The Swiss-based crypto exchange, SwissBorg, has released a report on the risks surrounding Terra’s stablecoin, UST. The token is currently undergoing extreme volatility, trading at just $0.59 at writing. SwissBorg issued a risk warning to users on May 10 and paused withdrawals of UST on the same day, hours before Binance followed suit. The report was completed in April, and almost all of the risks they identified are currently playing out.

Risks of TerraUSD (UST)

Unlike other stablecoins such as USDT or USDC, backed by fiat collateral and other liquid assets, UST is an algorithmically baked token. CryptoSlate has obtained a report from SwissBorg’s DFi team on UST risks. The report explained, “at any time, users on Terra can burn $1 of LUNA to mint 1 UST, or burn 1 UST to redeem $1 worth of LUNA. Therefore, the fate of UST and LUNA are closely linked, and so are the risks involved.” Importantly. It highlighted four key areas of risk;

- A death spiral of UST-TerraLuna

- Anchor Protocol risks

- UST loss of peg

- A structured model for default.

Death spiral of UST-TerraLuna

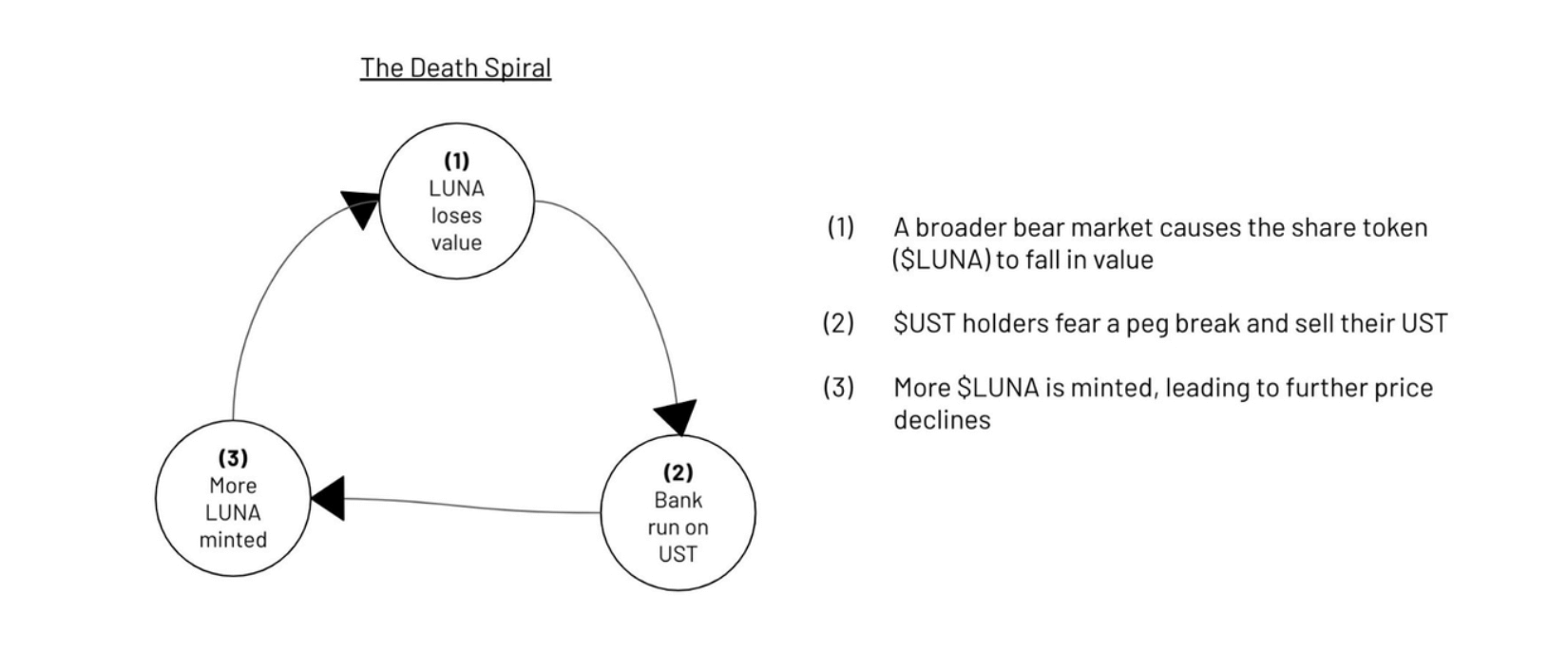

SwissBorg recounted a potential “death spiral” between TerraLuna and UST which would cause LUNA to crash and further emphasize a bank run on UST. LUNA is currently trading down 90% since May 9, indicating that this scenario is now playing out with UST also down 30%. The report explains the death spiral in detail.

“If LUNA’s price is under pressure, UST holders could be fearing that the UST peg is at risk and decide to redeem their UST positions. In order to do so, UST is burnt and LUNA is minted and sold on the market. This would exacerbate further the decline of LUNA’s price, pushing more UST holders to sell their UST. This vicious cycle is know and ‘bank run’ or ‘death spiral’

