Bitcoin lost half-a-percent overnight after Tesla said it had sold about 75% of its holdings of the virtual token.

The world’s largest cryptocurrency slid to $23,268.92 (£19,489) after the news, although it rebounded later and was last up 1.41% at $23,578.75.

Tesla bought $1.5bn (£1.2bn) of bitcoin more than a year ago, but on Wednesday it said it had sold $936m (£783m) during its second financial quarter.

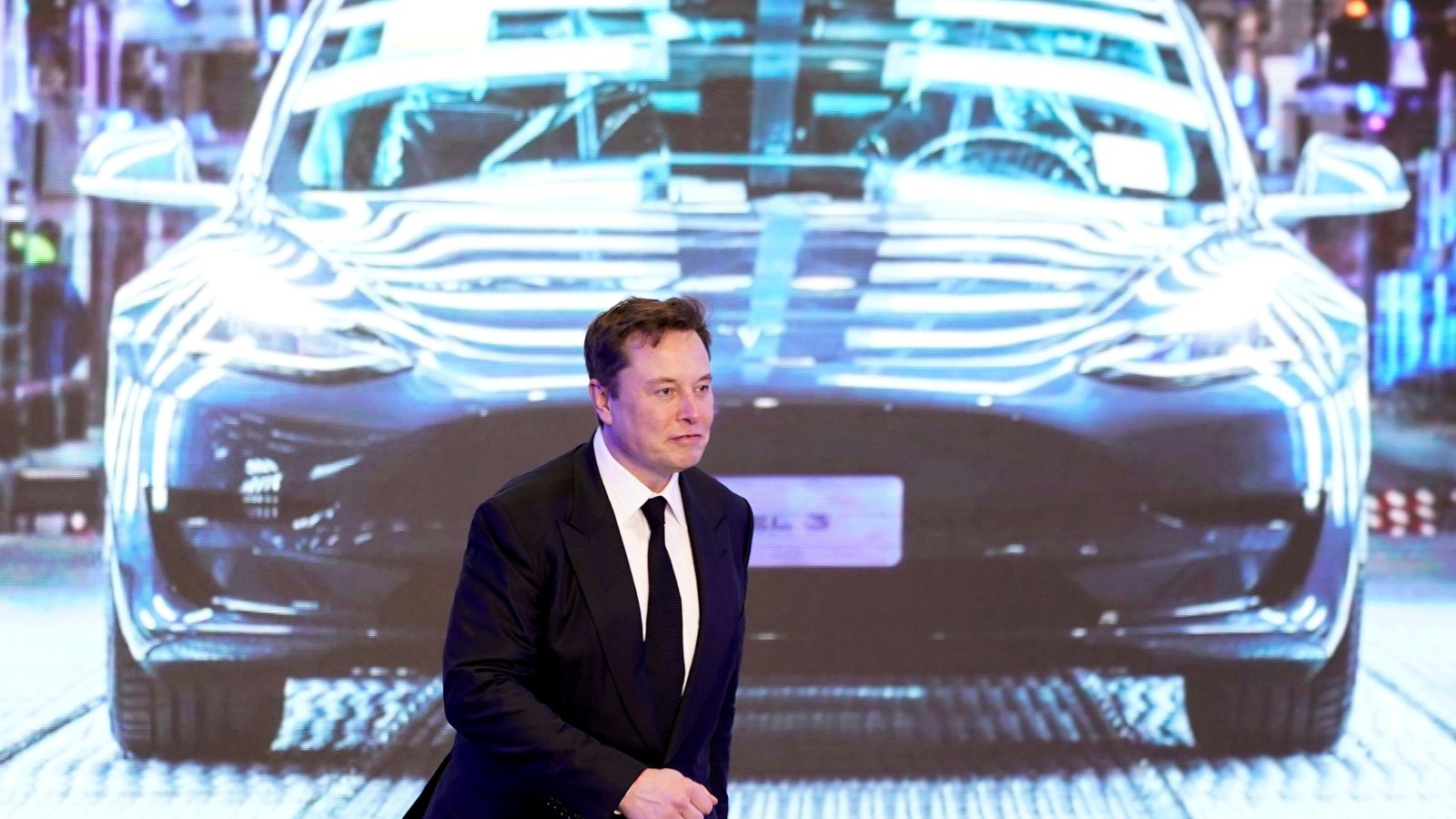

Tesla chief executive Elon Musk, a backer of cryptocurrency, said the main reason for the sell-off was uncertainty about China, which has seen its economy hit by strict COVID lockdowns.

Mr Musk, the world’s richest man, said: “We are certainly open to increasing our bitcoin holdings in future, so this should not be taken as some verdict on bitcoin.

“It’s just that we were concerned about overall liquidity for the company.”

Laura Hoy, analyst at Hargreaves Lansdown, said: “The bitcoin losses point out an important part of the Tesla investment case – its eccentric owner.

How a British man ended up on the FBI’s ‘Most Wanted’ list for allegedly helping North Korea evade sanctions

Signs of worst year for stock market investors in a decade after Wall Street slips into bear market and Bitcoin crashes

Bitcoin rallies slightly but still set for record losing streak after Terra ‘stablecoin’ collapse

“While Musk’s impressive innovation has served the company well, his personal flair is starting to raise governance questions.”

Read more:

Twitter and Elon Musk set for takeover deal showdown

Elon Musk sued for $258bn over Dogecoin promotion scheme claim

The news came as the electric carmaker reported that its total revenue had fallen to $16.93bn (£14.18bn) in the second quarter from $18.76bn (£15.71bn) a quarter earlier.

It said increasing the price of its best-selling vehicles had helped to offset challenges caused by China’s COVID lockdowns.

The US price of Tesla’s Model Y long-range version is up more than 30% since the start of 2021 to $65,990 (£55,270).

Mr Musk said he expected inflation to ease by the end of the year – having previously said he had a “super-bad feeling about the economy” – and his company promised a “record-breaking second half”.

Tesla shares were up about 1% in after-hours trading, but were down about 40% from their November peak.