What makes this Arctic outpost so attractive to bitcoin miners, considering the country’s tiny geographical size and small population?

The below article is part of a larger series on Bitcoin mining around the world compiled by the team at Arcane Research.

This is the second article in a series describing the bitcoin mining industry in various countries around the world. The first article covered Georgia, and I now do a similar analysis on Norway. Coming from Norway, I have first-hand knowledge of the country’s bitcoin mining industry. Also, I work for Arcane, which has a mining operation in Norway.

I will explain why the bitcoin mining industry is flourishing in Norway, focusing on the power market and regulatory environment while also providing an overview of all the mining operations in the country.

A Large Mining Industry Given The Country’s Small Size

We should first find out how big Norway’s bitcoin mining industry is. I will provide a couple of existing estimates before coming up with my own numbers.

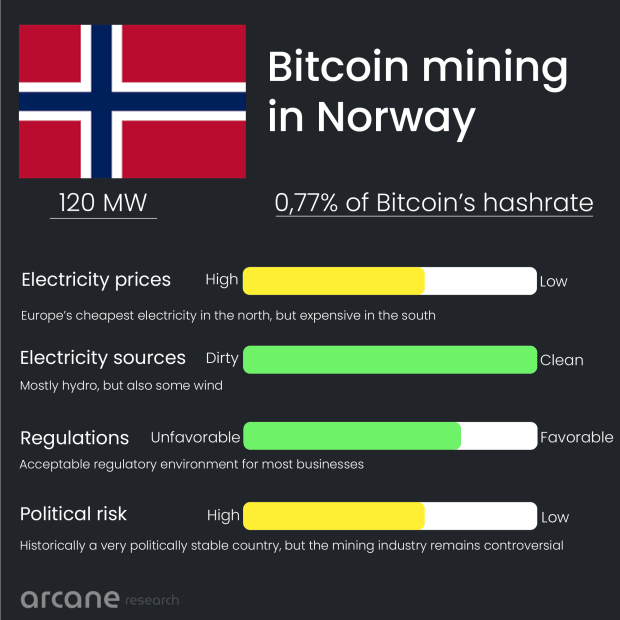

Cambridge’s Bitcoin Mining Map, which estimates the hashrate share of each country, gives Norway 0.58% of Bitcoin’s hashrate. Multiplying this share with their 15.6 GW estimate for the Bitcoin mining network’s total power demand gives Norwegian miners a power draw of 90 megawatt (MW), assuming their hardware has the same power efficiency as the network average.

CoinShares also estimated the size of Norway’s bitcoin mining industry and found it having 66 MW of installed power. While Cambridge’s top-down methodology used data from four mining pools to estimate the geographic distribution of miners, CoinShares applied a bottom-up procedure to identify all the mining facilities in each country.

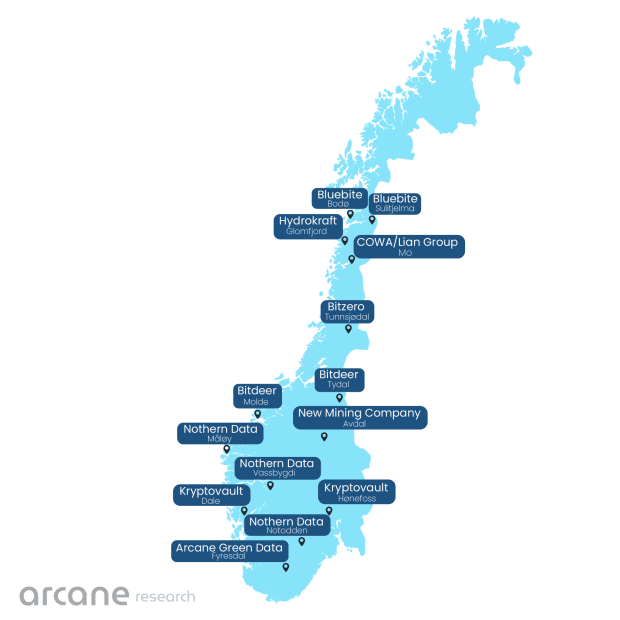

Similar to CoinShares, I did my best to map out all the mining facilities in Norway and identified 120 MW of current bitcoin mining operations in Norway, which you can find on the map below. This power draw, multiplied by Сambridge’s estimate for the Bitcoin mining network’s total power demand, means Norwegian bitcoin miners produce 0.77% of Bitcoin’s hashrate.