Anchor Protocol Risk

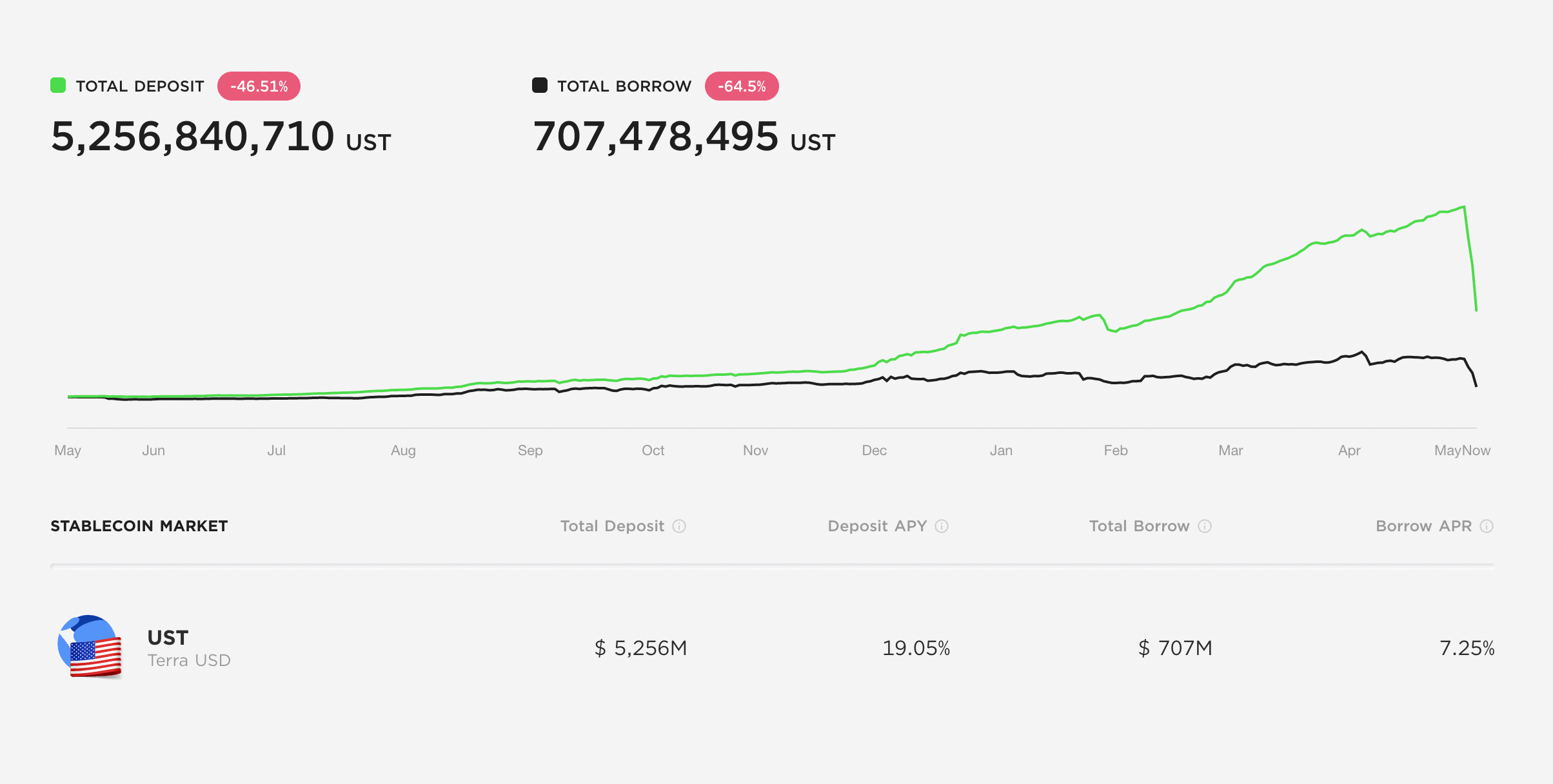

Anchor Protocol is the Terra ecosystem platform that offers high interest in UST staking. The platform has offered up to 19% in recent weeks with a peak TVL of around $15 billion. The TVL has plummeted over the past few days, with both deposit and borrow values free falling.

SwissBorg identified the risk here as “if the price of LUNA (and bLUNA) falls, this could trigger a liquidation of the LUNA collateral positions. UST would then be burned back into LUNA, further exacerbating the LUNA price decrease.”

Via reports from users on Twitter, numerous investors have been unable to access their Terra Station wallets due to network congestion leading to liquidations.

An inability to access wallets has caused users to be unable to deposit funds to decrease their LTV, forcing liquidation. This appears to be partly responsible for the steep decline in LUNA’s price over the past week. SwissBorg specifically stated in their report that “any issue with Anchor would likely cause a cascade of UST redemptions with all the consequences previously mentioned.”

