Just like the crypto market, the popularity in the DeFi market has exploded over the past few years, prompting several new entrants.

According to DeFi Pulse, the total value locked in DeFi protocols is more than $78 billion, representing a tenfold increase since May 2020. Also, the total value locked in DeFi protocols is over $80 billion already.

While such growth means that investors can dive into the DeFi space right away, it also means they should be on the lookout for opportunities and make well-informed purchases when the market is down, and trade when it is doing well.

In the last seven days, however, Defi’s price has dropped by 26.61 percent. In the last 24 hours alone, the price has dropped by 31.43 percent. This seems like an opportune time to invest in DeFi, though you should also take note of the best assets to put your stakes in.

Listed below are the 10 Top DeFi coins today that you should know about.

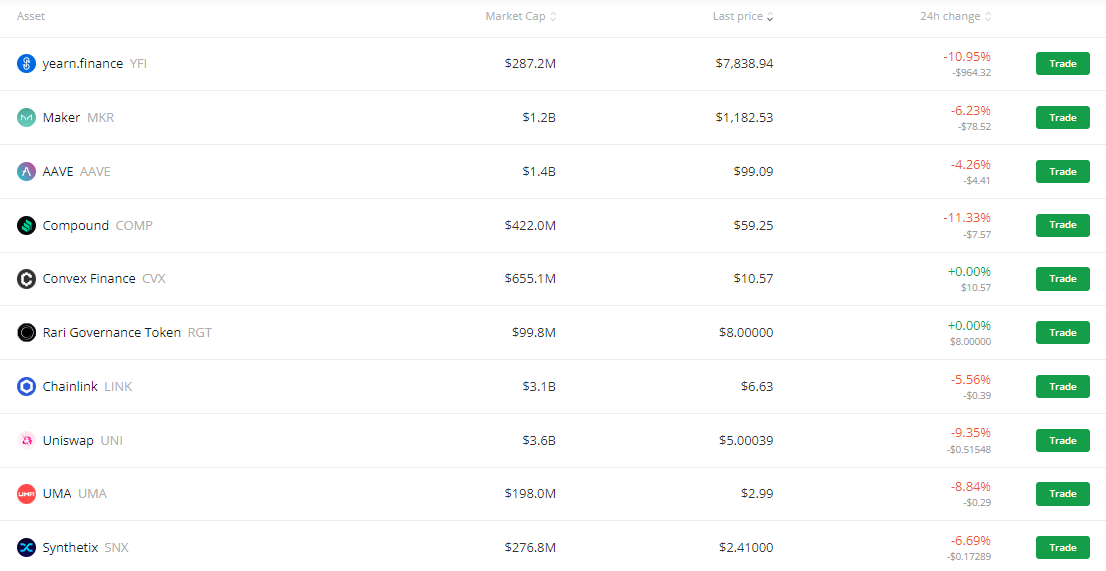

Top 10 DeFi Coins Today

1. yearn.finance (YFI)

yearn.finance is a collection of Ethereum blockchain protocols that enable users to maximize their earnings on crypto assets through lending and trading services.

yearn.finance, one of a number of emerging decentralized finance (DeFi) projects, provides its services entirely through code, eliminating the need for a financial intermediary such as a bank or custodian.

To accomplish this, it has created a system of automated incentives based on its YFI cryptocurrency.

The DeFi platform benefits from on “yield farming,” in which users lock up crypto assets in a DeFi protocol to earn more cryptocurrency. The protocols award tokens to users based on the number of assets they lock in a platform.

The token YFI governs the yearn.finance platform as well, meaning by voting on proposals, anyone who owns YFI tokens can influence the rules that users must follow when using yearn.finance.

The current floor price of YFI is $8,191.02 with a 24-hour trading volume of $93,787,968. It has a live market cap of $300,100,301. The DeFi coin has a circulating supply of 36,638 YFI coins and a maximum supply of 36,666 YFI coins.

Your capital is at risk.

2. Maker (MKR)

MakerDAO is an Ethereum-based decentralised credit platform that supports Dai, a USD-pegged stablecoin. Anyone can use Maker to open a Vault, secure collateral like ETH or BAT, and generate Dai as debt against that collateral.

A stability fee (i.e., continuously accruing interest) is charged on Dai debt and is paid upon repayment of borrowed Dai. That MKR, along with the repaid Dai, is destroyed.

