It seems that the more intense the chaos, the deeper the changes emerge from it. In the present post-Covid-19 chaos of supply disruptions, 40-year high inflation rates, and a war in Europe—we seem to be on the brink of a major monetary pivot. To understand its implications and how digital assets fit into it, we first must revisit the previous reset.

World War II as the First Great Reset

As World War II chaos was coming to closure in July 1944, it birthed a new paradigm we still live in today. In the Bretton Woods mountain resort, 44 nations set up a new international monetary system. The arrangement was simple.

As the economic and military powerhouse, the US would become the monetary center, as other nations would peg their currencies to the dollar. In turn, the dollar itself would be pegged to US gold reserves, at $35 per ounce. Other nations would then contract or expand their USD supply within the 1% range of the fixed-rate, as investors used forex brokers to exchange foreign currencies.

President Richard Nixon abandoned the gold peg in 1971—and effectively the Bretton Woods system altogether—framing it as “There is no longer any need for the United States to compete with one hand tied behind her back.” Yet, the Bretton Woods legacy remained. Both the International Monetary Fund (IMF) and the World Bank have served as key cogs for the post-Bretton Woods era – the petro-dollar.

The US as the World’s Money Controller

President Nixon was correct in that the gold peg hobbled US expansion. On both sides of the equation, the gold peg has a number of issues:

- Because the money supply was constrained by a fixed exchange rate, so too were the government’s expansionary policies. These ranged from unemployment interventions to military spending.

- Furthermore, the gold peg was a double-edged sword. Although countries that pegged their currencies to the dollar ceded some of their domestic economic policies, they could also redeem dollars for gold.

- While the gold itself is rare and expensive to mine, its supply is not fixed. Even so, its supply doesn’t match up with the economic growth of the global economy.

- If a nation falls into a deficit, when the government’s income is lower than its spending, it has fewer options available to right the course around the recession storm.

Altogether, it was the last point that made Nixon cut off the gold peg. He needed the Federal Reserve to provide an inexpensive money supply via lower interest rates. In this way, the economy would be flooded with cash, meaning it would grow sufficiently to offset a recession, regardless of the dollar being devalued in the process. Sound familiar?

