A reversal in interest rates shows that markets are pricing in lower inflation expectations and a rising probability of a deflationary market on the horizon.

The below is an excerpt from a recent edition of Bitcoin Magazine Pro, Bitcoin Magazine’s premium markets newsletter. To be among the first to receive these insights and other on-chain bitcoin market analysis straight to your inbox, subscribe now.

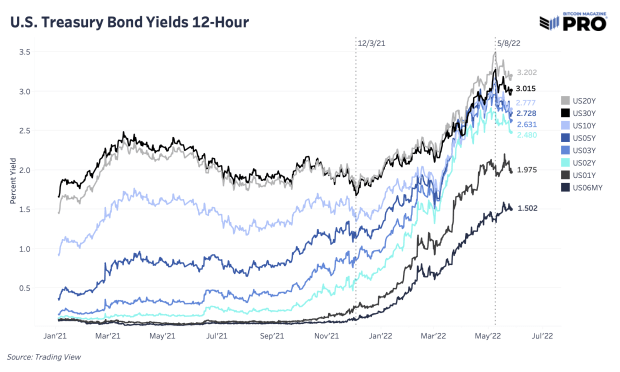

U.S. 10-Year Peaks At 3.19%

Over the last few weeks, we’ve seen a sharp reversal in interest rates, especially longer duration, as markets seem to be pricing in lower long-term inflation expectations and the rising probability of a more deflationary market regime on the horizon. The U.S. 10-year treasury yield has fallen over 50 basis points to around 2.78%.

The recent rally in bonds could be caused by a few different factors, with the most obvious being the large institutional players such as pension funds that are (and have been) in desperate need of yield. The second factor at play could be the impending economic slowdown taking place in the United States, as bond investors (often touted as being the smart money) front-run a slowdown in consumer spending and inflation expectations.

With the fall in bond yields, equity indices have rebounded, with the S&P 500 currently trading 6.7% off of its May 20 lows. With bonds and equities bouncing off the local lows, the looks of a prototypical bear market rally seem to be in the works.

Final Note

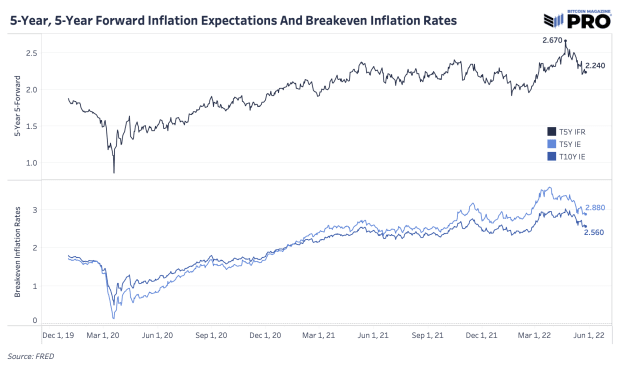

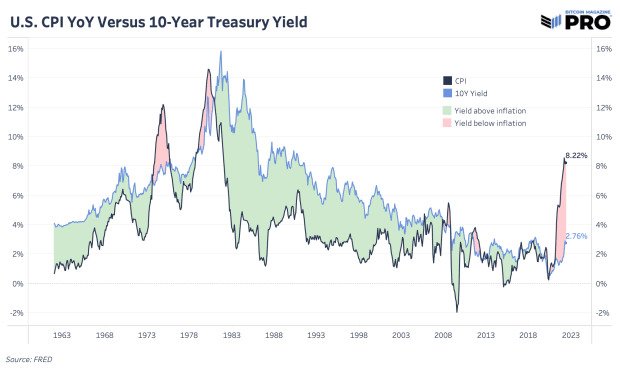

While forward inflation expectations for the next five years are sitting at 2.24%, current year over year consumer price inflation is 8.22%, meaning the real yield on all global fixed income instruments has been deeply negative. This dynamic has been a large focus of our research over the previous year, and due to global debt levels, this will need to persist.

In 2022, the liquidity tide has been pulling back. In due time, the tide will reverse, solely based on the realities of a debt-based monetary system. Every rational investor will be searching for a safe haven for their capital.