Users can borrow up to 66 percent of the value of their collateral (150 percent collateralization ratio).

Vaults that fall below that rate face a 13 percent penalty and liquidation (by anyone) to bring the Vault back into compliance. On the open market, liquidated collateral is sold at a 3 percent discount.

Holders of MKR govern the system by voting on risk parameters like the stability fee level, for example. In the event of a black swan event, MKR holders serve as the last line of defence.

If the value of the system’s collateral falls too low too quickly, MKR is minted and sold on the open market to raise more collateral, diluting MKR holders.

The current Maker price is $1,211.89, and the 24-hour trading volume is $109,508,396. With a live market cap of $1,184,783,670, there are 977,631 MKR coins in circulation, with a maximum supply of 1,005,577 MKR coins.

Your capital is at risk.

3. AAVE

Aave is a protocol for decentralised finance (DeFi) that allows people to lend and borrow cryptocurrencies and real-world assets (RWAs).

It was initially built on top of the Ethereum network, with ERC20 tokens distributed across the network. Aave has since expanded to include Avalanche, Fantom, and Harmony.

The protocol itself makes use of a DAO, or decentralised autonomous organisation. That is, it is run and governed by the people who own and vote with AAVE tokens.

Aave currently has pools for 30 Ethereum-based assets, including Tether, DAI, USD Coin, and Gemini dollar stablecoins. Avalanche, Fantom, Harmony, and Polygon are among the other markets.

Aave also offers real-world asset pools such as real estate, cargo and freight invoices, and payment advances.

Aave’s current price is $103.84, with a 24-hour trading volume of $330,675,209. It has a live market cap of $1,440,119,074. There are 13,868,191 AAVE coins in circulation, with a maximum supply of 16,000,000 AAVE coins.

Your capital is at risk.

4. Compound (COMP)

Compound is an Ethereum algorithmic money market protocol that allows users to earn interest or borrow assets against collateral.

Anyone can contribute assets to Compound’s liquidity pool and start earning continuously compounding interest right away. Rates are automatically adjusted based on supply and demand.

cTokens represent the underlying interest-earning underlying assets that serve as collateral for supplied asset balances. Users can borrow up to 50% to 75% of the value of their cTokens, but this depends on the quality of the underlying asset.

Users can also add or remove funds whenever they want. This is subject to their debt not becoming undercollateralized. Upon liquidation, a 5% discount on liquidated assets is provided as an incentive.

Compound first appeared on the mainnet in September 2018 and was upgraded to v2 in May 2019. BAT, DAI, SAI, ETH, REP, USDC, WBTC, and ZRX are now supported by the protocol. Compound has undergone auditing and formal verification.

Compound’s price today is $63.06 with a 24-hour trading volume of $81,314,549. It enjoys a live market cap of $449,278,559 and a circulating supply of 7,124,109 COMP. The coin’s maximum supply at the moment is 10,000,000 COMP coins.

Your capital is at risk.

5. Convex Finance (CVX)

Convex Finance enables Curve.fi liquidity providers to earn trading fees and claim increased CRV while not locking CRV. Liquidity providers can benefit from increased CRV and liquidity mining rewards with little effort.

Curve LP tokens can be staked directly on the Convex Finance website, which has a user-friendly interface. The platform enables CRV token holders and Curve liquidity providers to earn extra interest and Curve trading fees on their tokens.

Convex Finance’s current price is $10.08, with a 24-hour trading volume of $10,062,270. The current market capitalization is $625,714,575. There are 62,078,307 CVX coins in circulation, with a maximum supply of 100,000,000 CVX coins.

Your capital is at risk.

