The demand for DeFi coins has risen substantially in 2022 with DeFi making breakthrough improvements in its infrastructure over time. Some of the DeFi coins have showcased excellent price movement in the past few months, which could be a good option for investment and trading purposes.

Following is the list of the top 10 DeFi coins based on market price.

10 Top DeFi Coins Based on Market Price

1. Wrapped Bitcoin (WBTC)

Wrapped Bitcoin is an ERC 20 token that represents Bitcoin on the Ethereum Blockchain. Being compatible with Ethereum, it can be fully integrated into Decentralized Finance Ecosystem -Ethereum wallets, dapps, and smart contracts.

One WBTC equals One BTC. BTC can be converted into WBTC and vice versa. BTC holders can convert their BTC holding into WBTC to fully utilize the Ethereum Ecosystem.

The current market price of WBTC is $28,858.02, which has a 24h trading volume of $309,300,694 and a market cap of 7,923,022,099. Currently, 274,552 coins are in circulation with a total supply of 274,552 coins.

Your capital is at risk.

2. renBTC (REN)

renBTC too is a tokenized form BTC like WBTC. It is an ERC 20 token built on the ETH network and minted on REN Protocol. 1 renBTC is equivalent to 1 BTC. Users need to send their BTC to RenVM. RenVM is a virtual machine operating in the Ren Protocol that eliminates cross-blockchain barriers and facilitates interoperability.

Once the users send the BTC to RenVM, it secures the assets and mints an equal number of renBTC on ETH and issues the same to the users. To redeem the BTC, a similar process is to be followed and a small amount of gas fee is to be paid.

The current price is per coin $28,907.88. Its 24h trading volume is $7,819,669 with a market cap of $190,791,289. The total circulating supply of the coin is 6,600 and the max supply is 13,698 coins.

Your capital is at risk.

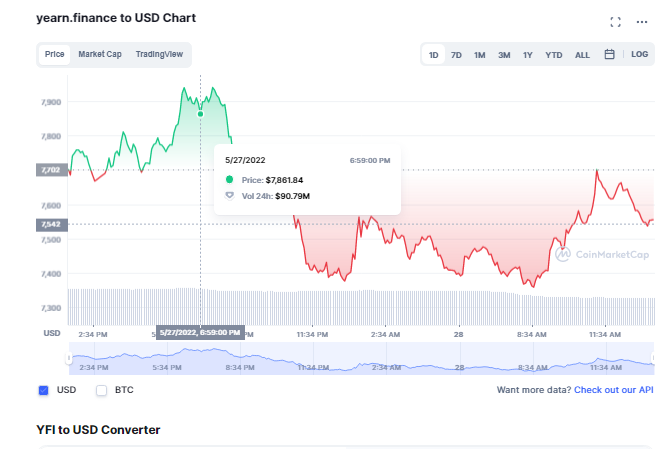

3. yearn.finance (YFI)

The Yearn Finance is a Blockchain-based decentralized financial services protocol. It aims to provide a platform for investors to engage in financial services like lending and borrowing and optimize their crypto earnings without the intervention of centralized financial institutions or banks.

It acts as an aggregator or marketplace for finding different interest-bearing crypto products to help investors find the highest yield on their crypto holdings. Its native governance token is YFI, which provides users with voting rights to implement changes to the protocol.

YFI is currently trading at a price of $7,579.61. The 24h trading volume is $55,432,885. It enjoys a market cap of 277,699,795. The max supply of the coin is 26,666 out of which 36,638 are in circulation.

Your capital is at risk.

4. c.Vault.finance (CORE)

c.Vault.finance is a blockchain ecosystem that incorporates various revenue earning strategies to help crypto owners earn attractive rewards. Assets that enter the c.Vault protocol are converted into CORE tokens. Rewards can be earned by staking, lending assets to others, options trading or locking up the cryptos in a liquidity pool.

CORE, being the governance token of the protocol provides holders with the right to vote to implement changes to the protocol, introduce new liquidity pools or eliminate existing pools.

The floor price of CORE as on today is $5,952.95. The 24h trading volume and the market cap of the coin is $30,286 and $59,529,472 respectively. The number of coins that are presently in circulation is 10,000.

Your capital is at risk.

5. Maker (MKR)

Maker is the governance token backing the MakerDAO and Maker Protocol. The former is a decentralized organization while the latter is a software platform. Both are based on the ETH blockchain and together aim to issue and manage the DAI stable coin.

MKR holders get a voting share in the organization that manages DAI to implement changes in the protocol. Today, DAI is one of the largest stable coins in the digital market. This is why the demand for MKR crypto is considerable high among crypto investors.