UST loss of peg

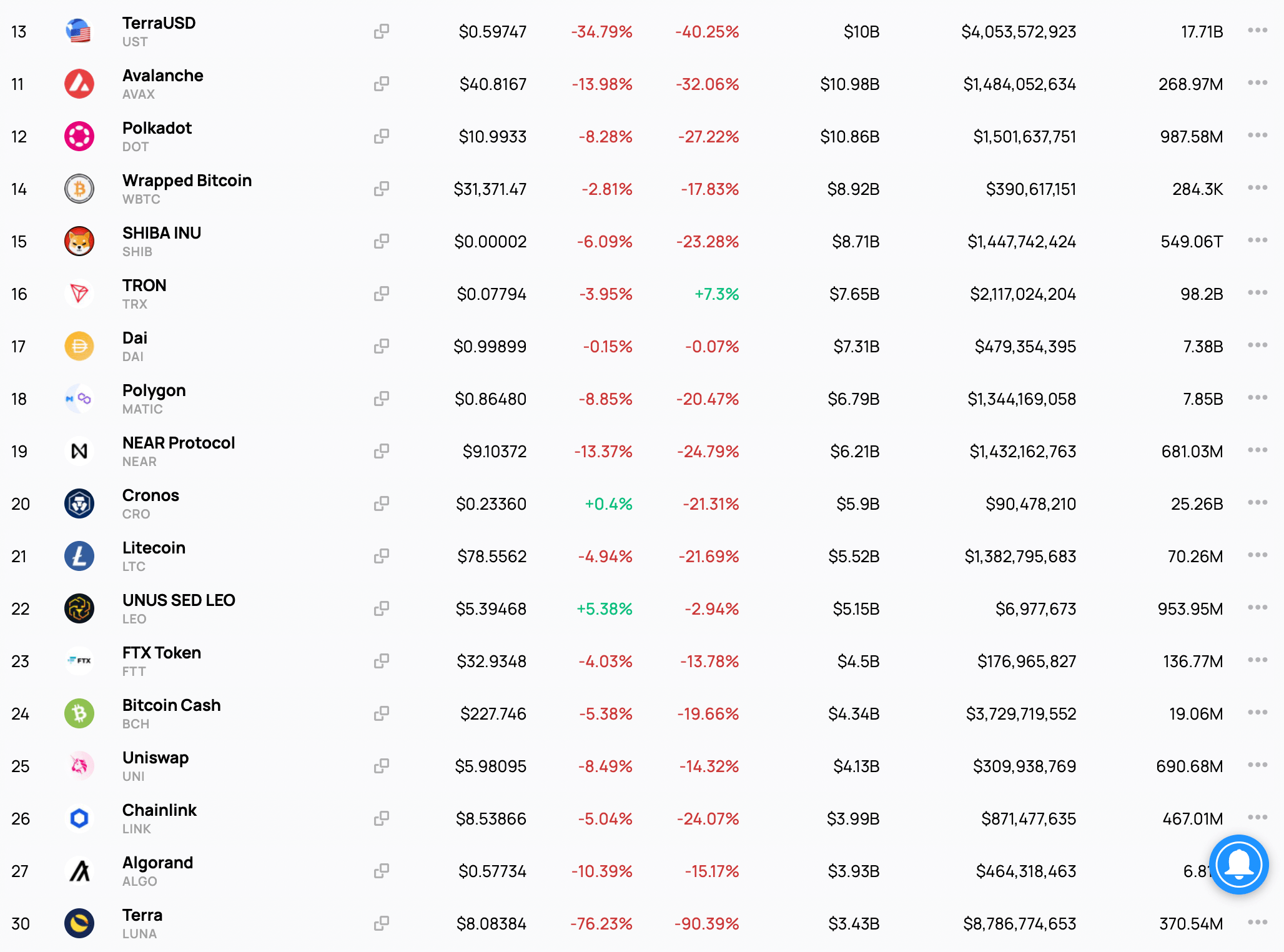

Swissborg outlined a potential scenario whereby “a death spiral along with a cascade of liquidations in Anchor could cause the market capitalization of LUNA to fall below the market capitalization of the circulating UST.” As seen on the CryptoSlate coin tracker, this has now played out, with LUNA dropping to just $370M in market cap.

