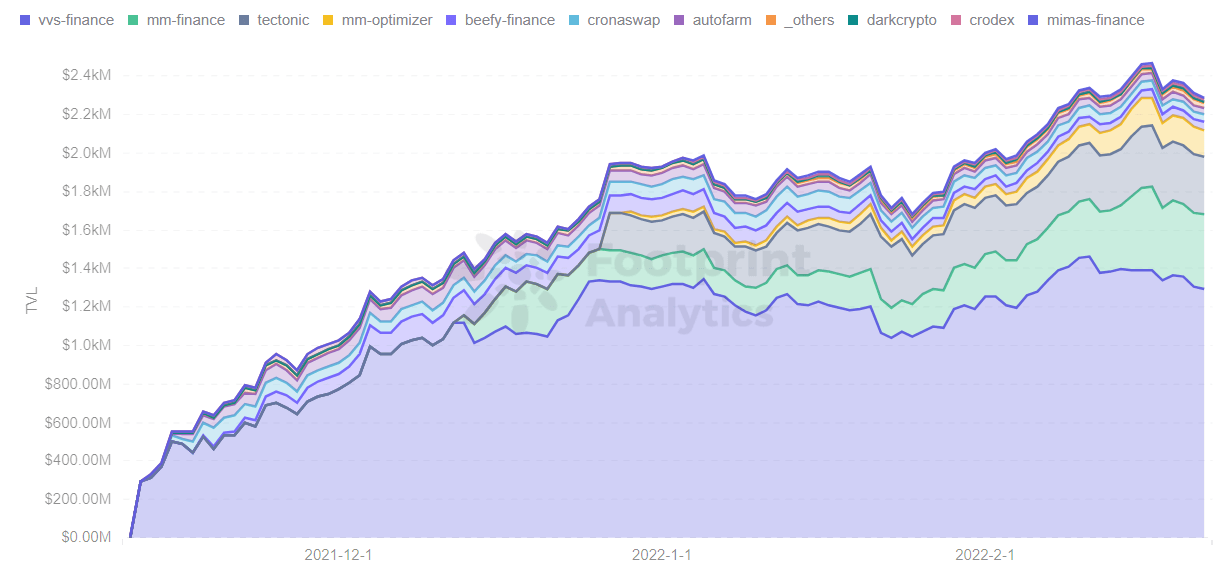

CRO is also the native token of the Cronos. According to Footprint Analytics, Cronos’ TVL has climbed since its launch, and TVL has not been affected by the fall in CRO’s coin price. This also means that it is cheaper to use CRO as a fee for transactions on the Cronos.

In addition, Cronos has already ranked in the top 9 blockchains within 4 months since launched , which implies that it is crucially important to launch a blockchain that is cheaper and faster than Ethereum.

Currently, there are 41 protocols on the Cronos, and the largest proportion of Cronos TVL is VVS Finance, which is the DeFi protocol used by most users. Users can use its VVS Token to provide liquidity mining, which can earn between 50% and 70% annualized return.

In all, Crypto.com has been online for more than 5 years now, while the mainnet and sidechain came online after the DeFi boom. If Cronos had launched earlier, it might have been able to outperform other blockchains such as Tron, based on the current growth trend of TVL, instead of competing with many blockchains as it is now.

Summary

The attack on Crypto.com has put its CRO coin price on a downward trend, while the TVL of the sidechain Cronos has not been affected for the time being. The Crypto.com team also acted quickly to fix the vulnerability and compensate the loss to users.

With a newfound focus on security in addition the expansion of the Cronos chain, Crypto.com could continue to see TVL growth.

Date and Author: February 08 2022, Vincy

Data Source: Footprint Analytics – Cronos Dashboard

This article is contributed by Footprint Analytics community.

What is Footprint Analytics?

Footprint Analytics is an all-in-one analysis platform to visualize blockchain data and discover insights. It cleans and integrates on-chain data so users of any experience level can quickly start researching tokens, projects, and protocols. With over a thousand dashboard templates plus a drag-and-drop interface, anyone can build their own customized charts in minutes. Uncover blockchain data and invest smarter with Footprint.

The post Crypto.com’s Ups and Downs Highlight Importance of Security appeared first on CryptoSlate.