The much-awaited Ethereum 2.0 is nearing its launch and a core Ethereum developer, Tim Beiko, has pointed out some significant changes that users can expect from the update, The Merge.

Ethereum is all set to move from its present PoW (Proof-of-Work) consensus to PoS (Proof-of-Stake) consensus––a transition that is said to happen in three phases. As a result, the network is going to be much bigger, highly energy-efficient, and more secure than its current version.

What is the Merge?

The Merge is an update to the Ethereum blockchain protocol that will be rolled out between 2022 and 2023 in three phases. It is a core technical change that will change the way blocks are mined on Ethereum’s network.

In essence, this update will eventually merge “the current Ethereum Mainnet… with the beacon chain proof-of-stake system,” states Ethereum.

Although the Merge has been popularly referred to as Ethereum 2.0, the company has done away with that term as it makes Eth2 sound like a new network, rather than an update to the existing network.

After the update, Eth1 will be called the “execution layer” while Eth2 will be known as the “consensus layer” – the third layer of the stack, which helps enforce the network rules during transactions.

Your capital is at risk.

What are Consensus and Consensus Mechanisms?

Consensus is a general but formalized agreement used to indicate that at least 51% of the nodes agree on a state of the network. Consensus mechanisms dictate the way a network of computers will validate the blocks while staying secure.

Consensus mechanisms include consensus protocols and consensus algorithms. And while they are both used interchangeably, protocols are a set of rules that help standardize a transaction, whereas algorithms are used to actually solve the mathematical problem.

How does Proof of Stake Differ from Proof of Work?

PoW and PoS are two types of consensus mechanisms used in crypto mining. Currently, Ethereum relies on the proof-of-work consensus for validating all the transactions done on its network.

In proof-of-work (PoW), miners compete to solve mathematical puzzles in order to validate transactions and add them to the blockchain. They get rewarded based on how much effort they put into mining blocks (i.e., solving complex math problems). Because it is such an energy-intensive process, the miner who successfully processes a block first enjoys some well-deserved rewards.

Like Ethereum, the most popular implementation of PoW is Bitcoin (BTC). In order to mine bitcoin, miners must first solve a cryptographic puzzle that requires significant amounts of computing power and electricity. The first miner to solve this puzzle is rewarded with new BTCs for their work.

An apt example of the Difference between PoW and PoS Mechanism

Some cryptocurrencies, on the other hand, use proof-of-stake (PoS) to achieve distributed consensus. In this consensus protocol, a subset of nodes is selected to verify the next block, which is chosen based on the size of their stake. If you own 10% of all tokens, for example, then you have a 10% chance of being selected as one of these nodes.

There is no mining involved in PoS because validators are chosen at random instead of competing against each other. They receive rewards proportional to their stake as long as they participate in validating transactions on the network regularly and honestly.

So, if you have 10% of all the coins in circulation, you get 10% of all the network rewards. This means that as long as you keep your coins in the network, you will continue to receive a share of the total rewards. Should you spend them, your rewards will eventually stop coming in altogether.

Invest in Ethereum via FCA Regulated eToro

Your capital is at risk.

Why is this Shift Important?

The Merge will provide the future users of Ethereum with a much better and more seamless experience. Here’s how:

Scalability

Scalability is a major problem in PoW because of its energy-intensive nature. At present, Ethereum can handle about 30 transactions per second. Once the network transitions into PoS, it will be able to support 100,000 transactions per second, making it faster and bigger. This shift promises to drive the prices of ETH to newer heights.