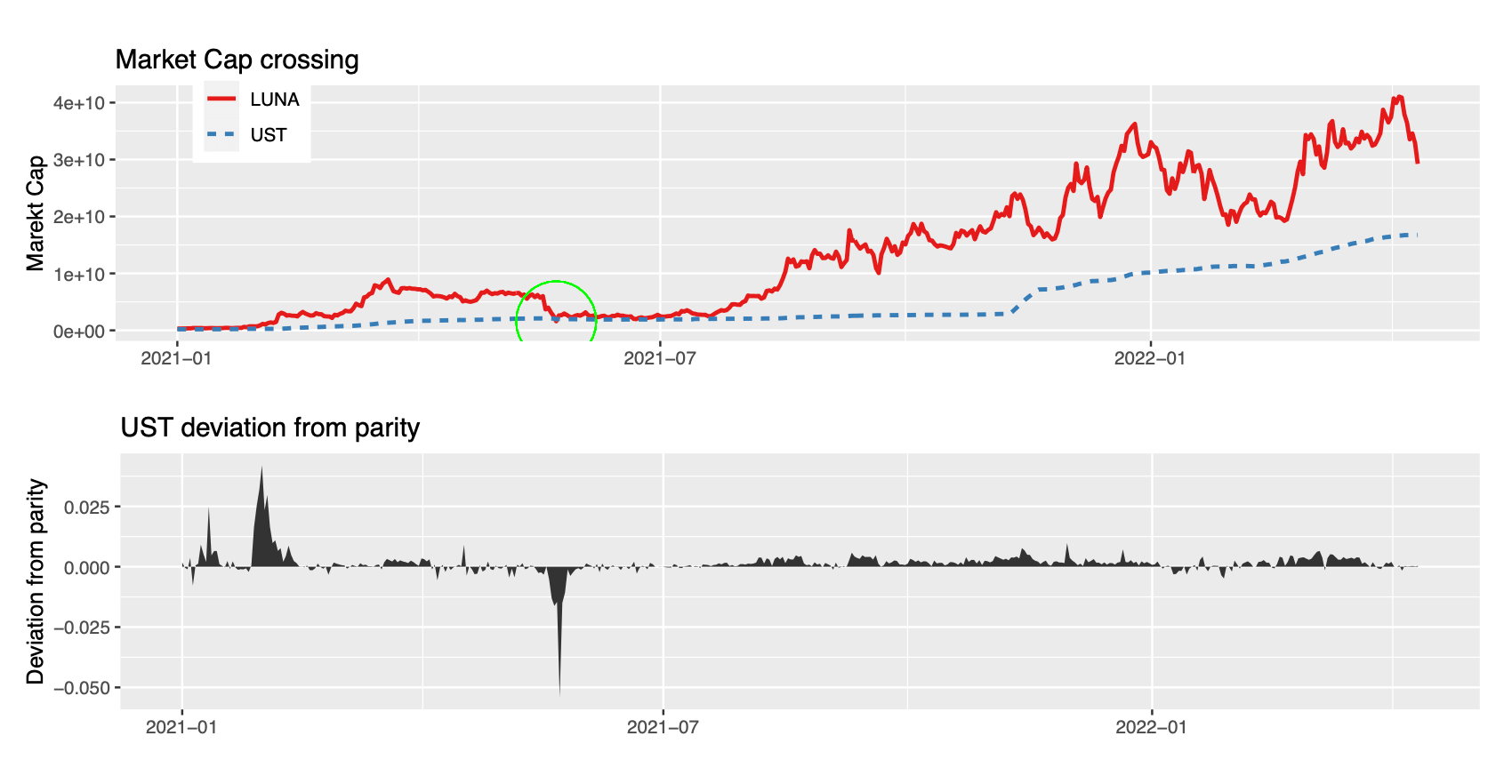

SwissBorg identified this situation alone as being highly correlated with a risk of UST de-pegging. The current state of play has this as just one of the factors affecting the Terra ecosystem. The below graph shows an event in May 2021 where the market cap crossed for a brief period and its effect on the UST peg.

