The cryptocurrency market is on the slide, following in the footsteps of global markets. Its total cap is down to $1.95 trillion, representing a drop of 4.5% in the past 24 hours. It’s also down by around 14% in a week, much like many major coins. However, falls usually provide the opportunity to buy assets on the cheap. It’s for this reason we’ve put together a list of the 5 best cheap cryptocurrency to buy right now. These coins provide good scope for short-term gains, with most of them also being good long-term prospects.

5 Best Cheap Cryptocurrency to Buy

1. Lucky Block (LBLOCK)

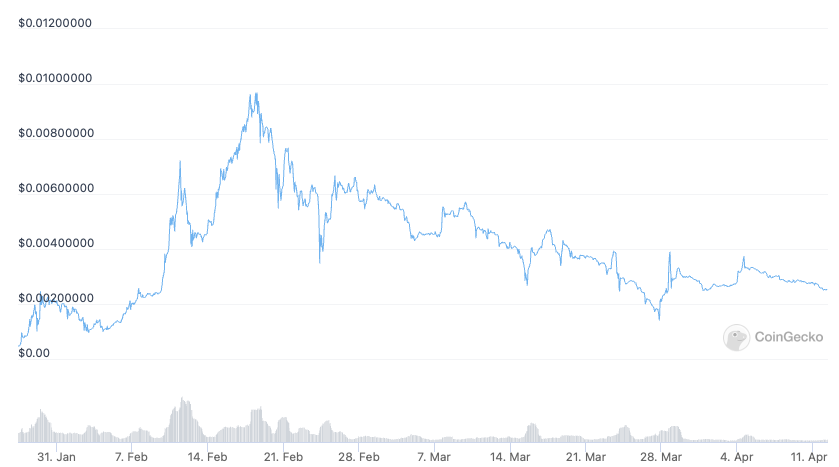

LBLOCK is down by 6.5% today, at $0.00255423. It’s also down by 21% in a week and by 38% in a month. On the other hand, it remains up by an impressive 480% since the end of January, when it launched.

LBLOCK is the native token of the Lucky Block lottery platform. Running on Binance Smart Chain, the latter will hold regular draws, beginning later this month. Users can enter any draw by spending LBLOCK, giving them the chance to win 70% of its fund. Meanwhile, all holders of LBLOCK equally share 10% of each and every draw’s kitty.

This simple premise has resulted in Lucky Block attracting early attention and growth. LBLOCK has just recently reached the milestone of 50,000 holders, while in February it also boasted becoming the fastest ever cryptocurrency to reach a market cap of $1 billion.

Gm! 🤞

We recently passed the milestone of 50K holders! And tonight, we are hosting a party on that occasion! 🥳

Make sure you join us:

Venue 👉 https://t.co/4MigxHlmDP

Time 👉 7pm BST ⏰Have a great day! 🦾 pic.twitter.com/5FU3ZD3pJQ

— Lucky Block 🤞 (@luckyblockcoin) April 11, 2022

While it hasn’t held its first draw yet, it has passed some important milestones as it approaches its inaugural lottery. Firstly, it has launched its Android app in beta, and is awaiting approval for its iOS equivalent.

✅ Lucky Block update

👉 Lucky Block web app – working on security solutions and fiat ramps.

👉 Desktop apps – Testing continues, fixing bugs

👉 iOS app – Still in App Store Connect, we are waiting for feedback that should arrive shortly

👉 Android app update incoming pic.twitter.com/H8mfL5Mmbe— Lucky Block 🤞 (@luckyblockcoin) April 7, 2022

On top of this, it has also recently launched a smaller side-lottery, giving purchasers of 10,000 NFTs the chance to win $1 million or a Lamborghini.

Our #NFTs, except of a life-time entry give you an amazing 1 in 10k chance to:

👉 Win a Lambo 🏎️

👉 Win $1 million 💰Hurry up, the #NFTs will sell out quickly, don’t miss your chance, buy now at 👇https://t.co/jRlmqSyNx1 #NFT #crypto #NFTCommunity pic.twitter.com/MFOXROzyv6

— Lucky Block 🤞 (@luckyblockcoin) March 30, 2022

2. Waves (WAVES)

WAVES is one of a very small handful of coins to have risen in the past 24 hours. At $23.37, it’s up by 3% in the past day, but down by 32% in the past week and by 48% in a fortnight.

WAVES has suffered a decline since reaching an all-time high of $61.30 on March 31, and its indicators reflect this. Its relative strength index (in purple above) has been under 30 for much of this month, indicating that the market is overselling it. Likewise, its 30-day moving (in red) has dropped well below its 200-day average (in blue), suggesting a bottom.