Who Mines Bitcoin In Norway?

Generating almost 1% of Bitcoin’s hashrate, Norwegian miners are not the biggest but still important contributors in securing the network. Who are they?

The industry consists of some local and several large international companies. Local players include Kryptovault and Arcane Green Data, while Northern Data, Bitdeer, Bitzero and COWA are among the larger global companies.

You can read more about each facility in the appendix at the bottom of the article.

A Green Oasis Of Renewable Energy

Now we will start exploring what attracted all these miners to Norway.

Mining is an energy-intensive industry under heavy public pressure regarding its carbon footprint. Therefore, a top priority for miners is powering their operations with renewable energy.

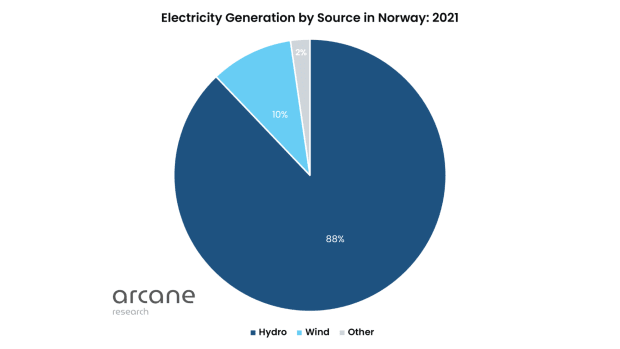

With its mountainous terrain and wet climate, Norway is made for hydropower. The buildout of hydroelectric power stations started at the end of the 19th century. Since then, hydro has been Norway’s primary source of electricity, giving the country an abundance of cheap, reliable and green power.

In a typical year, 88% of electricity generated in Norway comes from hydro and 10% from wind. Except for a 2% share of natural gas powering the Norwegian offshore oil shelf, Norway is powered by 100% renewable energy, making the country attractive to miners who want to mitigate their carbon footprint.

Things look great here and now, but how will electricity generation in Norway develop in the coming years?

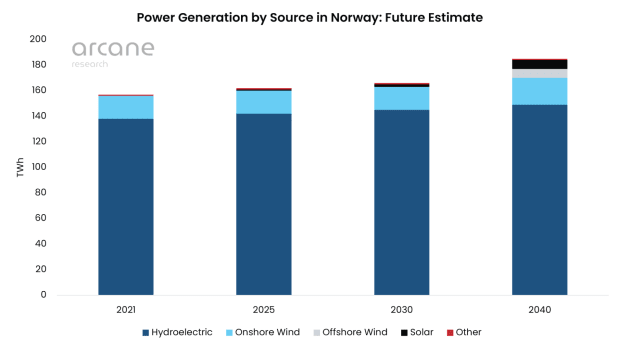

Norway has massive potential for new hydropower development, but getting development permissions has gotten harder. NVE (Norwegian Water and Energy Authority) estimates that until 2040, only 11 TWh of new hydroelectric generation will be installed, corresponding to a meager 8% increase from today’s capacity.

Although the onshore wind capacity has grown fast, NVE estimates it will only see a 3 TWh growth until 2040. On the other hand, the offshore wind capacity will grow fast, from 0 to 7 TWh in the same period. And believe it or not, solar could also increase from 0 to 7 TWh.

As you can see, not much will change on the power generation side in Norway until 2040, except for a little higher share of wind and solar.

The most important takeaway for bitcoin miners regarding Norway’s electricity mix is that it’s fully renewable, and will stay that way.

The Further North, The Cheaper Electricity

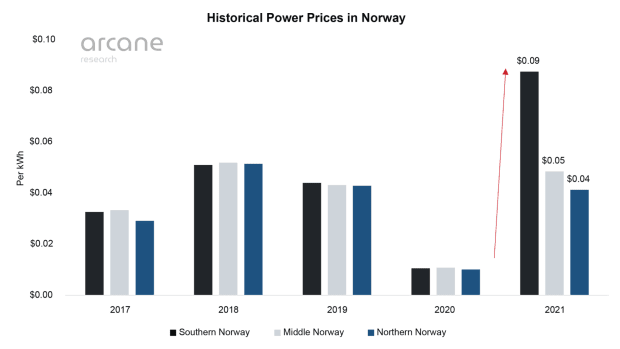

With zero marginal cost of hydroelectric power, Norway has enjoyed some of Europe’s cheapest electricity. Although the country is divided into five electricity price zones, prices have historically been similar in all zones. That changed in 2021.

