The Bitcoin mining hash rate spiked as high as 298.5134 EH/s on September 4, marking a +60% spike in 24 hours.

Founder of fintech research firm Quantum Economics, Mati Greenspan, commented that the surging hash rate posted a new all-time high for the leading cryptocurrency.

Huge spike in bitcoin's hashrate this weekend. New record high attained. pic.twitter.com/p7AQZBxNuO

— Mati Greenspan (@MatiGreenspan) September 4, 2022

Far from being an outlier, an analysis of the hash rate on a yearly time frame showed an uptrend of higher highs — despite a drop-off in June following the Terra implosion and subsequent liquidity crisis.

Throughout this period, Bitcoin’s price has been trending downwards, adding further weight to the argument that hash rate and price are uncorrelated.

Price uncertainty remains

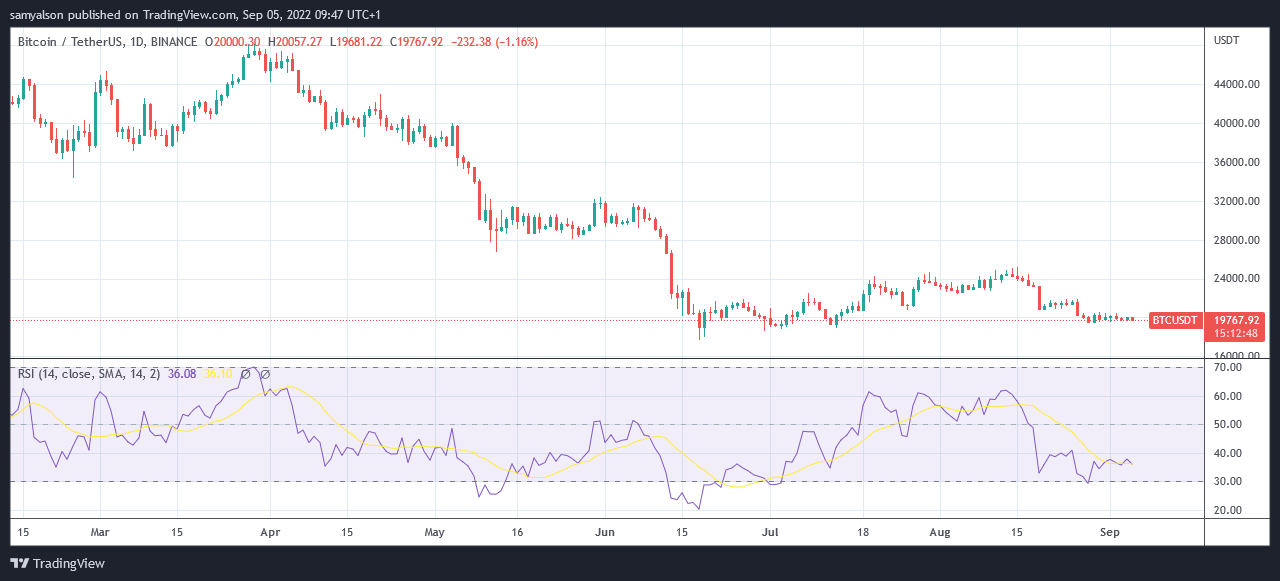

After bottoming at $17,600 on June 18, Bitcoin began a gradual uptrend which peaked at $25,100 on August 15.

Since then, macro events have taken hold as market participants exercise caution over the threat of looming interest rate hikes.

Since August 28, BTC has been trending downwards and is currently caught in a tight trading range between $19,400 and $20,400.

Analyst MarcPMarkets recently commented that bearishness in the stock market and the spiking dollar weigh heavy on Bitcoin. He said:

“…the bearish price action in the S&P and new highs on the Dollar are still facilitating an environment that favors LOWER prices over the coming week or two.”