Structured model for default

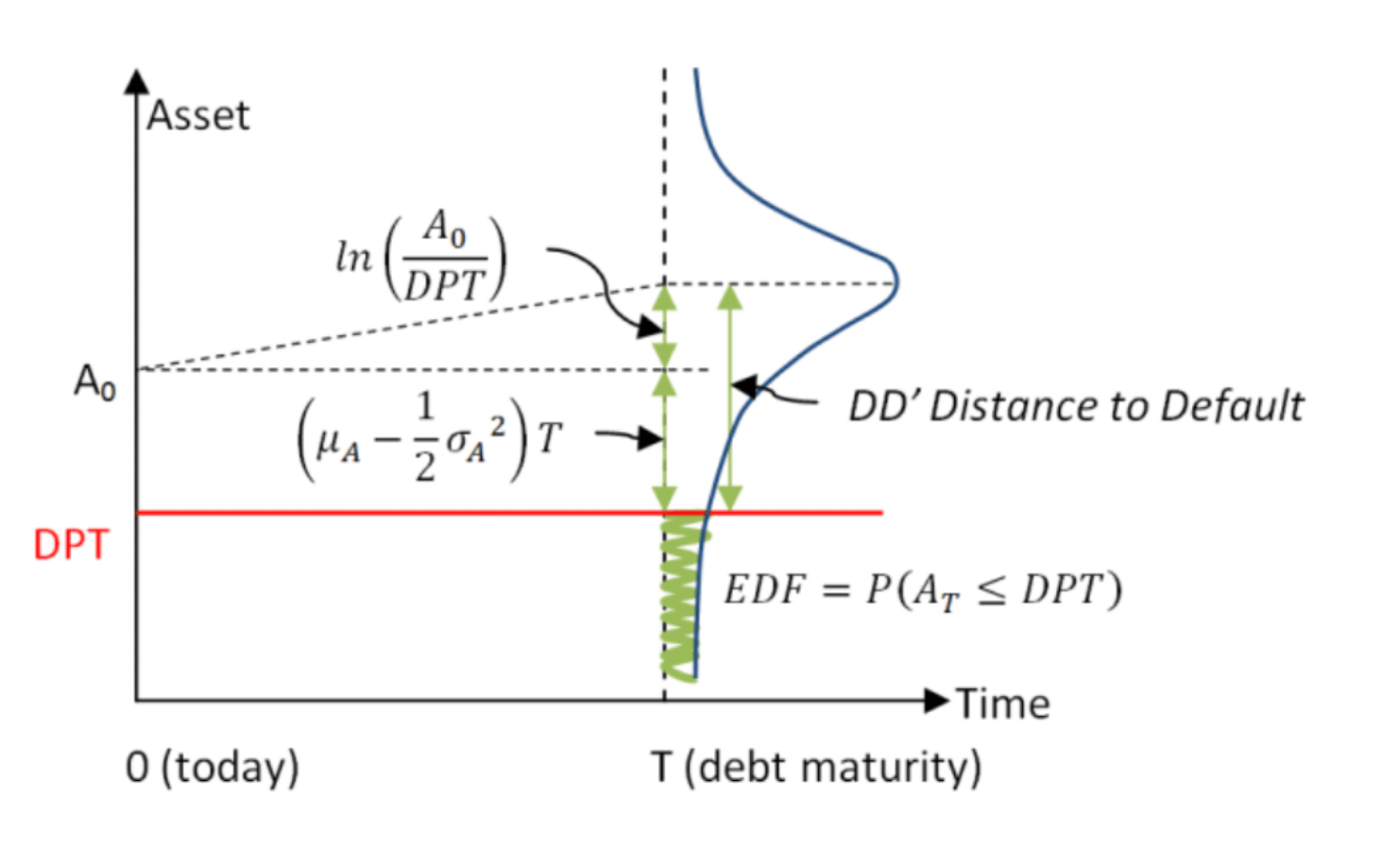

SwissBorg identified the Merton model for assessing the risk of default as applying to an assessment of the risks associated with UST.

“The Merton model uses the Black-Scholes-Merton option pricing methods and is structural because it provides a relationship between the default risk and the asset (capital) structure of the firm.”

The report illustrated how the complex formula used in the Merton model analyses the risk of an asset falling below its liability threshold, as shown below.

Concerning the Terra ecosystem, the report determined the probability of UST losing its peg.

• Asset value A is represented by the market capitalization of LUNA

• Liabilities value L is represented by the market capitalization of UST

• if at a given time horizon T the market cap of Luna is smaller than that of UST, the UST peg is lost

The above data was charted to show the probability of UST losing its peg daily. In May 2021, the risk rose to just under 100% before falling back to 20% in November. The threat had been steadily rising to 60% as of April 2022. At present, UST, trading at $0.59, has definitively lost its peg.

Risk conclusions

SwissBorg concluded that “the fate (and risks) of UST are strictly linked to that of LUNA. Any convergence in the market capitalization of LUNA toward that of UST poses serious risks of losing the peg.” Their recommendation was to monitor the position of UST with LUNA closely, watch the TVL of Anchor Protocol for a decline, track market volumes for LUNA to ensure liquidity, and monitor for a decrease in demand for Terra stablecoins.

At present, all of these conditions are true. LUNA has dropped 90%, UST is down 30%, Anchor Protocol TVL is down 60%, and demand for Terra stablecoins is flatlining. Further, a drop in the total market cap of crypto as a whole has created a perfect storm for a black swan event in regards to the Terra ecosystem. Will Terra survive this storm, or are tens of billions of dollars worth of tokens about to be wiped from the face of the earth?

Regardless of whether Terra can recover, there are plenty of investors who will not be able to due to Anchor Protocol liquidations.

And it’s not a small amount, $133k.. was all I had man, seriously this shit is pretty much wiped me out besides a few k in savings. I’m fucked 10 ways to sunday

— Wicklidation (@Joe_Cool_Bitmex) May 11, 2022

The post SwissBorg report explains cause of the “death spiral” of UST appeared first on CryptoSlate.