After an explosive 2021, the recent downturn has left a bitter taste for crypto investors, not least those who went heavy on DeFi.

Since the market peaked in November 2021, investors had pinned their hopes on bulls shaking off the infrequent bearish signs that were presenting.

But the Tera scandal brought those expectations to an abrupt end in early May, and to add insult to injury; the great CeFi unwind that followed. Speculation continues to mount over which centralized platforms will follow Celsius, Voyager, and BlockFi into crypto limbo.

The high leverage risky investment practices employed in pursuing yield were a significant factor in their demise. Investors now think twice about promises of high yield. And considering yield is decentralized finance’s trump card, that wariness has spilled over to DeFi.

DeFi under the spotlight

By removing the control of centralized entities from the financial equation, DeFi users can (in theory) conduct transactions with no censorship resistance, have more control over their funds, and with fewer intermediaries in the mix, obtain a better deal, including higher returns on yield protocols.

As witnessed recently, DeFi is not isolated from the goings-on in the wider crypto market or even the macroeconomic landscape.

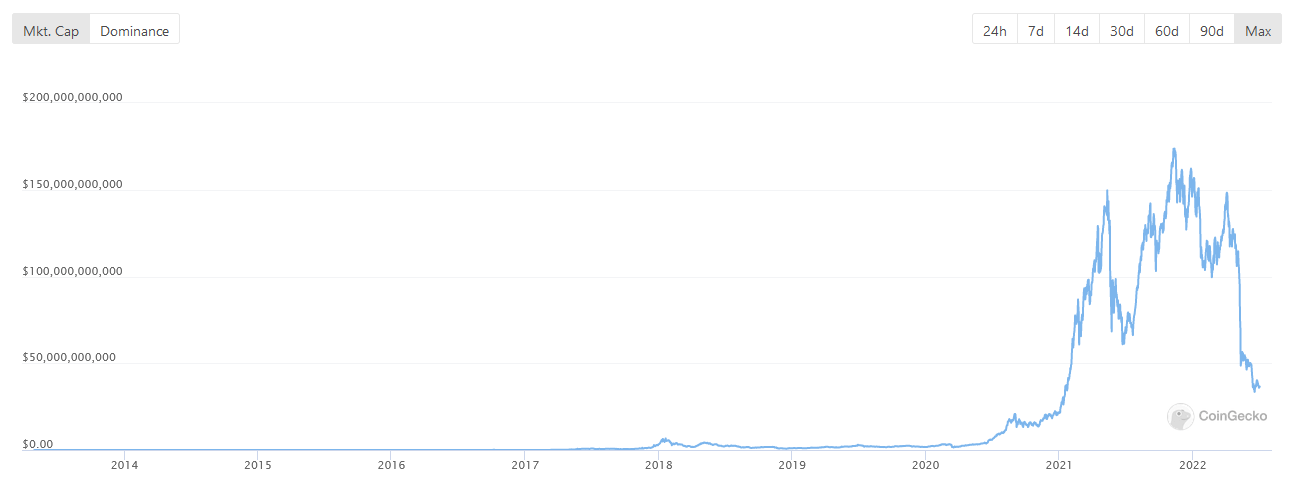

Coingecko’s DeFi index, which tracks the market cap of the top 100 DeFi protocols, demonstrates the scale of the devastation as a result of the downturn.

The chart below shows a peak on November 10, 2021, of $172.2 billion, followed by a sharp decline to bottom on February 22, 2022. The ensuing bounce was cut short at $142.8 billion, leading to a near-vertical drop-off from May onwards to hit a low of $33.5 billion.

Year-to-date losses come in at -76%, erasing all of the gains of the last 17 months. As reality sets in, many wonder if DeFi can recover, especially considering the increased scrutiny over yield generation due to the great CeFi unwind.

The state of the market

As catastrophic as the state of the market appears, the CEO and founder of DEFIYIELD, Michael Rosmer isn’t worried. By email, Rosmer said, while TVL has sunk, DeFi protocols continue to remain fully operational – something which cannot be said of some CeFi platforms.

“While the total value locked in DeFi and asset prices overall have sunk, causing many many investors to flee crypto, much of the DeFi market is still afloat. We’ve seen a decline in investors on our platform, but not enough for us to be worried.”

What’s more, by aligning with strong communities, Rosmer cites Cardano as an example, the DEFIYIELD platform has maintained a significant proportion of its userbase during this period.

However, what the recent turn of events does mean is the need for protocols to shore up their operations. This will translate into declining yields in the short term.

Future trends

On what else to expect going forward, Rosmer brings in the macroeconomic environment, saying the most significant factor affecting DeFi at the present time is the Fed’s continued hawkish stance, more so how things could play out in the last quarter.

“The most important trend we can expect this year is the Fed’s continued incremental raising of interest rates at its meetings scheduled for this month, October, November, and December.”

He expects further volatility in the immediate future as a result. But over the longer term, as the rate hikes kick in to curb demand and spending, the long-term outlook will provide “much-needed respite” against inflationary pressures.

And while CeFi and DeFi demonstrated a strong degree of price correlation lately, despite their apparent opposing ideologies, Rosmer said, long-term, DeFi will fare better and come out stronger “because it is functioning as intended – transparently.”

The post Here’s why the crypto downturn isn’t the end for DeFi appeared first on CryptoSlate.