In the last five years, power prices usually stayed between $0.03 and $0.05 per kilowatt-hour (kWh) in all the price zones, only interrupted in 2020 when they fell below $0.01 per kWh, caused by higher-than-average precipitation that filled up the hydropower reservoirs.

After an unusually cheap 2020, Southern Norway’s electricity consumers were shocked in 2021 as they saw a seven-fold increase in their prices, while consumers in the Northern and Middle regions didn’t see similar increases.

There are several explanations for the sudden regional price differences, but the most significant factor is that the southern part of Norway has become heavily connected with the rest of Europe’s power markets as new underwater power lines to the continent were opened at the end of 2020 and the beginning of 2021.

With Southern Norway so connected to the European markets, the prices on the continent directly influence our domestic power prices. 2021 was a year with record-high energy prices globally, with gas, coal and CO2 prices shooting through the roof, making electricity expensive in Europe, further dragging up prices in Southern Norway.

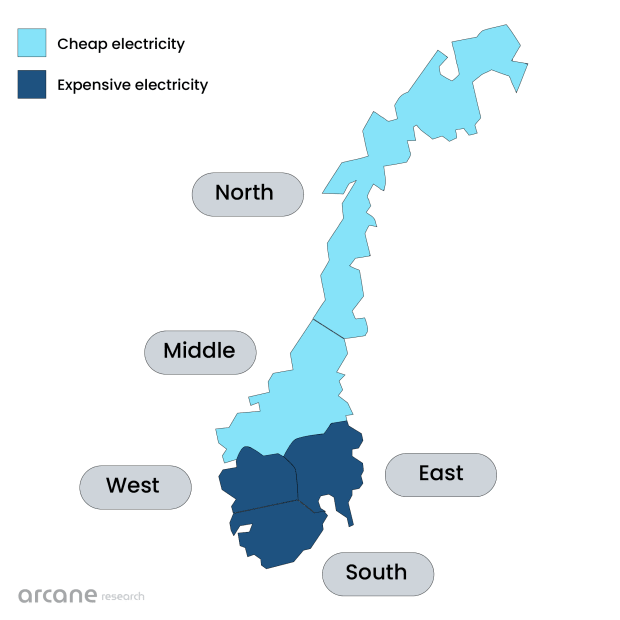

Due to transmission constraints between Middle Norway and Southern Norway, only the southern part of the country is fully connected with the European market. The middle and northern regions are still enjoying low prices due to the limited transmission capacity.

Power Will Stay Expensive In The South And Cheap In The North

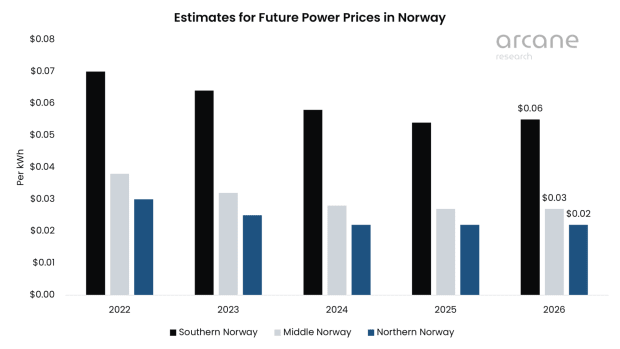

With Norway connected to the volatile European market, it’s uncertain how electricity prices will develop in the future. National grid operator Statnett expects the power prices to gradually decrease due to European gas and coal prices “normalizing.”

Statnett’s analysis is from before Russia invaded Ukraine. The conflict has already led to soaring fuel prices, putting upward pressure on European power prices. Therefore, I don’t share Statnett’s optimism that fuel prices will “normalize,” and I expect power prices to stay at elevated levels in Southern Norway.

Although prices will stay high in the South, I don’t expect similar price increases in the North soon. With record-high prices in Southern Norway, they would love to tap into Northern Norway’s electricity but can’t, due to limited transmission capacity. Statnett plans to build new transmission lines to alleviate these constraints until 2030, and I expect the price gap to persist at least until then.