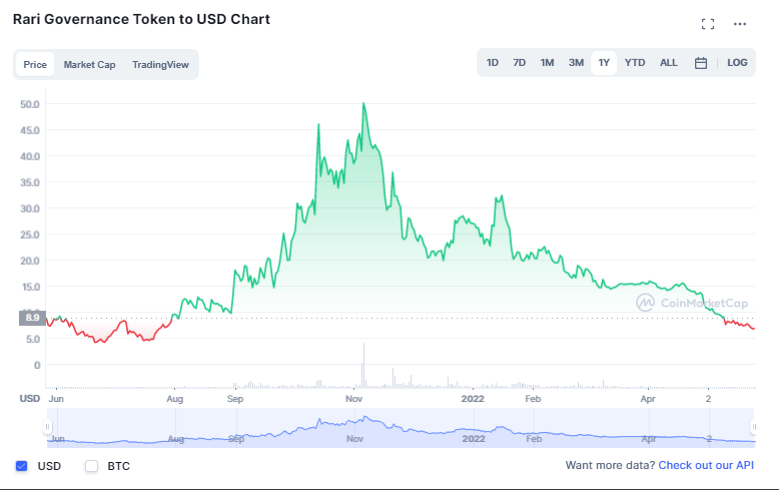

6. Rari Governance Token (RGT)

RGT is an Ethereum token that powers Rari Capital, a decentralised lending and borrowing protocol. The Rari Governance Token is used for fee reductions as well as protocol governance.

Rari is a platform for decentralised finance (DeFi) that enables users to lend, borrow, and farm cryptocurrency assets. According to the project’s blog, Rari Wealth’s goal is to create technologies that will allow the masses to profit from their idle capital without requiring user participation.

The key selling point of the DeFi application is its automatic non-custodial fund, which is built on the Ethereum blockchain. By relying on underlying smart contracts, users can entrust cryptocurrency to the platform.

The computer then searches DeFi applications for the highest yield-earning opportunities. Portfolios are automatically rebalanced using both cryptocurrencies and stablecoins.

The current price of Rari Governance Token is $6.87, with a 24-hour trading volume of $258,707. RGT has a live market cap of $85,700,202, a circulating supply of 12,469,774 RGT coins, and the maximum supply is not known.

Your capital is at risk.

7. Chainlink (LINK)

Chainlink is a decentralised oracle network that provides real-world data to blockchain smart contracts. Smart contracts are pre-specified blockchain agreements that evaluate information and execute automatically when certain conditions are met.

LINK tokens are the digital asset tokens used to pay for network services.

Through oracles, the decentralised network of nodes transfers data and information from off-blockchain sources to on-blockchain smart contracts.

This process, combined with extra secure hardware, eliminates the reliability issues that could arise if only a single centralised source is used.

Contract holders are being asked to use LINK to pay Chainlink node operators for their efforts. Prices are set by the Chainlink node operator based on demand for the data and current market.

The live Chainlink price today is $6.75 with a 24-hour trading volume of $394,434,686. The coin has a live market cap of $3,153,790,320 and a circulating supply of 467,009,550 LINK coins. The maximum supply is pegged at 1,000,000,000 LINK coins.

Your capital is at risk.

8. Uniswap (UNI)

Uniswap, which launched in November 2018, was one of the first decentralised finance (or DeFi) applications to gain significant traction on Ethereum.

Several other decentralised exchanges have since launched (including Curve, SushiSwap, and Balancer), but Uniswap remains by far the most popular.

Uniswap pioneered the Automated Market Maker model, in which users contribute Ethereum tokens to Uniswap “liquidity pools” and algorithms set market prices based on supply and demand (as opposed to order books, which match bids and asks on a centralised exchange like Coinbase).

Users can earn rewards while enabling peer-to-peer trading by supplying tokens to Uniswap liquidity pools. Anyone, from anywhere, can contribute tokens to liquidity pools, trade tokens, and even create and list their own tokens (via Ethereum’s ERC-20 protocol).

Uniswap currently supports hundreds of tokens, with stablecoins such as USDC and Wrapped Bitcoin among the most popular trading pairs (WBTC).

The current Uniswap price is $5.15, and the 24-hour trading volume is $211,085,099. It currently has a market capitalization of $3,705,085,925. There are 718,889,312 UNI coins in circulation, with a maximum supply of 1,000,000,000 UNI coins.

Your capital is at risk.

9. UMA

UMA is an open-source infrastructure that allows for the deployment and enforcement of synthetic assets on Ethereum. The coin allows developers to create synthetic tokens that track the price of anything quickly and easily. UMA provides invaluable financial contracts.

In the event of a disagreement, priceless financial contracts only require an on-chain price feed. Priceless contracts reduce reliance on oracles, making UMA contracts less vulnerable to cyber-attacks.