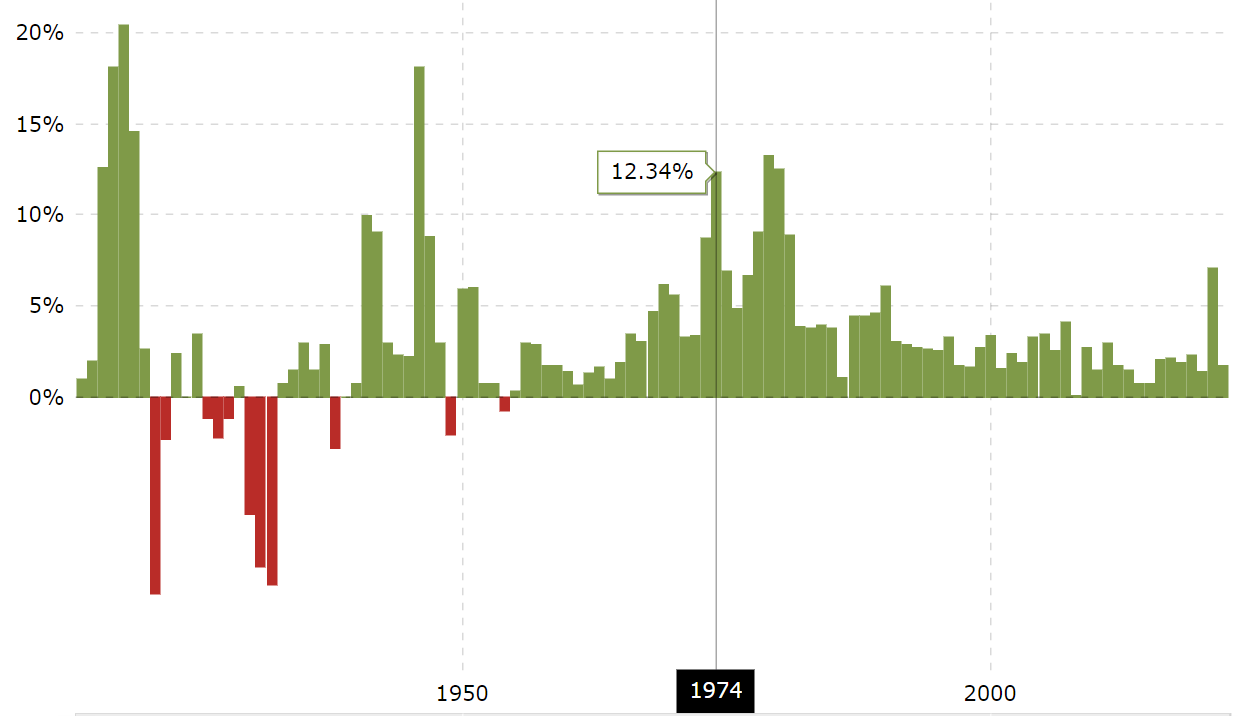

We have certainly seen record-high stock market gains thanks to the Fed’s injection of trillions of USD, which triggered a new era of retail traders using commission-free stock trading platforms. Needless to say, with the stabilizing gold peg gone, the 1970s were a period of the Great Inflation, just as appears to be happening now.

