Bitcoin Custodians Facing Liquidity Crisis As Price Falls

This is an opinion editorial by Josef Tětek, the Trezor brand ambassador for SatoshiLabs.

Bear markets can be scary, with bitcoin dropping to unthinkable levels, leverage positions being liquidated and custodians failing on their promises. When FUD replaces FOMO, fortunes are easily lost. Keeping your head cool and your bitcoin in cold storage is imperative to survive in this unpredictable environment.

“Banks must be trusted to hold our money and transfer it electronically, but they lend it out in waves of credit bubbles with barely a fraction in reserve.”

The current situation that some of the bitcoin exchanges and custodians are facing reeks of solvency issues, colloquially known as “bank runs.”

Bank runs are nothing new. There are well-documented bank runs dating back over 200 years; the first American bank run happened just a few decades after the Declaration of Independence, in 1819 (for curious readers, I recommend Murray Rothbard’s “The Panic Of 1819”). Bank runs are a consequence of the age-old story of greed and counter to the notion of “getting away with it.” Bankers have always lent out some of their customers’ deposits to create revenue, but doing so increases their risks of going bust when depositors want their money back en masse.

In a fiat economy, bank runs are prevented in a typical statist fashion: the practice of fractional reserve banking that leads to bank runs is sanctified, and inevitable losses are mitigated by printing more money. And while this practice has been mostly hidden from the public eye for the most part of the 20th century, it became quite obvious after 2008: Banks that were supposed to fail were simply bailed out with taxpayers’ money and via a zero-interest rate policy, which ultimately led to inflation levels not seen since the 1980s.

But still, bank runs are mostly a thing of the past in the fiat economy, though they are still very much a possibility in the “crypto” economy.

In Bitcoin, Shysters Face The Music

In many aspects, Bitcoin is the direct opposite of fiat. The fixed issuance of 21 million coins is widely cited, but the fact that there are no leaders and no bailouts is no less critical for Bitcoin’s long-term success. However, this doesn’t stop certain risk-prone characters from recreating fiat institutions. The “crypto lending” shops such as Celsius are fractional reserve banks in principle; however this time there is no “lender of last resort” in the form of a central bank to bail out the founders and their clients when things turn sour.

Let’s make one thing clear: a yield always has to come from somewhere. To generate a positive yield on a scarce asset such as bitcoin, the institution offering said yield has to leverage the clients’ deposits in various ways. And whereas banks face strong regulatory requirements as to what they can do with the customer deposits (such as buy treasuries, facilitate mortgage loans etc.), cryptocurrency lending companies face no such regulatory requirements, so they basically go and put their customers’ deposits into casinos of various kinds — DeFi yield farming, staking, speculating on obscure altcoins.

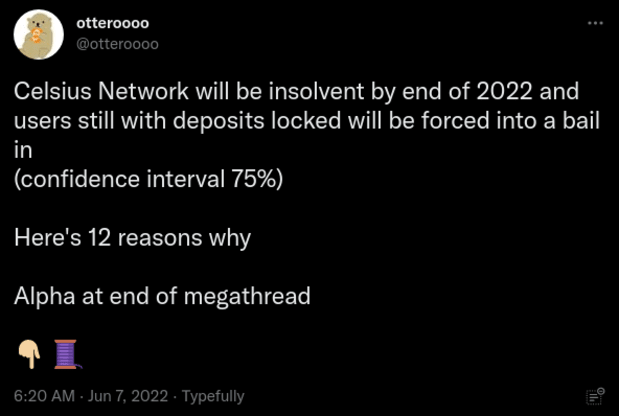

As Twitter user Otterooo recently mapped out, Celsius thus lost hundreds of millions dollars in user deposits on various badly-placed bets:

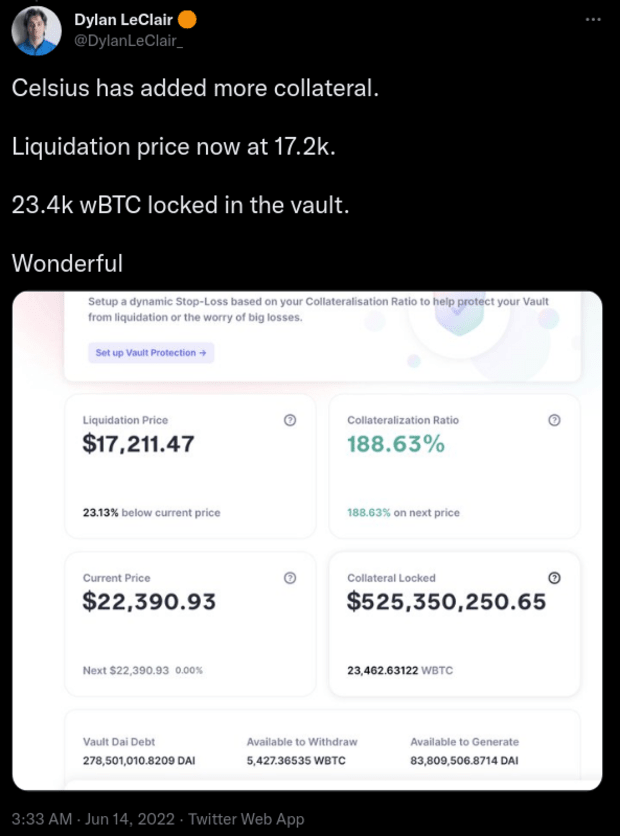

As of the time of this writing, Celsius has stopped all user withdrawals and seems to be having a serious solvency issue. With no bailout incoming, all the hapless users can do is grab some popcorn and watch the Celsius team fight for its half-billion leveraged position, the liquidation of which could mean the evaporation of most of its users’ funds:

Celsius Is Not The Only One

“You never know who’s swimming naked until the tide goes out.”