UMA’s Priceless contracts include mechanisms to incentivize people who create synthetic tokens (known as token sponsors) to ensure that their positions are adequately collateralized.

Taking a position entails creating a fictitious token that can be repaid to close the position and return the collateral.

UMA tokens are currently priced at $3.18 with a 24-hour trading volume of $26,733,816 as of today. The coin’s present market capitalization is at $211,408,386. Besides, it has a circulating supply of 66,420,391 UMA coins and a maximum supply of 101,172,570 UMA coins.

Your capital is at risk.

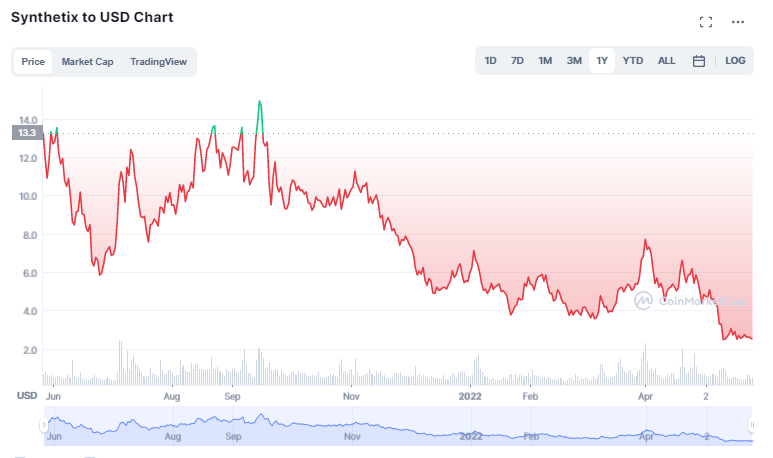

10. Synthetix (SNX)

Synthetix is a DeFi protocol for issuing synthetic assets that track and return on another asset without requiring you to hold that asset.

Synthetic commodities such as gold and silver, synthetic cryptocurrencies, synthetic inverse cryptocurrencies, synthetic cryptocurrency indexes, and synthetic fiat currencies are all supported by Synthetix. The platform introduces non-blockchain assets into the crypto ecosystem, resulting in a more mature financial market.

The Ethereum-based protocol employs decentralized oracles. These are smart contract-based price discovery protocols that allow you to track the prices of the assets represented and hold and exchange Synths as if you actually owned the underlying assets.

Synthetix is currently trading at $2.50 with a 24-hour trading volume of $63,454,036. Synthetix currently has a market capitalization of $287,194,479. It has 114,841,533 circulating SNX coins and a maximum supply of 212,424,133 circulating SNX coins.

Your capital is at risk.

Where to Find Top DeFi Coins?

DeFi investments have skyrocketed in recent times because of the emergence and popularity of the technology. To invest in DeFi, it is critical to adhere to the best DeFi platforms that provide simple and reliable information about their performance and predictions. Some of them are listed below.

eToro

As one of the most popular Crypto platforms, eToro also offers additional tools for researching, purchasing, and managing DeFi investments.

The “smart” DeFiPortfolio on eToro collects selected crypto assets from the DeFi revolution, such as Ethereum. This portfolio requires a minimum investment of $500.

Your capital is at risk.

Binance

To invest in DeFi on Binance, first obtain the necessary tokens from the Binance Smart Chain. To purchase, you will need BNB (BEP20). Then you’ll need a wallet with a dapp browser to trade tokens on platforms like Pancake Swap, Venus, Uniswap, and others.

Once you have the tokens and the wallet, you can enter the DeFi ecosystem with confidence.

Your capital is at risk.

Coinbase

Coinbase is a hub of information and resources when it comes to purchasing the top DeFi coins. It is also a popular platform for researching upon them in detail.

Your capital is at risk.

Read more:

Lucky Block – Our Recommended Crypto of 2022

- New Crypto Games Platform

- Featured in Forbes, Nasdaq.com, Yahoo Finance

- Worldwide Competitions with Play to Earn Rewards

- LBLOCK Token Up 1000%+ From Presale

- Listed on Pancakeswap, LBank

- Free Tickets to Jackpot Prize Draws for Holders

- Passive Income Rewards

- 10,000 NFTs Minted in 2022 – Now on NFTLaunchpad.com

- $1 Million NFT Jackpot in May 2022