Norwegian Miners Want To Contribute To The Energy Sector

Norwegian miners are exploring how to increase their participation in the energy sector, either by providing balancing services in the power market or by reusing the excess heat from their operations.

The need for energy-intensive industries like bitcoin miners to help balance the electricity system is increasing as wind and solar’s share of the generation capacity grows. The electricity supply and demand must always be in balance, and historically we have been able to provide this balance by simply adjusting production. Because wind and solar are weather dependent, we can’t easily adjust their production to follow the demand.

Norway’s grid operator Statnett understands that the need for grid balancing will increase, and therefore opened a balancing market this year where demand-side resources like bitcoin miners can participate. Bitcoin mining is highly suitable for grid balancing since the process is both energy-intensive and can be interrupted at almost no cost. You can learn more about that in this article, explaining how miners are helping stabilize Texas’ electricity system.

In addition, many Norwegian bitcoin miners are experimenting with reusing excess heat from their operations. These waste-minimization initiatives can benefit Norway, both from an economic and ecological perspective since heating makes up a significant share of a cold country’s energy consumption. At the same time, heat is bitcoin miners’ main waste component.

Kryptovault has been reusing the heat from their Hønefoss operation to dry lumber for more than two years. The company collects the heat from its mining operation in pipes and donates it to a local lumber company that employs six people at the site, reducing waste and creating local jobs.

Kryptovault’s lumber-drying project is just one of many potential applications of reusing heat from bitcoin mining. Miners are looking at possibilities for connecting to district heating systems, heating fish farms, greenhouses, pools, spas, etc. The potential is enormous, and I believe that we will see this process flourish in Norway in the coming years.

A Politically Stable Country, But Bitcoin Mining Is Controversial

In addition to looking for cheap and green electricity, miners seek jurisdictions with favorable regulatory environments and political stability.

Norway is one of the world’s most politically stable countries, with acceptable regulatory conditions for most businesses, giving it ninth place in the World Bank’s Ease of Doing Business Index.

Still, the bitcoin mining industry is not the most popular in the country and has faced some political opposition. To understand the political risk, you must know about the power-tax saga from 2019.

While most power consumers in Norway pay a power tax of NOK 0.1541 ($0.017) per kWh, the energy-intensive industrial sector pays only NOK 0.0055 ($0.0006) per kWh. In 2016, the Norwegian government made data centers eligible for this reduced power-tax rate to attract more of them to Norway.

The government hoped for Google or Facebook but instead got bitcoin miners. Displeased by how their regulations backfired, they decided to revoke the reduced tax rate specifically for crypto miners in 2019. As a result, miners’ electricity prices suddenly increased by $0.016 per kWh, a substantial amount in an industry with a median power price of $0.04.

Many Norwegian data centers are combined facilities, partly hosting bitcoin miners. Therefore, this tax hike affected a significant share of the data center industry. In addition, data centers that weren’t directly affected started to question the previously indisputable political stability of operating in Norway, and the country’s excellent international reputation in the industry began to crack.

The whole sector quickly joined forces and started fighting against the tax hike, backed by the Confederation of Norwegian Enterprises (NHO) and the Norwegian IT association, IKT Norge.

In 2020, the Norwegian government gave in to the pressure and decided not to revoke the reduced power tax after all. They may have realized that such a granular selectivity in their decision-making for who is eligible for a reduced power tax is most likely in conflict with several Norwegian and international laws.

Still, the harm was already done. Bitmain, Hive Blockchain and several other companies decided to leave Norway because of the increased regulatory uncertainty.

Bitcoin miners are considered eligible for the reduced power tax, but we may not have seen the end of the saga yet. Some Norwegian politicians still haven’t given up on increasing miners’ power tax, while some even want to ban bitcoin mining.

Recently we have also seen attempts on regulatory restrictions from the EU, of which Norway is not a member. However, the EU still has a considerable influence on Norwegian legislation since Norway is, through various agreements, obliged to comply with a large part of the EU’s regulations.

In November 2021, Swedish regulators proposed a draft for an EU-wide Bitcoin ban from 2025. Norwegian local government and regional development minister Bjørn Arild Gram announced that he would attempt to copy the ban in Norway if it passed the vote in the European Parliament. In the end, the ban attempt was unsuccessful.