MKR’s current market price is $1,209.76 and 24 h trading volume is $120,104,451. It has a market cap of $1,183,552,130. The circulating supply is 977,631 and the max supply is capped at 1,005,577 coins.

Your capital is at risk.

6. Gnosis (GNO)

Gnosis dApp is an ETH-based decentralized prediction market protocol. It provides the necessary infrastructure to developers to build prediction market applications wherein users can predict the outcome of certain events and trade cryptocurrencies on the basis of their predictions. Gnosis tokens lose or gain value based on the outcomes of the event

Its two primary tokens are GNO and OWL. GNO is the ERC 20 token that can be staked within the Gnosis protocol to earn rewards in OWL.

GNO’s current market price is $188.13 and 24h trading volume is $5735467. It has a market cap of $48,530,2093. At present, there are 25,79,588 coins in circulation and the max supply is limited to 10 million.

Your capital is at risk.

7. Aave (AAVE)

Aave is a decentralized financial protocol built on blockchain to facilitate lending and borrowing of funds in the form of crypto to earn attractive interests on cryptos without the involvement of an intermediary. It funds the loans from the liquidity pool wherein crypto holders put their assets to earn interest in return.

The platform issues two primary tokens- aToken and AAVE. AAVE is the native token of the platform. Borrowers who borrow loans denominated in the AAVE token need not pay transaction fees. Also, those who present AAVE as collateral to borrow funds can borrow a higher amount at a discounted fee. AAVE owners can have a watch on available loans before they are released to the public.

AAVE is currently trading at a market price of $94.52 on major exchanges. The 24h trading volume is $162,940,117 with a market cap of $1,301,803,295. AAVE’s current circulation is 13,868,541 coins and the max supply is set at 18 million.

Your capital is at risk.

8. Nexus Mutual (NXM)

Nexus Mutual is an ETH-built decentralized insurance protocol. Users can buy insurance plans to insure their smart contracts in the event of contract failure and can also avail cover from exchange hacks. Asset holders can also contribute their assets to its pool and earn rewards in return. It is in demand as it addresses the issue of vulnerability of smart contracts and provides protection from huge losses.

NXM serves as both the utility token and governance token of the platform. It can be used for purchasing insurance covers and staking for claims & risk assessment.

NXM has a floor price of $57.8 and a 24hr trading volume of $1411. The market cap of the coin is $376,915,397. There are 6,520,998 NXM coins in supply at present and the total supply is 6,796,909.

Your capital is at risk.

9. Compound (COMP)

Compound is a decentralized platform that facilitates the lending and borrowing of digital assets. Crypto holders can lend their assets into its liquidity pool and earn interest in return. It uses the pool to lend money to people seeking loans.

Its native token COMP can be used to lend cryptos to the lending pools. It also allows holders with voting rights to exercise the same for implementing changes in the protocol.

One can buy COMP at a price of $57.17 per coin. Its market cap is $407,352,404 and 24 hr trading volume is $65,156,071. Currently, there are 7,125,222 coins in circulation. The max supply of the coin is 10 million.

Your capital is at risk.

10. Enzyme (MLN)

Enzyme is a decentralized asset management platform built on the blockchain. Users can create and manage their own funds by putting them in single custody. The platform helps users to find a trustable vault based on their investment strategies. They can put their assets in the selected vault and manage them with utmost transparency.

MLN is the utility and governance token of the platform. It enables holders to participate in network governance by proposing and voting on changes to the platform’s protocol.

MLN has a floor price of $26.77 and a 24hr trading volume of $2,693,683. The market cap of the coin is $56,027,688. There are 2,093,289 MLN coins in supply at present and the total supply is 1,824,437.

Your capital is at risk.

Where to Find Top DeFi Coins?

Our top recommendation for buying DeFi coins is eToro. It is a regulated, safe and cost-effectively social trading platform. Those who are new to the world of cryptos can simple follow the footsteps of successful traders on the platform and use the copy portfolio feature to start trading on DeFi coins.

It has also introduced its “smart” DeFiPortfolio on its platform to help investors have a diversified DeFi portfolio. The portfolio requires a minimum investment of $500.

Your capital is at risk.

Read more:

Lucky Block – Our Recommended Crypto of 2022

- New Crypto Games Platform

- Featured in Forbes, Nasdaq.com, Yahoo Finance

- Worldwide Competitions with Play to Earn Rewards

- LBLOCK Token Up 1000%+ From Presale

- Listed on Pancakeswap, LBank

- Free Tickets to Jackpot Prize Draws for Holders

- Passive Income Rewards

- 10,000 NFTs Minted in 2022 – Now on NFTLaunchpad.com

- $1 Million NFT Jackpot in May 2022