Bitcoin miners under pressure

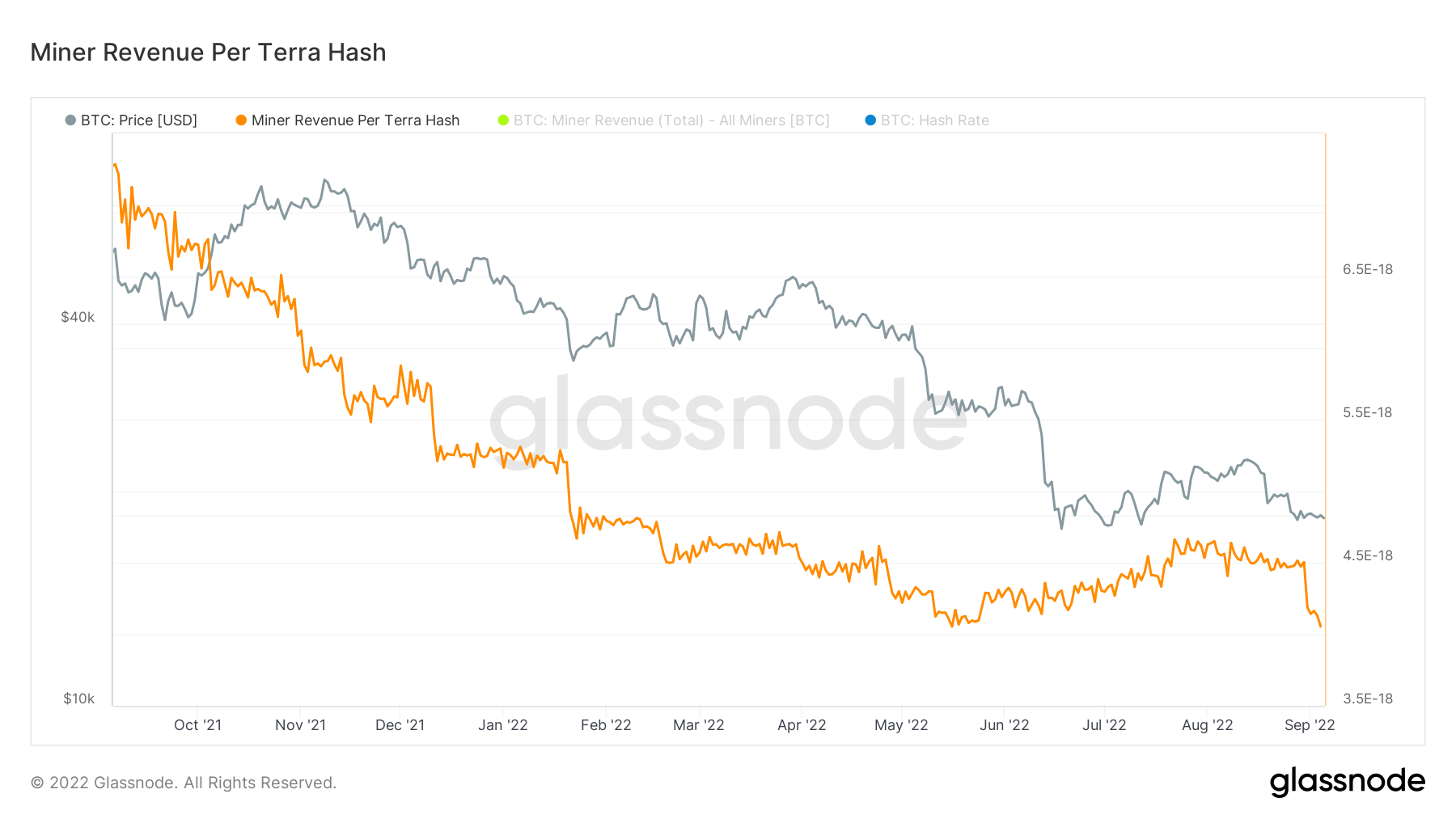

Bitcoin miners are coming under increasing pressure amid price uncertainty. The chart below shows miner revenue per terra hash continuing to slide since the market top in November 2021.

Although a bottom was hit in late May, leading to a gradual increase in revenue per terra hash, recent events have triggered a sharp drop.

Meanwhile, in conjunction with the rising hash rate, mining difficulty is also on the up. On August 31, mining difficulty jumped to 30.98 T — marginally below the all-time high of 31.25 T, which occurred between May 11 and May 24.

For now, it’s all eyes on the Bitcoin price, as further sell-offs will force the least efficient miners to shutter their operations.

The post Bitcoin mining hash rate spikes 60% despite plummeting revenue per terra hash appeared first on CryptoSlate.