It’s quite frustrating to witness people lose funds in essentially the same way as Mt. Gox users did in 2013. Exchanges and custodians fall for the same temptation that bankers did for centuries: leveraging user deposits to squeeze out more than what they would earn from the service fees. It’s quite paradoxical that bitcoin (and most altcoins) offer a straightforward way to offer a proof of self-audit via a cryptographic signature of addresses with sufficient balances, yet no exchange, save for a few exceptions, performs such proofs of reserves.

It may very well be that all the exchanges are perfectly solvent, but the issue is we have to trust them on that. As the “Oracle of Omaha” famously quipped, we’ll never know who’s naked until the tide goes out. So, when Binance, one of the world’s largest exchanges, halts bitcoin withdrawals, we never know if it’s really only a temporary technical hiccup, or a much more sinister liquidity issue.

How Can We Protect Our Coins?

While we can collectively call for exchanges to offer proofs of reserves, the only real mitigation of the counterparty risk that exchanges pose is to take possession of our coins. The only way to be really certain that nothing shady is happening with our coins is to hold the private keys ourselves. Bitcoin is unique in the way it makes administering one’s own wealth easy, and ever since the first hardware wallet in the form of Trezor was introduced in 2014, there are no excuses not to hold your own keys.

Buying bitcoin in a peer-to-peer fashion is preferable from the privacy standpoint, so if you can find a reliable seller — usually through Bitcoin meetups — making regular purchases through the same channel and stacking straight into a hardware wallet is the way to go. ATMs also can allow for purchasing amounts of bitcoin up to $1,000 with good privacy. But, if for any reason you prefer buying through exchanges, there is no reason to leave your coins off of your own wallet.

And if you’re keeping your coins on an exchange right now, it’s a good idea to consider withdrawing into your own wallet. Even if you earn a yield on your coins, the long-term risks of losing 100% of your coins simply isn’t worth it.

Hardware Wallet Manufacturers Do Not And Cannot Gamble With Your Wealth

Surprisingly, a lot of people misunderstand the nature of hardware wallet devices and the business models behind them. Some people believe that hardware wallet manufacturers are actually in possession of users’ coins and can recover the coins in case the user loses their recovery seed or passphrase — this couldn’t be further from the truth! It’s the wallet users that are always in the sole and exclusive possession of their coins. The manufacturer’s business is to sell devices; not to lend out or otherwise leverage the coins of their users!

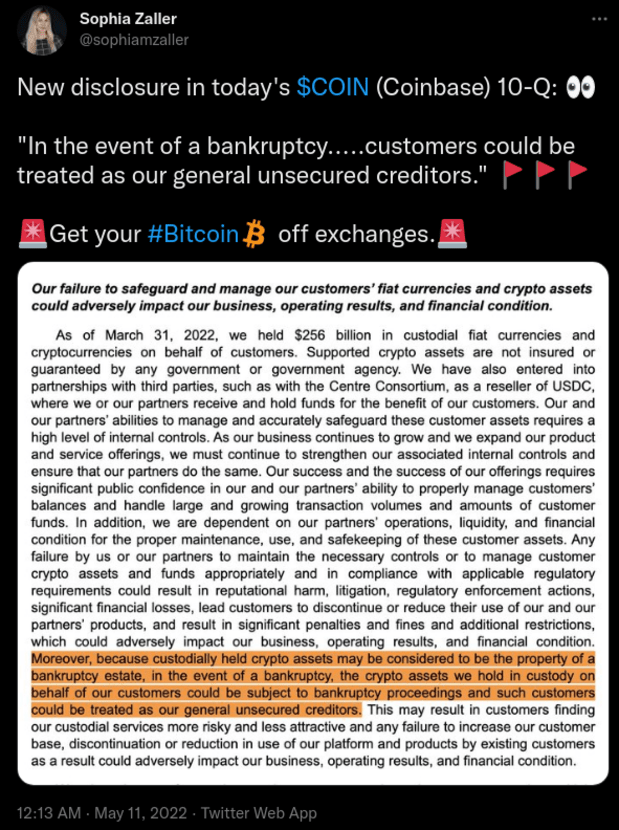

Contrary to exchanges and other custodians, there is no counterparty risk with using a hardware wallet. If Trezor or any of the other manufacturers went bankrupt tomorrow, users would be unaffected, because they are the sole owners of their coins. Compare this fact with the disclaimers of the major bitcoin exchanges, which can state that, in the case of bankruptcy, users’ coins are basically confiscated.

Nightmare For Some, Lifetime Opportunity For Others

The discovery of the fractional reserve practices being undertaken by some of the foremost custodians in the space might be an unpleasant surprise for many newcomers, who were seduced by the vision of earning yield on their otherwise “unproductive” assets. The further discovery of there being no bailouts might turn into a nightmare. Yet that is the nature of Bitcoin: in a stark contrast to the fiat system, Bitcoin rewards the prudent and punishes the frivolous. And through that mechanism, Bitcoin helps build a more responsible world.

This is a guest post by Josef Tětek. Opinions expressed are entirely their own and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.