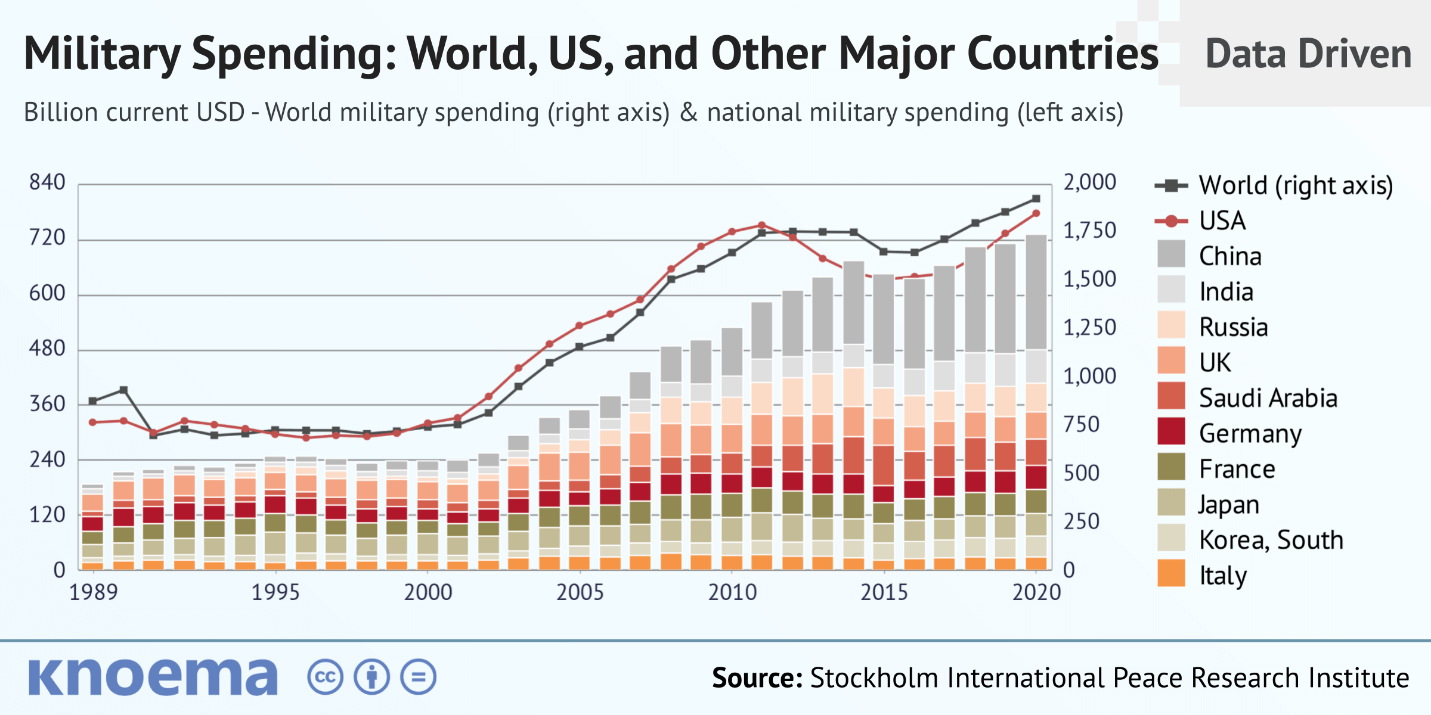

Nonetheless, things would have been worse without the USD growing into its petrodollar status. In a nutshell, the USD has become the world’s global reserve currency because the US spends nearly as much on the military as the entire world.

With influence over Europe stemming from WWII firmly entrenched and its control over the Gulf states, the US has been using the petrodollar as a vehicle to offset the downsides of unlocking its money supply and relentless spending. Both OPEC (Organization of Petroleum Exporting Countries) and non-OPEC nations, such as Russia and Qatar, have been using dollars to trade oil and gas.

Such a system holds a glaring vulnerability that the West punctured this March, as it took unprecedented financial moves against Russia.