Luckily, Norway doesn’t have a long history of populistic bans on certain activities based on subjective opinions. In addition, certain international agreements also protect industries from government overreach. Therefore, even though fractions in the national government may not like it, it’s very unlikely that mining will become regulatorily infeasible in Norway.

Conclusion

Thanks to its cheap and clean power, cold climate and political stability, Norway has attracted an outsized bitcoin mining sector considering the nation’s small population.

From 2021, substantial power price differences emerged between the southern and northern parts of the country. These price gaps will persist and therefore miners should ideally locate their operations in the much cheaper North.

Even though Norway is considered one of the most politically stable countries globally, the bitcoin mining industry remains controversial and faces some political opposition. Examples are the Norwegian government’s unsuccessful attempt to raise power taxes specifically for miners and Swedish regulators’ failed EU-wide Bitcoin ban.

Still, we should keep in mind that the bitcoin mining industry is not only controversial in Norway but also in most other countries. Therefore, relative to most other alternative countries for bitcoin mining outside North America, I don’t consider Norway one of the most politically hostile to the industry.

Recently, North America has soaked up a large share of the mining capacity, and I assume some of these miners look at Norway as a potential location to diversify their operations geographically.

Also, as miners increasingly face public pressure in using renewable energy, tapping into the Norwegian green hydropower becomes even more attractive.

Because of these reasons, I expect the bitcoin mining industry in Norway to keep growing, especially in the northern part of the country.

If you would like to discuss bitcoin mining with me or have questions about mining in Norway, please reach out to me @jmellerud on Twitter.

Appendix: Overview Of Norwegian Miners

Here are all the mining facilities I identified in Norway.

Kryptovault In Hønefoss

Kryptovault in Hønefoss is the biggest facility in Norway, with 45 MW of bitcoin mining capacity. They are currently operating around 18 MW since they are in the process of replacing their older ASICs with newer and more energy-efficient models.

In 2018, Kryptovault rebuilt Norske Skog’s paper mill in Hønefoss, which had been abandoned since 2012. On this site, Kryptovault reuses waste heat from their mining operations for drying lumber.

Kryptovault In Dale

In addition to their Hønefoss facility, Kryptovault operates a 25 MW facility in Dale. Currently, they utilize around 8 MW of the facility’s capacity.

The Dale data center is located in a building that once was Norway’s largest textile factory. This revitalization of abandoned industrial buildings helps bring new life to old buildings and saves Kryptovault investment costs and development time.

COWA And Lian Group In Mo

Cowa and Lian Group’s facility in Mo, in the North, is the country’s second largest with a capacity of 40 MW, of which 36 MW is currently used. Bitfury built this facility in 2018 and self-mined here until 2022.

Bitdeer In Molde

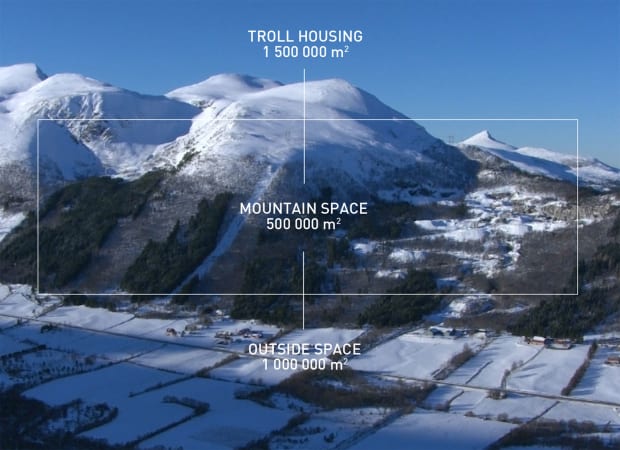

Cloud mining platform Bitdeer hosts 38 MW in the Troll Housing data center outside Molde. Troll Housing’s facility utilizes a former mine, where the climate conditions are perfect for bitcoin mining year-round.

Although planning a public listing, Bitdeer is reluctant to share information on its operations, but according to an investor prospectus from January 2022, they have 38 MW of mining in Molde. The only data center I could find in the Molde area with sufficient capacity to host 38 MW is Troll Housing. Therefore, I’m reasonably sure that Troll Housing is hosting Bitdeer.

Bitdeer In Tydal

Bitdeer is expanding its Norway operations with a 50 MW data center under development in Tydal. Troll Housing, which also hosts Bitdeer’s Molde operation, is constructing the Tydal data center.

