The relationship between energy prices, hash rate, difficulty and the bitcoin price will be extremely important as the price of energy rises.

The below is a direct excerpt of Marty’s Bent Issue #1194: “Rising energy price, difficulty, and their effect on mining profitability.“ Sign up for the newsletter here.

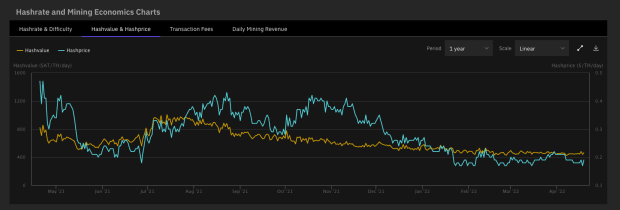

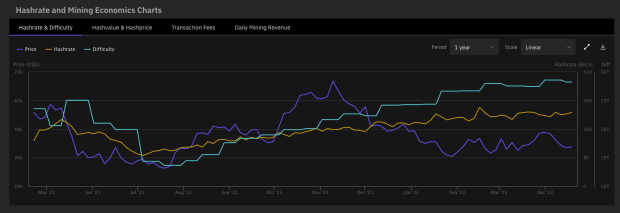

Here’s something to pay close attention to in the coming months: the economics of the bitcoin mining industry. With the bitcoin price staying in a tight price range for the first three-and-a-half months of the year as hash rate and difficulty have risen consistently (for the most part) alongside surging energy prices, your Uncle Marty has his antennae perked for signs of struggle in the mining world. The current market conditions are certainly putting a strain on many miners at the moment. Particularly those who do not have (or think they have) fixed electricity prices that are relatively low compared to the rest of the market.

As energy prices rise and miners who made purchases a while ago begin to get ASICs delivered and attempt to reap payback as quickly as possible by plugging said ASICs in as quickly as possible, driving hash rate and difficulty up in the process, the market conditions are getting very tight out there for many operators. If the price of bitcoin remains locked in the range that it has been trading in for the last four months, miners continue to plug in more ASICs as they get delivered and energy prices continue to rise, we could see a lot of blow ups in the market that lead to some consolidation among players.

What will be most interesting to see is how power purchase agreements (PPAs) hold up under these conditions. Many miners that leverage the grid to mine typically engage in PPAs with a fixed price of electricity over a specified period of time to lock in a part of their operating expenditures (opex). If raw energy input prices continue to climb at the pace that they have over the last year, the utility companies that signed those PPAs are increasingly incentivized to figure out ways to get out of those PPAs so that they can increase their margins and continue to operate in an extreme market. Does upstream price pressure force the hands of utilities companies to the point where they are forced to renegotiate their PPAs mid-contract? If so, how many miners who baked in fixed electricity costs get wiped out due to an unexpected rise in opex that makes them unprofitable? Time will tell.

Keep your eyes on the relationship between energy prices, hash rate, difficulty, and the bitcoin price as the calendar turns. You may notice a bunch of people getting caught with their pants down.