New World Monetary Order Emerging

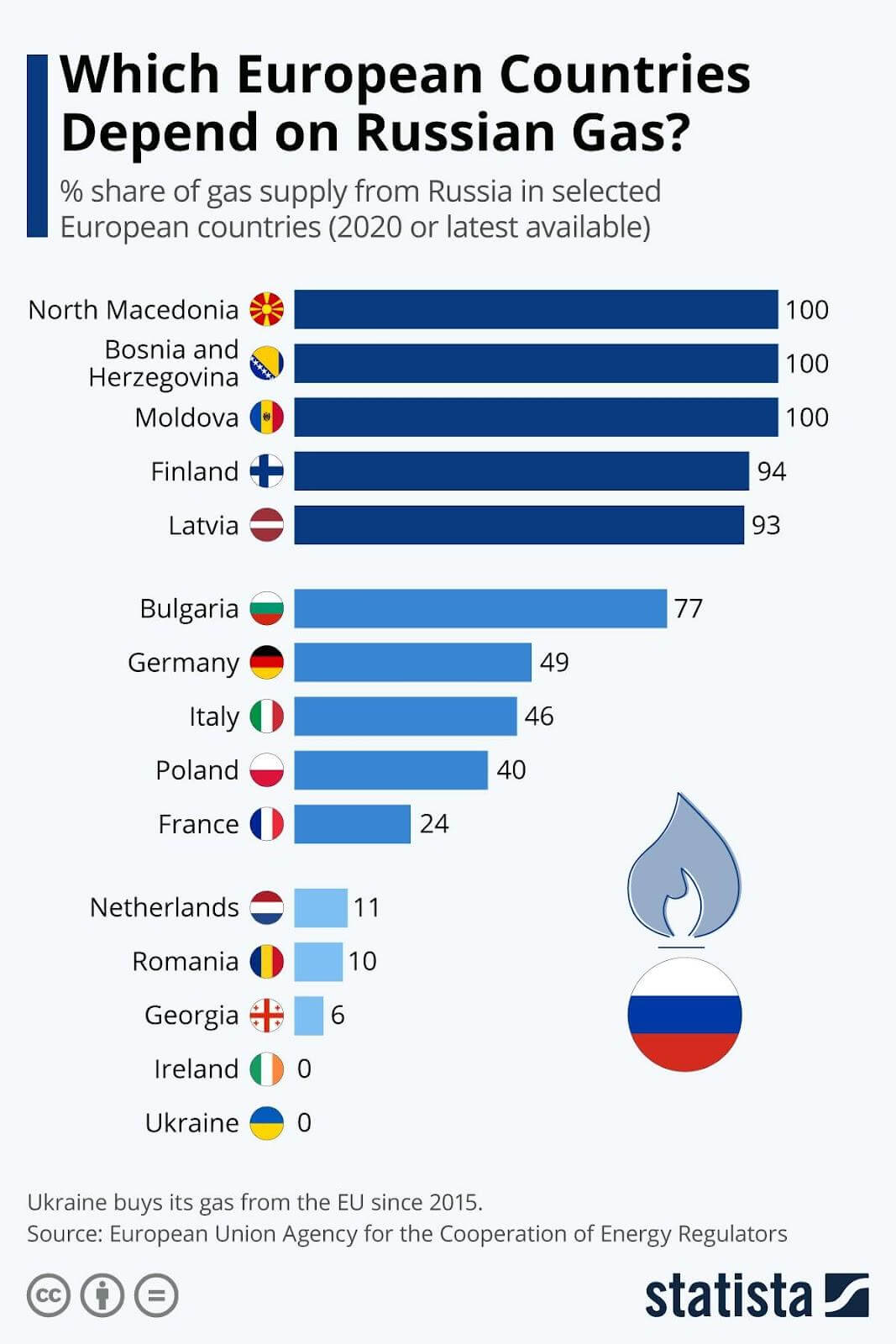

As a nation with the world’s largest landmass, Russia holds an abundance of energy reserves. Accordingly, Russia’s main exports are energy-related products, at 63%, of which 26% and 12% constitute crude oil and gas, respectively. This places Russia in a domineering position against Europe, which largely depends on Russian energy imports.

Furthermore, according to National Geographic, Russia and Ukraine are supplying the world with a 12% caloric intake, via 30% wheat production. So, what happens when these two nations go to war with each other?

Much of this depends on the West’s response—which to date, has been sanctioned. It would take quite some time to list all the sanctions against Russia thus far. Suffice to say, the key one was the seizure of Russia’s forex reserves by G7 nations. This marks a clean break from established international norms, which China and India took note of, as well as Saudi Arabia. Consequently, they have all expressed plans or considerations to start trading energy products in non-petrodollar (USD) currencies.

Likewise, President Putin accelerated these considerations by signing an executive order by which unfriendly nations (those that imposed sanctions) would have to pay in Russian rubles for not only oil and gas imports but wheat as well. In other words, Putin has poised the ruble to become a commodity-based currency.

As Zoltan Pozsar, the Former Federal Reserve and U.S. Treasury Department official put it:

“A crisis is unfolding. A crisis of commodities. Commodities are collateral, and collateral is money, and this crisis is about the rising allure of outside money over inside money.”

So far, G7 ministers have rejected Russia’s demand to pay for its energy products in rubles. By the same token, Germany and Austria are already preparing for gas rationing, with the former often dubbed as Europe’s economic engine. Moreover, the CEO of Germany’s multinational BASF SE, the world’s largest chemical producer, warned of a complete supply chain collapse.

“To put it bluntly: This could bring the German economy into its worst crisis since the end of the Second World War and destroy our prosperity. For many small and medium-sized companies, in particular, it could mean the end. We can’t risk that!”

In between the US and Russia, Europe is at a turning point, just like it was in 1944 with the setup of the Bretton Woods monetary order. However, while these cycles seem to repeat, one novelty cannot be dismissed—decentralized networks which have the capability to create sovereign digital money.

Bitcoin – the Global Reserve Currency for the Little Guy

In this midst of the current state of the world’s monetary world order, new assets have emerged that have the potential to remain neutral. This is a critical benefit that Bitcoin offers to the world—a sovereign, stateless, digital currency with a fixed supply.

Unlike gold, however, Bitcoin is also not seizable. If one remembers their recovery seed phrase, they can always restore access to their assets on Bitcoin’s blockchain network. While a recent EU proposal tries to crack down on un-hosted wallets, legislative words are a far cry from technological reality.

Corporate investors are already seeing Bitcoin in this light, as a new Bitcoin Standard is evolving beyond the gold standard. Last week, Michael Saylor’s MicroStrategy took out a BTC-collateralized loan from Silvergate Bank worth $205 million. Why? To buy more BTC of course, on top of MicroStrategy’s already substantial 125,051 bitcoins (~$6 billion).