Bitdeer’s most recent investor prospectus confirms this data center.

Bitzero In Tunnsjødal

Canadian miner Bitzero is developing a facility in Tunnsjødal. With 100 MW under development, the facility can potentially become the biggest in Norway when finished in 2023. Having completed the first development step, Bitzero currently mines with 7 MW.

The facility is located close to Tunnsjødal Power Station, the biggest power plant in the central part of Norway, with an installed capacity of 176 MW.

Arcane Green Data In Fyresdal

Arcane Green Data has since 2021 hosted 2.5 MW in Oslofjord Datacenter in Fyresdal, currently operating close to full capacity.

Oslofjord Datacenter is a combined facility that only uses part of its capacity for bitcoin mining. In addition to hosting Arcane Green Data, they also host 2.5 MW for another bitcoin miner, giving their data center a total bitcoin mining capacity of 5 MW.

Bluebite In Bodø

The German company Bluebite has since 2019 operated a 1 MW data center in the Arctic city of Bodø inside a building previously used for the production of marine equipment. The company considers the Bodø data center as a pilot project while looking for expansion opportunities in northern Norway.

Bluebite In Sulitjelma

Bluebite is developing a data center in Sulitjelma, a former mining town one hour from Bodø. In addition to doing cloud computing, they are currently mining with 4 MW but are looking to expand.

Bluebite is revitalizing one of the town’s many abandoned industrial buildings, bringing new industrial activity in the form of bitcoin mining to the former copper mining powerhouse of Sulitjelma.

Making a local impact is a top priority for Bluebite, so they plan to reuse excess heat from their data center for a greenhouse or spa to create even more local jobs.

New Mining Company In Alvdal

New Mining Company is a Russian group mining bitcoin since 2018 in Alvdal. Their 3 MW operation has been highly controversial, with neighbors complaining about the noise and some even suspecting the company of using their mining activities as a cover for a Russian spy operation.

After a series of disagreements, the local government terminated their land-lease agreement with New Mining Company, giving them one year to leave the property.

Northern Data In Måløy

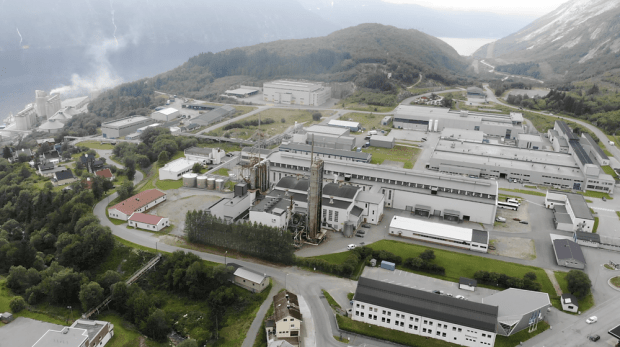

Although this article focuses on bitcoin miners, I decided to include one big ether miner. German company Northern Data mines ether with a capacity of 25 MW deep inside a mountain in the Lefdal Mine data center in Måløy in the western part of Norway.

Lefdal Mine is one of several abandoned mines in Norway which have been turned into data centers. As one of Europe’s largest data centers, they also have several non-mining customers.

Northern Data In Notodden

After having mined crypto deep inside the mountain in Lefdal Mine since 2018, Northern Data expanded their Norway operations with a 40 MW data center in Notodden in 2021.

The data center is located in the industrial park Hydroparken, and like most miners in Norway, Northern Data are exploring how to reuse the excess heat.

Northern Data In Vassbygdi

In 2021 Northern Data bought an old industrial building in Vassbygdi, deep inside Sognefjorden, Norway’s longest fjord.

It’s unclear whether they mine bitcoin, ether or use the data center for other high-performance computing purposes. Still, just like in their Notodden data center, a job ad reveals that they are looking for engineers to work on GPUs, so they likely mine ether here.

Hydrokraft In Glomfjord

Hydrokraft is constructing a 30 MW data center in Glomfjord in northern Norway, planning to finish it later in 2022. The data center is located in Glomfjord Industripark, an industrial hub consisting of 19 companies. Hydrokraft has ambitions of reusing heat from the data center for other industrial applications.

This is a guest post by Jaran Mellerud. Opinions expressed are entirely their own and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.