Digital currency markets have been tumultuous during the past month as bitcoin shed 15.43% and ethereum dropped 17.49% against the U.S. dollar. Moreover, crypto spot volumes are down 18.95% lower than the month prior, and both futures and options volumes were down in April as well. Lower than average trade volumes typically suggest overall interest has declined, and investors may be waiting on the sidelines for lower prices.

April’s Crypto Market Spot Volumes Slip Close to 19% Lower Than Last Month

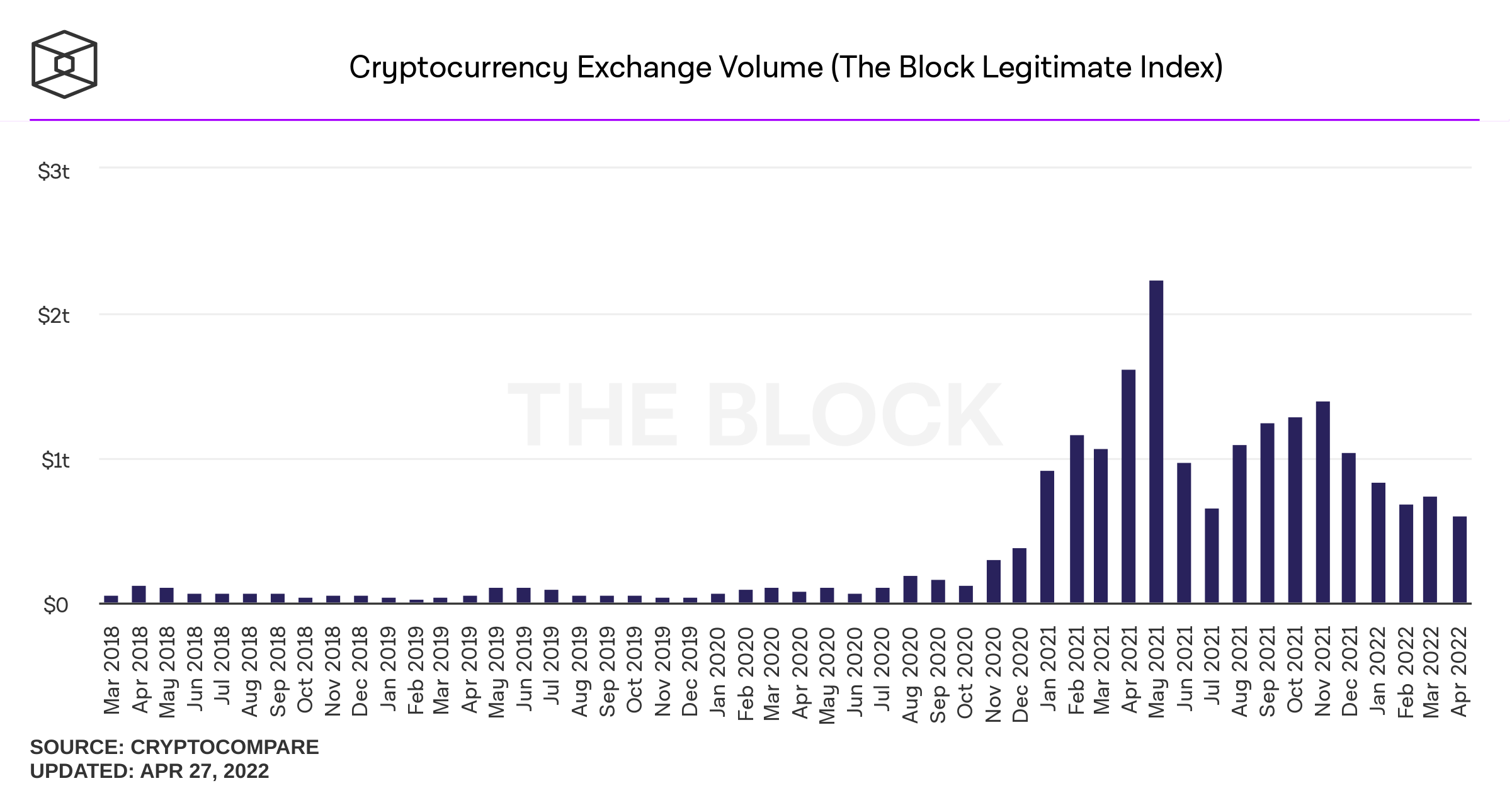

The crypto economy ended the month of April in the red, as most digital assets suffered losses during the last few weeks. At the time of writing, all ten of the top crypto assets are down significantly as they lost between 10.39% to 31.43% during the trailing 30 days. Metrics further indicate that April’s cryptocurrency exchange volumes dropped 18.95% lower than in March.

As of May 1, 2022, bitcoin lost 15.43%, ethereum dropped 17.49%, BNB slipped by 10.39%, solana slid 31.43%, and XRP lost 25.27% over the last 30 days. Trailing 30 day data indicates that terra is under 27.66%, cardano dropped 31.39%, but dogecoin only shed 3.46% this past month.

Statistics show that during the month of March, $739.4 billion in trade volume was recorded, in terms of overall crypto spot market volume. April’s spot volume, according to the Block’s Legitimate Index and Crypto Compare metrics, came in at $599.22 billion.

30 Day Crypto Derivatives Volume Slide, Dex Volumes Slip, NFT Sales Increased by 64%

The same can be said for crypto derivatives markets as data indicates April saw $1.06 trillion in bitcoin futures volume, while $1.32 trillion was recorded in March. April’s statistics, in terms of bitcoin futures open interest, are lower during the past 30 days as well.

Today, there is $14.58 billion in futures open interest, and a month ago there was $16.59 billion in bitcoin futures open interest. Bitcoin options volume from Deribit, CME, Okex, Bit.com, Ledgerx, FTX, and Huobi was lower in April than the month prior. In March, there was $20.77 billion in bitcoin options volume, while April’s bitcoin options volume saw $15.81 billion.

Furthermore, the recent defi report covered by Bitcoin.com News indicates that April’s decentralized exchange (dex) trade volumes were 21% less than in March. In March dex trade volume was $117 billion, while April’s dex trade volume recorded $92.18 billion.

Non-fungible token (NFT) sales, on the other hand, saw a 39.25% increase during the last seven days, which bumped NFT sales over the last month up 64.44%. Moonbirds was the top-selling NFT collection this past month with $492 million in global sales.

What do you think about the crypto market action during the last 30 days? Let us know what you think about this subject in the comments section below.