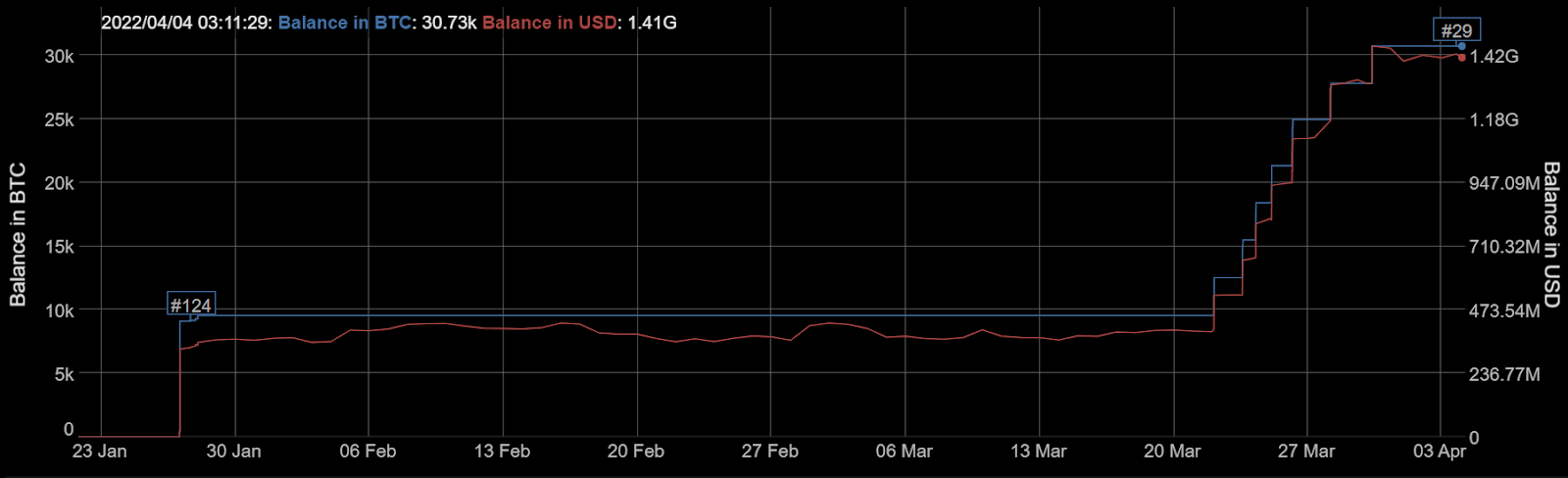

Both parties can only be confident in such debt leveraging if they view Bitcoin’s rise as inevitable. By the same token, Terraform Labs’ foundation is gradually increasing its Bitcoin supply with the end goal to top $10 billion worth of BTC.

This is quite significant as Terra aims to replace both Visa and Mastercard as a global payment system with its algorithmic stablecoin TerraUSD (UST). Just as Russia is in the process of expanding its ruble collateralization with commodities, so is Terra’s UST being collateralized by Bitcoin.

This is quite significant as Terra aims to replace both Visa and Mastercard as a global payment system with its algorithmic stablecoin TerraUSD (UST). Just as Russia is in the process of expanding its ruble collateralization with commodities, so is Terra’s UST being collateralized by Bitcoin.

In turn, Terra’s own ecosystem is bolstered by its Anchor Protocol, which produces a roughly 19% APY on UST deposits. The environment makes yield farming an attractive means of generating passive income, especially when considering the current CPI inflation rate in the US, which is approaching 8%.

The difference is, that Russia must now broker complicated deals with other nations, meaning there are multiple hurdles ahead. In contrast, blockchain assets are native to the internet—where decentralized and secure environments can potentially create conditions without geopolitical or ideological constraints. Most importantly, if the petrodollar is on its way out, regardless of how long that may take, the cost of the Fed’s endless money supply will no longer be alleviated.

With so many uncertainties in this new monetary world order, Bitcoin’s fundamental appeal and track record speak for themselves.

The post A New World Monetary Order is Emerging, and Bitcoin is Poised to Be a Part of It appeared first on CryptoSlate.