While active Bitcoin (BTC) addresses are seen as a good indicator of the overall health of the crypto market, they’re less helpful in predicting market cycles.

A valuable metric that can be used to predict bull runs with a significant degree of accuracy is accumulation addresses. Defined as Bitcoin wallets held by investors that haven’t withdrawn or spent any of the BTC stored in them, accumulation addresses are often used to calculate the bullish sentiment in the market.

Determining the number of accumulation addresses requires applying strict limitations to the data. Any amount of Bitcoin withdrawn or spent from this particular type of address immediately removes it from the cohort. When calculating the total number of accumulation addresses, Glassnode considered both cold and hot wallets.

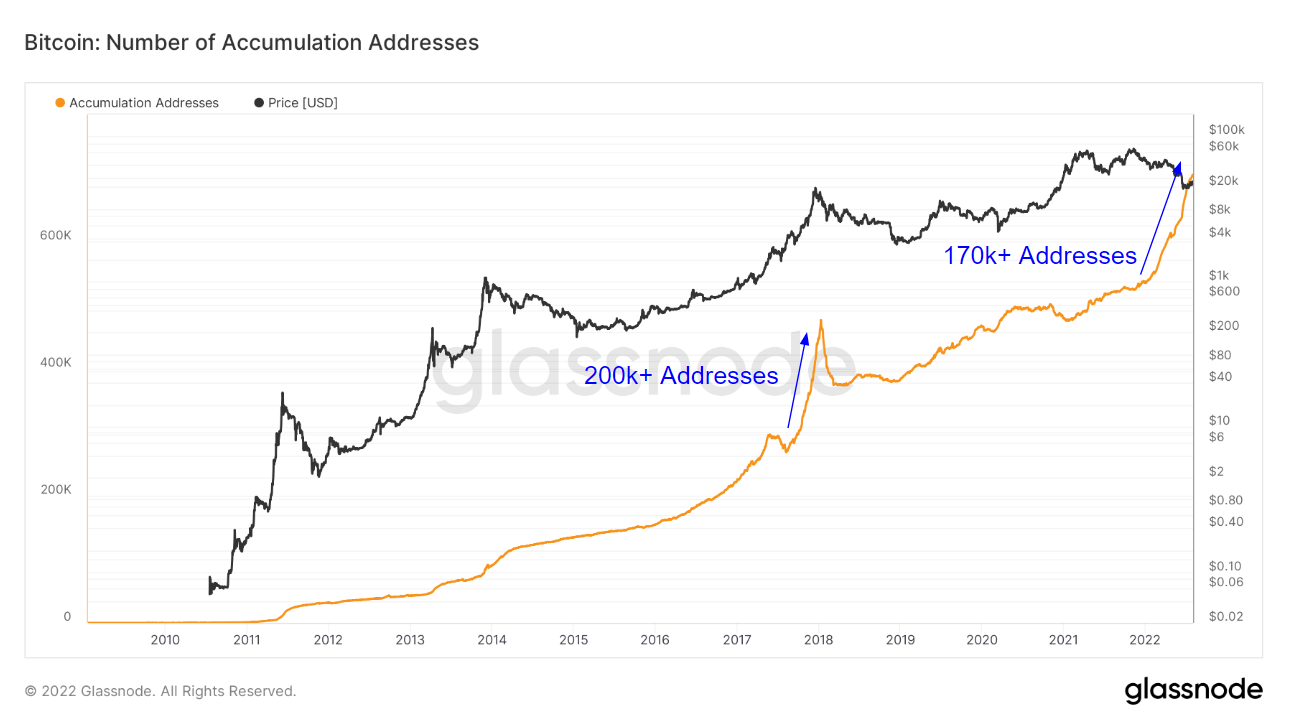

Zooming out to 2010 reveals an interesting trend — every time the number of these addresses increased, a bull run ensued.

The bull run of 2018 was preceded by the addition of 200,000 new accumulation addresses. Its peaks in 2014, 2013, and 2011 also correlated with a significant spike in the number of accumulation addresses.

According to Glassnode’s data, accumulation addresses have grown by 18% since Jan. 1, 2022, reaching an all-time high of 700,000 addresses.

The addition of 170,000 new accumulation addresses is typically a bullish indicator, as it shows an increasing amount of Bitcoin’s supply being taken out of the network. A drastically reduced supply of Bitcoins on exchanges then triggers an increase in buying pressure, pushing the price up.

The post Research: Accumulation addresses are an omen of a bull run appeared first on CryptoSlate.