Brazil’s central bank has unveiled plans to start a central bank digital currency pilot program that will be launched in 2022. The sovereign national digital currency will be based on fiat currency and will be based on a fixed supply, just like Bitcoin and some other crypto assets.

The Digital Real will Have a Fixed Supply

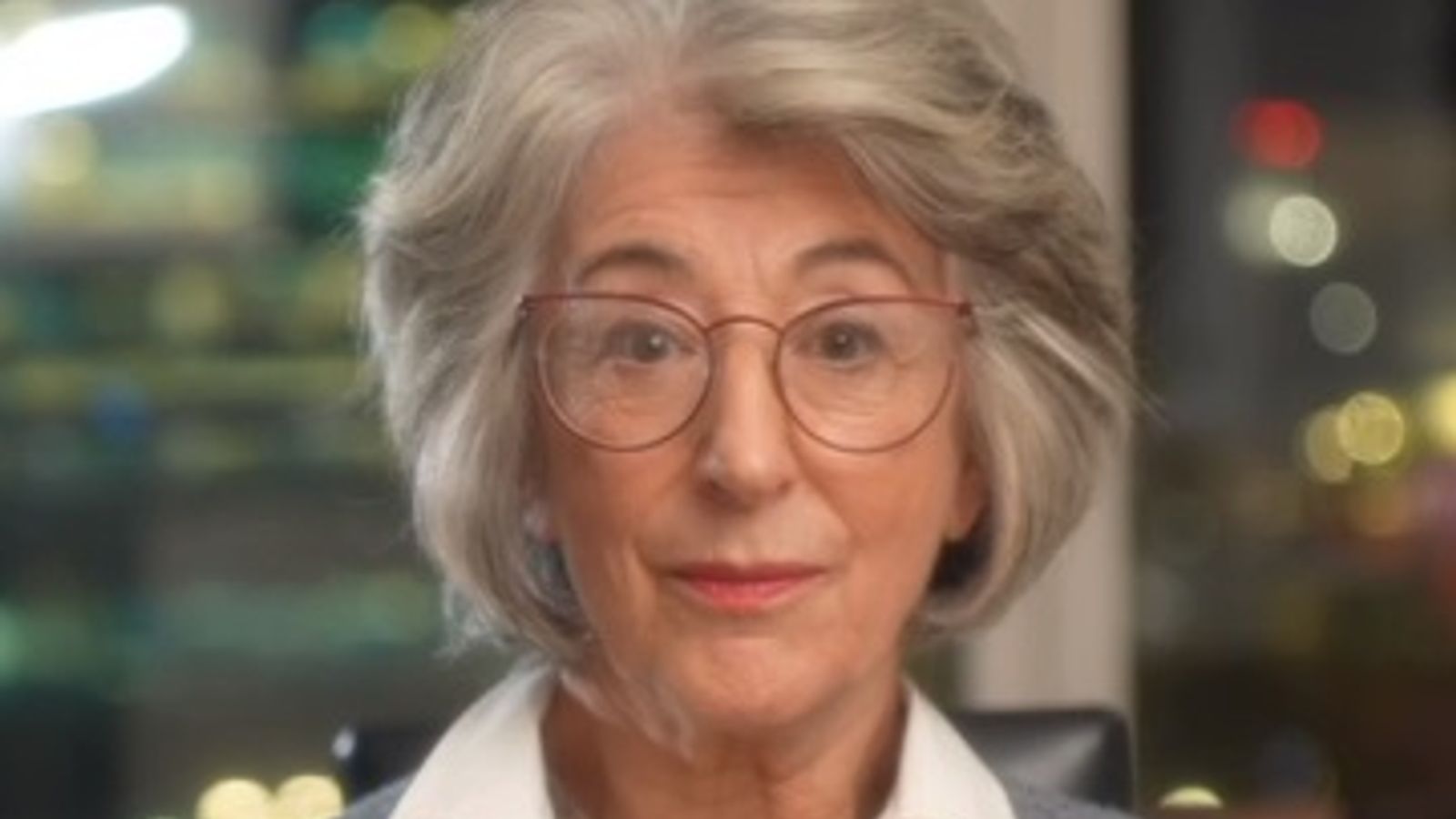

The president of the Central Bank of Brazil, Roberto Campos Neto, also confirmed that the CBDC pilot launch will go live this year. This was confirmed during an event on Monday where Neto stated that the value of the CBDC could be pegged to the national fiat payment system STR. Additionally, Neto noted that the “Digital Real”, as it would be called, will have a steady and fix supply to prevent scarcity. Additionally, like Bitcoin, only a certain amount of it would be minted.

Neto added that the Digital Real will be creating a digitalization of the currency without creating a negative impact on the banks’ balance sheets. “This project should have some kind of pilot in the second half of the year,” he said at the event.

Neto also stated that he believes cryptocurrency is more common as a form of investment rather than a form of payment, but this could change if it sees more adoption by individuals and institutions.

Brazil Recently Partnered With 9 Central Banks

The confirmation of the CBDC pilot phase in the second quarter of the year is coming only a few weeks after Brazil’s central bank announced a partnership deal with 9 other banks. The goal is to assist in the development and execution of the CBDC. This means Brazil will join the growing list of countries that are currently researching a CBDC for their respective fiat currencies.

Brazil is one of the countries that have proposed a regulatory framework for cryptocurrencies. The South American nation recently introduced a bill that will assist in the regulation of crypto business in the country.

Your capital is at risk.

Read more: