A curated NFT marketplace is one where the access to sell an item is restricted. Only creators that are allowlisted (invited by an existing member or accepted by the platform curator) can offer their items there.

While this helps build a strong community around the artists on the platform, it also can reduce its outreach to the overall market. In this article, we will cover the features of Foundation and SuperRare and compare them with OpenSea, the leader among NFT marketplaces.

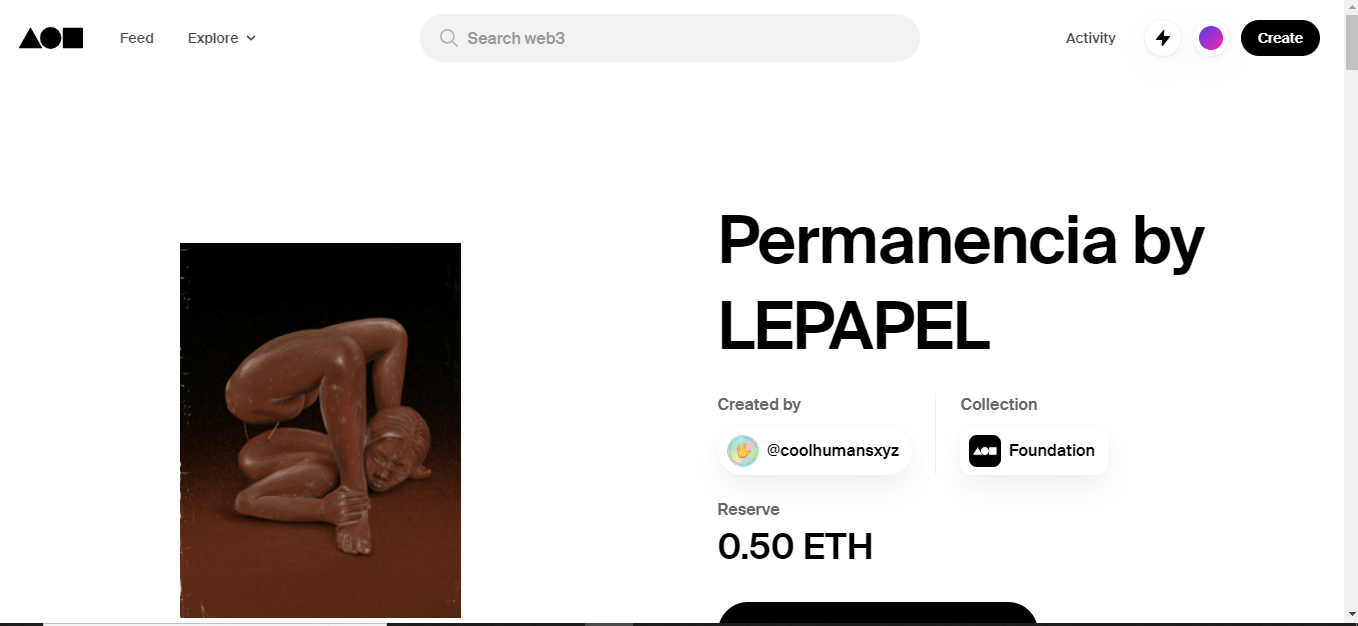

Foundation

Foundation is an NFT creators’ invite-only marketplace. Launched in February 2021, Foundation is one of the largest NFT marketplaces on the web. The platform is famous for having notable NFT auctions, such as Edward Snowden’s first NFT and the Nyan Cat animation.

NFT creators must get an invite code to be able to mint NFTs on the platform. The invites can only be sent by members who have already sold at least 1 NFT on the platform.

When an artwork is sold on the primary market, creators receive 85% of the final sale price. If an NFT is listed and collected again on the secondary market, a 10% royalty is automatically sent to the creator who originally minted the artwork.

Foundation has four selling options:

- Buy Now: This option is a direct buy, accepting the selling price of the NFT you like.

- Offers: This enables the buyer to send an offer direct to the creator.

- Reserve Auctions: A minimum price is set, and when this condition is met, a 24-hour auction starts.

- Private Sales: A direct transaction between two users.

Foundation collects a 5% marketplace fee on all transactions, meaning that creators get 95% of the total sales price when collectors purchase their NFT(s). If it is a secondary market sale, the seller will get 85% of the total sales, as 5% goes to Foundation, and 10% royalty goes to the creator.

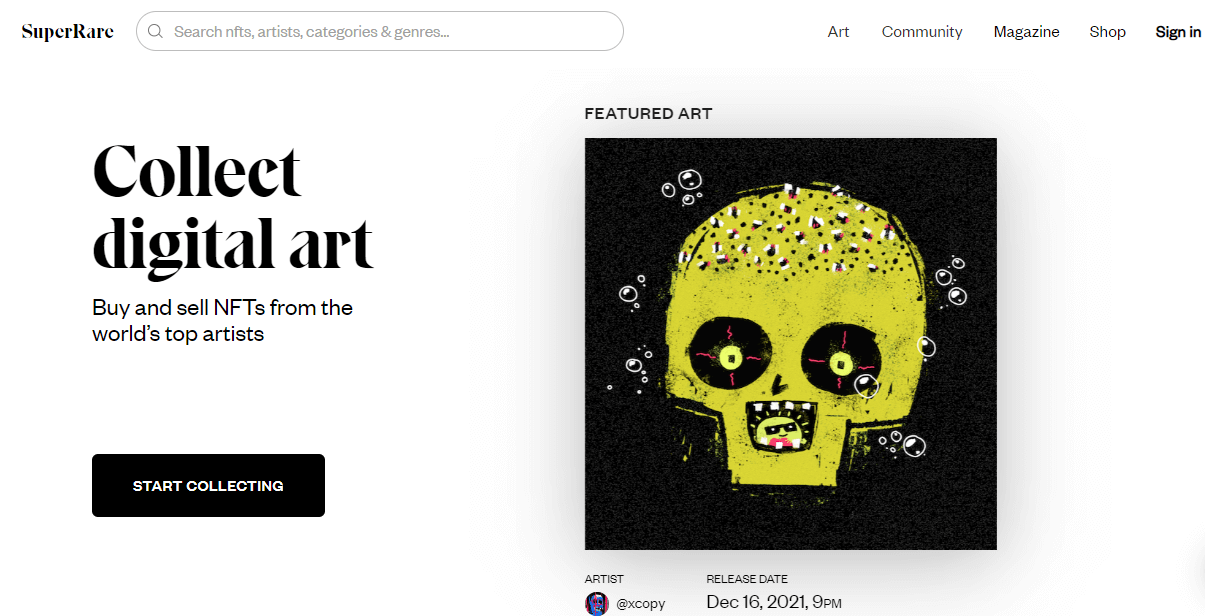

SuperRare

SuperRare is an NFT marketplace to collect and trade unique, single-edition digital artworks. The artist needs to be allowlisted to be able to sell a collection on the platform.

On primary sales (the first time an artwork is sold, also known as a mint sale):

- The artist receives 85% of the sale amount

- The SuperRare DAO Community Treasury gets 15% of the sale amount.

On secondary sales (which is any sale following the primary sale):

- The seller receives 90% of the sale amount

- The original artist receives 10% of the sale amount as a royalty

On all sales, a 3% marketplace fee is added to the sale price paid for by the buyer—this goes to the SuperRare DAO Community Treasury.

The SuperRare DAO Community Treasury is responsible for establishing artist and developer grant programs and ad-hoc expenditure of treasury assets as deemed necessary to support the continued growth and success of the SuperRare Network.

SuperRare Token ($RARE)

SuperRare introduced a token ($RARE) to pass the curation on the platform to the community (to SuperRare DAO). Part of the supply was airdropped to previous users who, together with the core team, are now part of the DAO that conducts the actions on the platform.

$RARE token holders collectively govern the SuperRare DAO – a decentralized organization that will oversee key platform parameters, allocate funds from the Community Treasury, and effectuate proposals passed through community governance relating to improvements to the network and protocol.

Besides curation and partnerships, another SuperRare DAO initiative is a Magazine where it shares more information about collections and artists and provides news about the NFT sector.