Energy-Efficiency

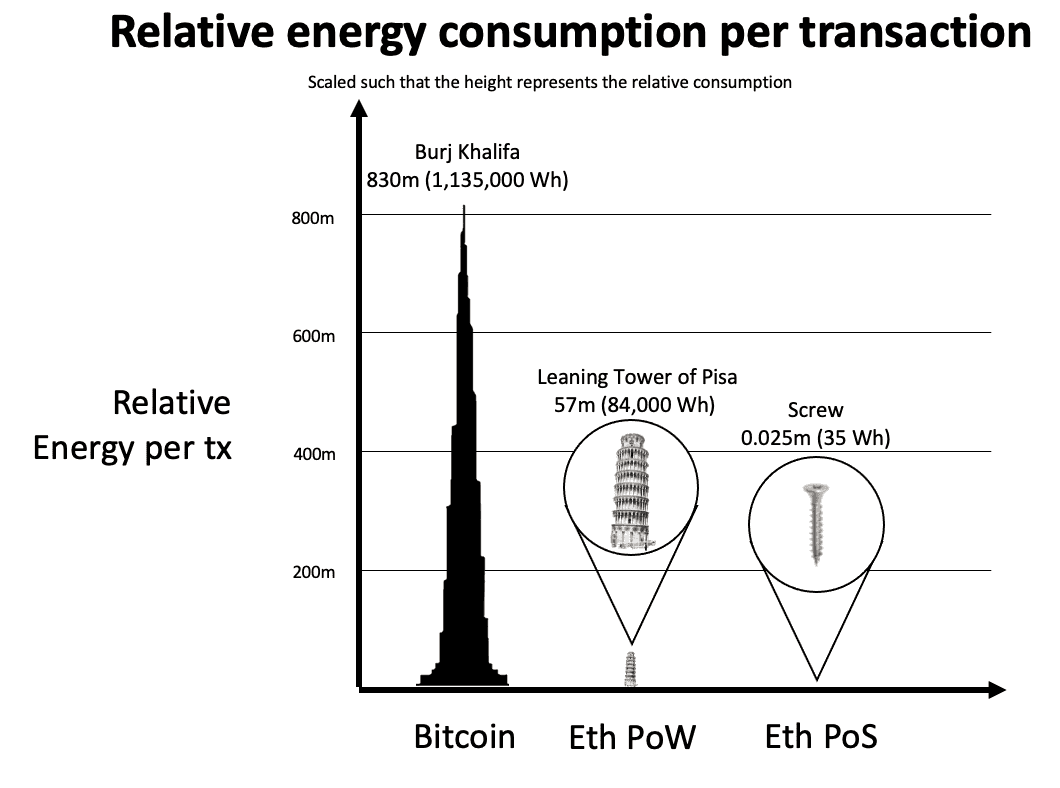

Even with crypto’s immense popularity, people are still concerned about the intensity of the carbon footprint left by the mining process. The more difficult the problem, the more energy it requires.

In this sense, proof-of-stake systems are more energy-efficient because they don’t require high computing power to verify blocks. Instead, validators on PoS networks will now vote on which blocks should be added to the blockchain.

Other validators will attest to the block proposition to show consensus. Once the consensus is reached and the block is successfully added to the chain, all will validators receive their respective ETH.

Security

Proof-of-work systems face significant security issues due to their open nature and high level of centralization as only a small group of miners are responsible for validating the blocks. But proof-of-stake consensus mechanism offers improved security since there are no miners with enough hashing power to control 51% or greater of the entire network at once like in PoW systems.

ETH 2.0 will need at least 16,384 validators to reach a consensus, which will make it more decentralized and thus, more secure than Eth1.

As Ethereum explains it, “[The Merge] will signal the end of proof-of-work for Ethereum and start the era of a more sustainable, eco-friendly Ethereum. At this point, Ethereum will be one step closer to achieving the full scale, security, and sustainability outlined in its Ethereum vision.”

Other Highlights from the Merge

The Merge will ensure that it reduces the block time to just 12 seconds per block from its current, which fluctuates between 13 to 14 seconds.

Besides, there will also be a cutback on the gas fees as the network will support a better and more energy-efficient validation method. This is also due to the shard chain that has already been implemented, which has allowed the diversification of all operations across 64 chains instead of on a single chain.

Vitalik Buterin, CEO of Ethereum, has also stated that Ethereum 2.0 will largely rely on ZK-rollups and its other scaling methods at present for at least a couple of years before the shard chains are properly implemented.

So far, validators have staked 12.6 million worth of ETH, the rewards for which are said to unlock after the Merge upgrade is complete.

Read more:

eToro – Our Recommended Ethereum Platform

- Monthly Staking Rewards for Holding Ethereum (ETH)

- Free Secure ETH Wallet – Unlosable Private Key

- Regulated by FCA, ASIC and CySEC – Millions of Users

- Copytrade Profitable Ethereum Investors

- Buy with Credit card, Bank wire, Paypal, Skrill, Neteller, Sofort