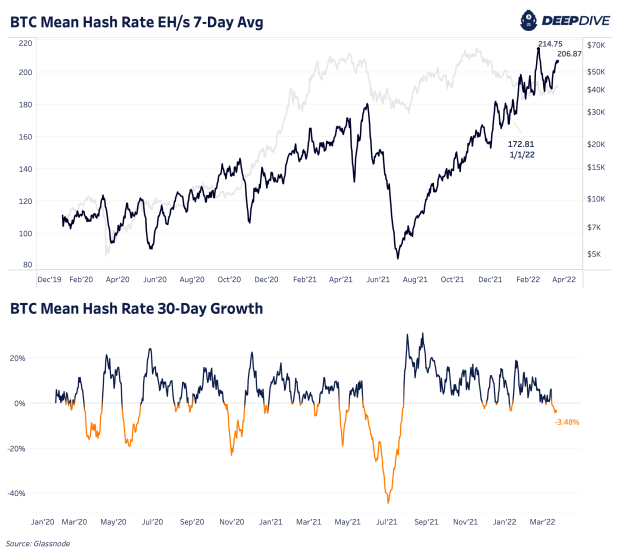

Analyzing the changes in average hash rate to measure miner capitulation in the bitcoin market can be a market indicator for miner capitulation.

The below is from a recent edition of the Deep Dive, Bitcoin Magazine’s premium markets newsletter. To be among the first to receive these insights and other on-chain bitcoin market analysis straight to your inbox, subscribe now.

In today’s analysis we cover the dynamics in the mining industry, with a particular focus on hash ribbons as a market indicator. We have covered the hash ribbons market indicator multiple times in previous daily issues, in particular on August 10, titled “One of The Biggest Indicators In Bitcoin Flashes,” before bitcoin rallied 50% over the following three months.

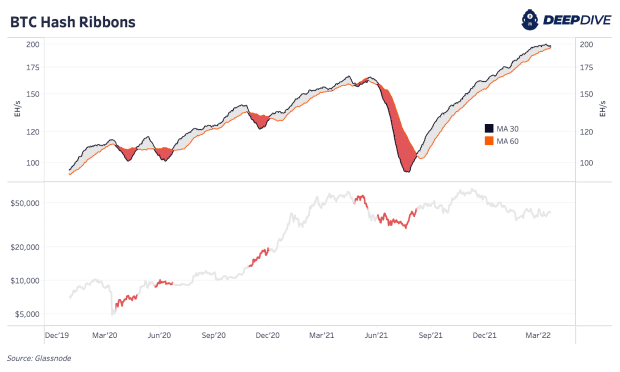

Hash ribbons take the 30-day and 60-day moving average of the Bitcoin hash rate, which is used to determine when sufficient miner capitulation has occurred.

Hash ribbons serve as such an effective and historically accurate buy indicator for bitcoin because it uses the changes in bitcoin hash rate to measure miner capitulation in the bitcoin market.

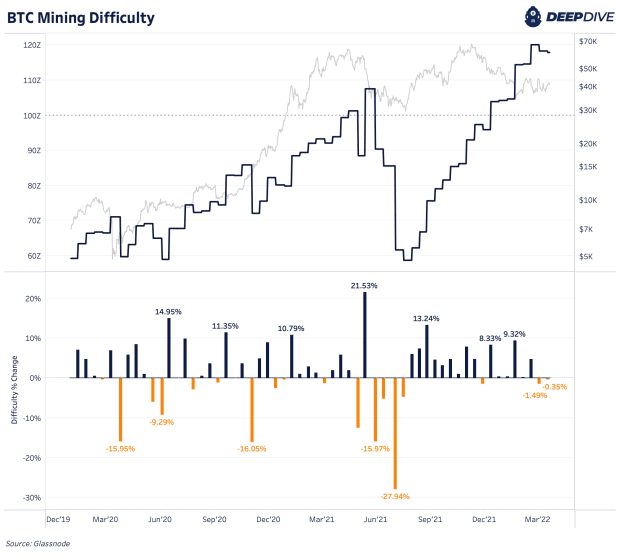

During periods when mining operations are turning off their rigs, it shows that it is uneconomical to mine. Hash rate declines, blocks are mined slower than the 10-minute block target, and eventually difficulty will adjust downwards to encourage these miners to plug back in.

As of the two most recent difficulty epochs, the short-term trend has been lower hash rate. Yet if we are in a secular trend of increasing hash rate, expect mining-related equities and bitcoin mining machines themselves to likely underperform bitcoin the asset during times when hash rate rises faster than the price of bitcoin. This is due to the inelastic supply issuance of the asset in an increasingly competitive global mining arms race.