Despite its recent dive, WAVES remains a promising alt coin. Its native platform, Waves, provides open‑source technologies to help developers build scalable and decentralised Web3 apps. It’s undergoing a series of important developments this year, providing one of the main reasons why WAVES had been rallying in late March.. Its biggest upcoming change is that it’s transitioning to Waves 2.0, which will introduce significant scalability enhancements. Waves DAO is also on the horizon, a decentralised autonomous organisation that will open its governance up to its community.

🤝 Waves DAO will upgrade the old futarchy concept and launch a new generic governance model, with applications going far beyond blockchain technology.

🎮 Level 0 Inter-Metaverse Protocol on Waves will help connect different games and metaverses

— Waves 🌊 (1 ➝ 2) (@wavesprotocol) February 10, 2022

On top of this, Waves’ total value locked in has risen by more than 200% since the start of February to $2.4 billion. With Waves 2.0 approaching, this is likely to continue in the coming weeks. This is why WAVES is one of our 5 best cheap cryptocurrency to buy.

3. Ripple (XRP)

At $0.704692, XRP is down by 5% in the past 24 hours. It’s also down by 15% in the past week and by 10% in the last 30 days.

XRP’s technical indicators mean one thing: it’s going cheap right now. Its RSI shows that the market is overselling it, which in turns means that it’s cheaper than it’s really worth.

In fact, XRP is much lower than its ‘real’ value. That’s largely because Ripple remains embroiled in a legal case with the US Securities and Exchange Commission. However, recent signals have been favourable to Ripple, suggesting that it may secure a favourable outcome.

BOOM! (And I don’t use that term lightly)

The SEC’s Motion to Strike the Fair Notice Defense is DENIED.

This is the one I’ve been waiting for.

NOW the SEC has something to lose. https://t.co/LcRpWysixn

— Jeremy Hogan (@attorneyjeremy1) March 11, 2022

While the case remains in its discovery period, there’s no doubt that XRP will rocket if Ripple prevails. There’s no telling how high it could reason, although in this respect, it’s interesting to note that it was one of the few coins not to break its 2017-18 high — of $3.40 — in last year’s bull market.

4. Cardano (ADA)

Much like XRP, ADA is an alt coin that has been primed to rise big for a while now. As of writing, it’s down by 6% in the past 24 hours, falling to $0.954116. This represents a 21% drop in the past week, but a 20% rise in the past month.

ADA’s indicators also show that it’s going pretty cheap right now. And sooner or later, it will rally strongly, given Cardano’s fundamentals. In particular, it’s witnessing substantial development right now, with its September launch of smart contracts laying the groundwork for Cardano’s ecosystem to expand to 900 projects.

Nearly 900 projects are currently #BuildinOnCardano 🤯And this is just the beginning…

Keeping track of all the news is quite the job and we’re still working on it. But we got you covered. In this thread, we look at the latest ecosystem updates 🧵

Let’s go!👇#Cardano $ADA pic.twitter.com/OSHbOIjFMq

— Input Output (@InputOutputHK) April 5, 2022

From standing at only $1 million at the start of January, Cardano’s total value locked in has now risen to $200 million. This is a rise of over 20,000%, with the launch of its DEX SundaeSwap in January largely responsible for this growth.

A new incubator scheme, Ariob, will enhance the growth of projects funded by #ProjectCatalyst. It offers high potential startups access to venture-building expertise & resources to help develop products that solve real-life challenges in Africa. https://t.co/c1pQrNWsus

— Input Output (@InputOutputHK) April 9, 2022

Input Output Hong Kong continues to develop Cardano’s capabilities, as well as announce new projects. It’s because it will reach a critical mass soon that ADA is one of our 5 best cheap cryptocurrency to buy right now.

5. NEAR Protocol (NEAR)

NEAR has risen by 1% in the past day, to $16.19. And while it’s down by 6% in the past week, it remains up by a healthy 55% in the past month.

NEAR’s indicators point to an imminent rebound. Given that it still has good medium-term momentum, its slight recovery now could outlast bounces from the rest of the market.

NEAR has been rallying for a variety of fundamental reasons. For one, its native platform, NEAR Protocol (a layer-one blockchain), has witnessed strong growth this month, with a number of new partnerships and app launches.

@NEARProtocol has been selected as the preferred Layer-1 blockchain to build on by the @OrangeDAOxyz, a crypto collective created by @ycombinator alumni. 🍊

This partnership will help attract even more promising projects to build on #NEAR.

Learn more: 🎥https://t.co/EwsMKsok2I

— NEAR Protocol (@NEARProtocol) April 8, 2022

Such growth has created confidence in the NEAR Protocol’s future. However, with Near Protocol’s total value locked in still at a modest $360 million, there’s plenty of potential for further growth. Not least when it’s not even two years old.

Capital at risk

Read more: