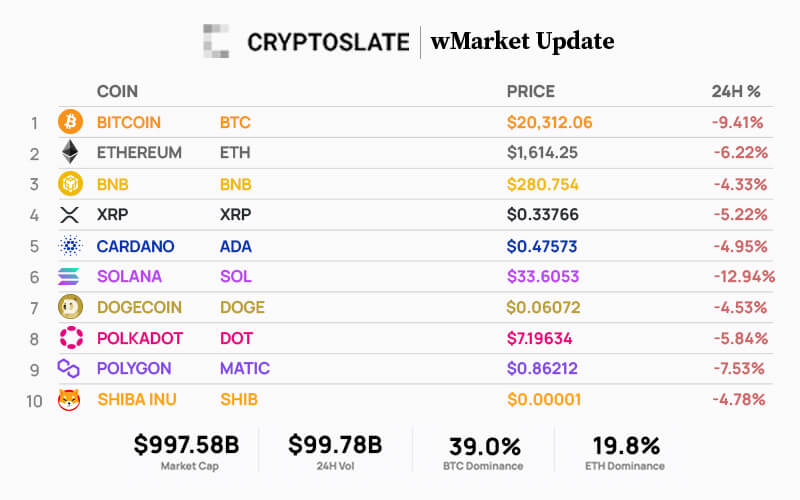

The total cryptocurrency market cap saw net outflows totaling $69.42 billion from the previous day. As of press time, it stood at $997.58 billion, down 6.5% over the last 24 hours.

Bitcoin’s market cap fell 9% over the reporting period to $390.05 billion from $428.73 billion. Meanwhile, Ethereum’s market cap fell by 6%, dropping from $210.18 billion to $197.90 billion over the same period.

Over the last 24 hours, all of the top 10 cryptocurrencies were down, with Solana the biggest loser, down 13% over the last 24 hours.

Source: CryptoSlate.comThe market cap of the top three stablecoins — Tether (USDT), USD Coin (USDC), and BinanceUSD (BUSD) — remained relatively flat over the past 24 hours, standing at $67.88 billion, $51.34 billion and $20.21 billion, respectively.

Bitcoin

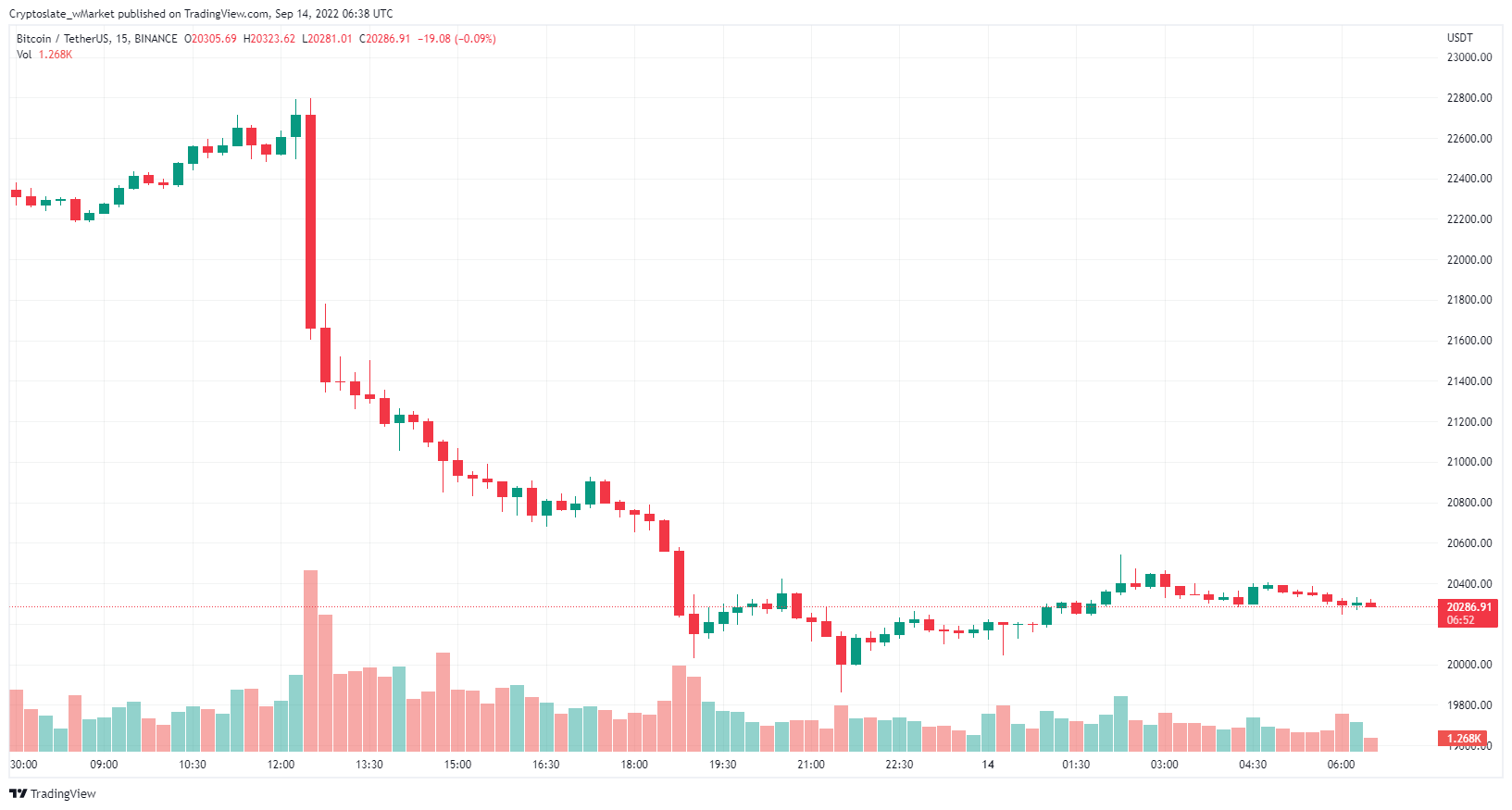

Since the last wMarket update, the Bitcoin price has fallen by 9% to stand at $20,300 as of press time. Market dominance fell from 40.2% to 39.0% over the past day.

The losses of the last 24 hours erased a significant proportion of the gains made since Sept. 7, when BTC set off on a run of six consecutive daily green candle closes. The sell-off was spurred by news that CPI inflation was up 0.1% for August.

Fears are the Fed will impose a “jumbo hike” later this month, putting further pressure on risk-on assets and consumer confidence.

Ethereum

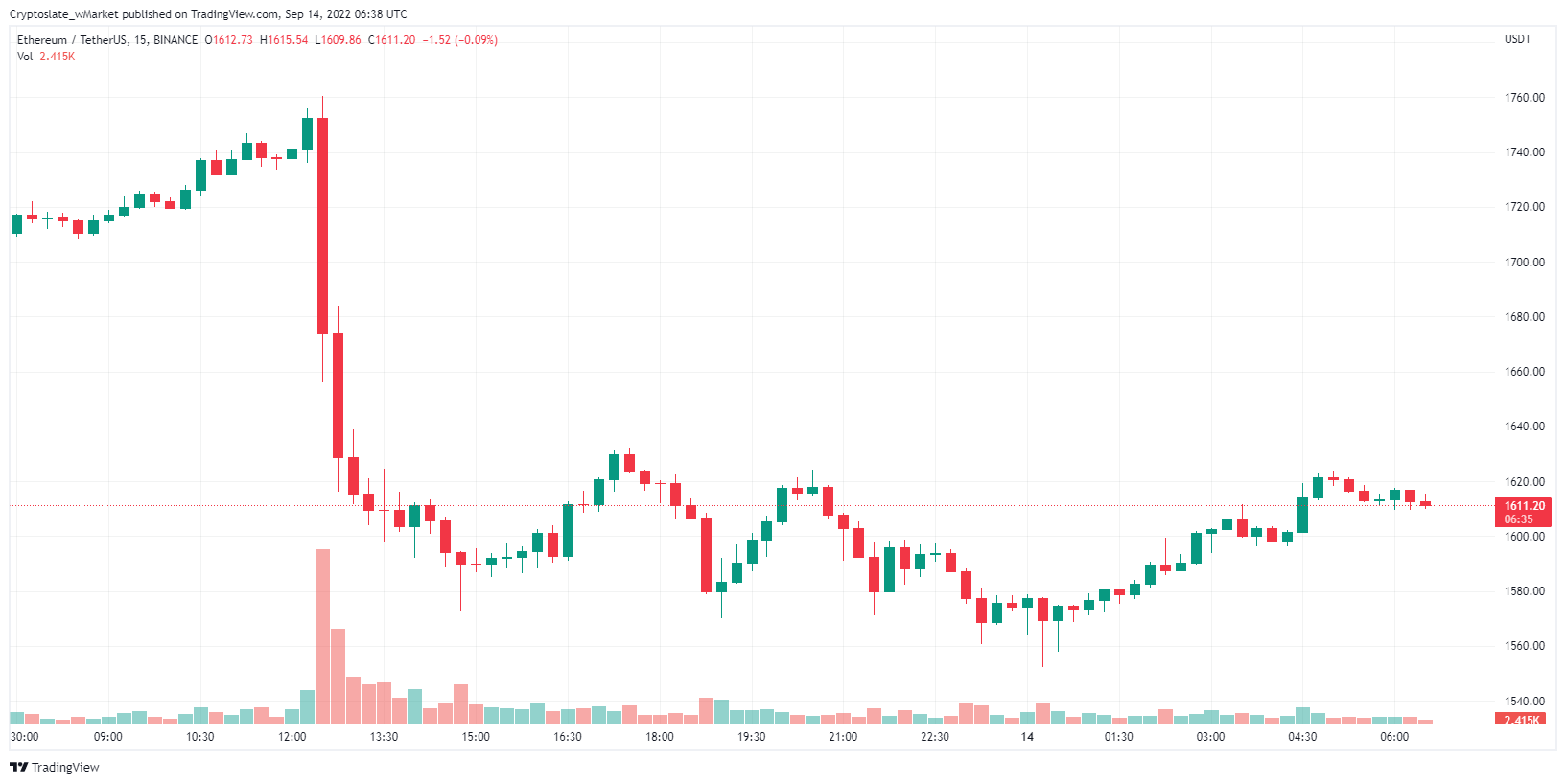

The price of Ethereum fell 6% to trade at $1,614 as of press time. Market dominance grew slightly from 19.7% to 19.8%.

The latest estimates put the Merge occurring around 06:00 UTC on September 15. Research showed derivatives traders expect price volatility post-Merge, with a significant proportion placing puts (the right to sell) at $1,100.

Top 5 gainers

Nervos Network

CKB lead the top gainers over the reporting period, trading around $0.00479 as of press time — up 23% over the past 24 hours. The token continues a respectable run, up 37% over the last 7 days. The market cap currently stands at $159.82 million.

Ravencoin

RVN continues climbing higher, recording gains of 10% over the past 24 hours to trade at around $0.06804 at press time. Over the past 30 days, RVN has increased 91% in value, likely driven by the exodus of ETH PoW miners. The token’s market cap stood at $712.57 million.

Voxels

VOXEL grew 5% over the past 24 hours and was trading at around $0.2905 at the time of publishing. Its market cap stood at $29.64 million.

MXC

MXC is up 4% since the last wMarket update to trade at $0.07203 at press time and up 117% from a year ago. Its market cap stood at $190.31 million at the time of writing.

Kyber Network

KNC bagged gains of 4% over the past 24 hours to trade at $1.91224 at the time of publishing. The DeFi liquidity protocol suffered a frontend hack at the start of September, leading to a loss of $265,000. However, the event has not spooked investors, who have driven KNC up 20% over the last 30 days. Its market cap stood at $340.01 million.

Top 5 losers

Pundi X

PUNDIX plunged 20% over the past 24 hours and hovered around $0.71577 at press time. Its market cap stood at $185.02 million. The token was yesterday’s top gainer, with +70% gains over the reporting period. However, profit-taking has since tanked the price.

Loom Network

LOOM continues sliding, down 17% over the past 24 hours to trade around $0.07564. The token had lost 23% over the previous reporting period. Despite that, LOOM is still up 49% over the past 30 days. Its market cap currently stands at $98.34 million.

Injective Protocol

INJ declined 17% over the past 24 hours to trade at $1.68061. The token is down 85% from a year ago and down 93% from its all-time high price of $24.33, achieved in May 2021. Its market cap stood at $122.69 million.

Prom

PROM fell 16% over the past 24 hours to around $6.07121 and trading down 67% from a year ago. The project describes itself as a gaming NFT marketplace.

Solana

SOL fell 12.6% over the past 24 hours to around $33.4703 as of press time. The token’s market cap stood at $11.83 billion. There have been no new developments to explain the sell-off. However, in recent times, SOL has demonstrated itself “higher beta,” which has played out in greater susceptibility to market swings in either direction.

The post CryptoSlate Daily wMarket Update – Sept. 13 appeared first on CryptoSlate.