Metrics

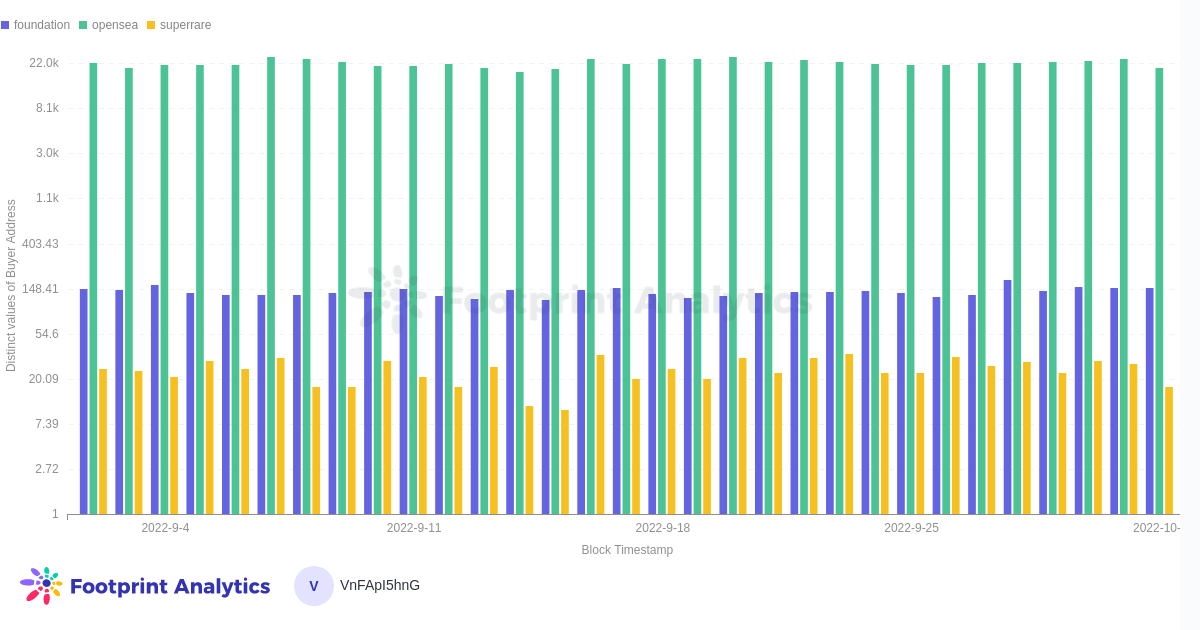

This section will present metrics of the curated NFT marketplaces and compare them against a benchmark—OpenSea.

As they offer exclusive collections, the curated NFT marketplaces can charge a higher fee than open Marketplaces. SuperRare also provides a token used to manage the platform (curation, fees, treasury), giving the community an extra incentive to participate.

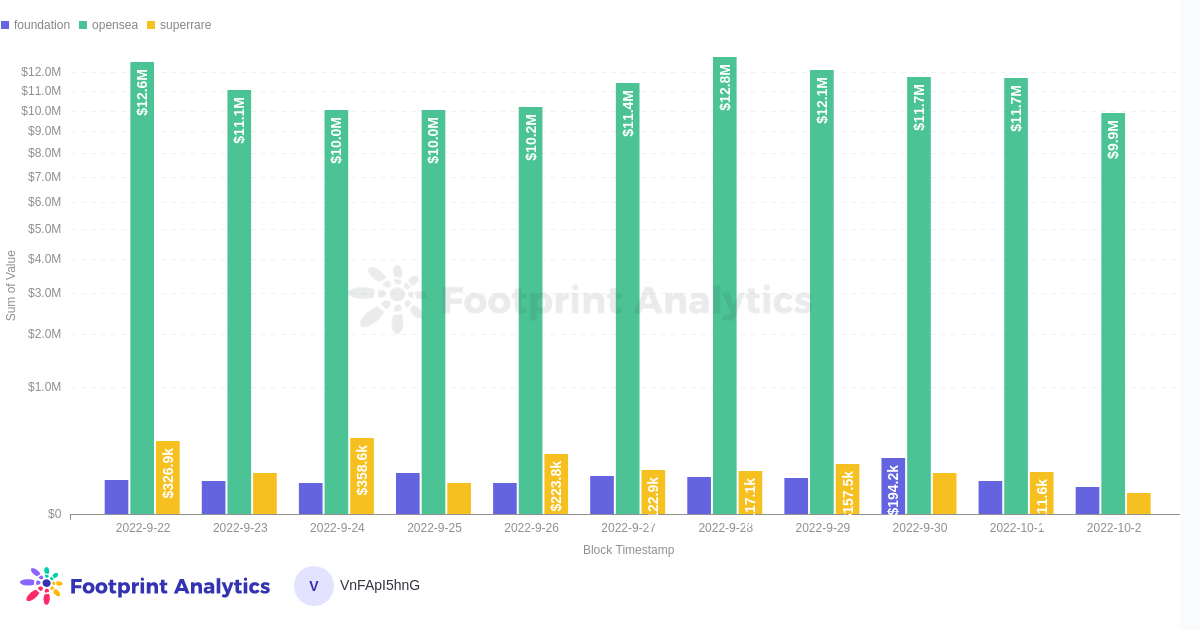

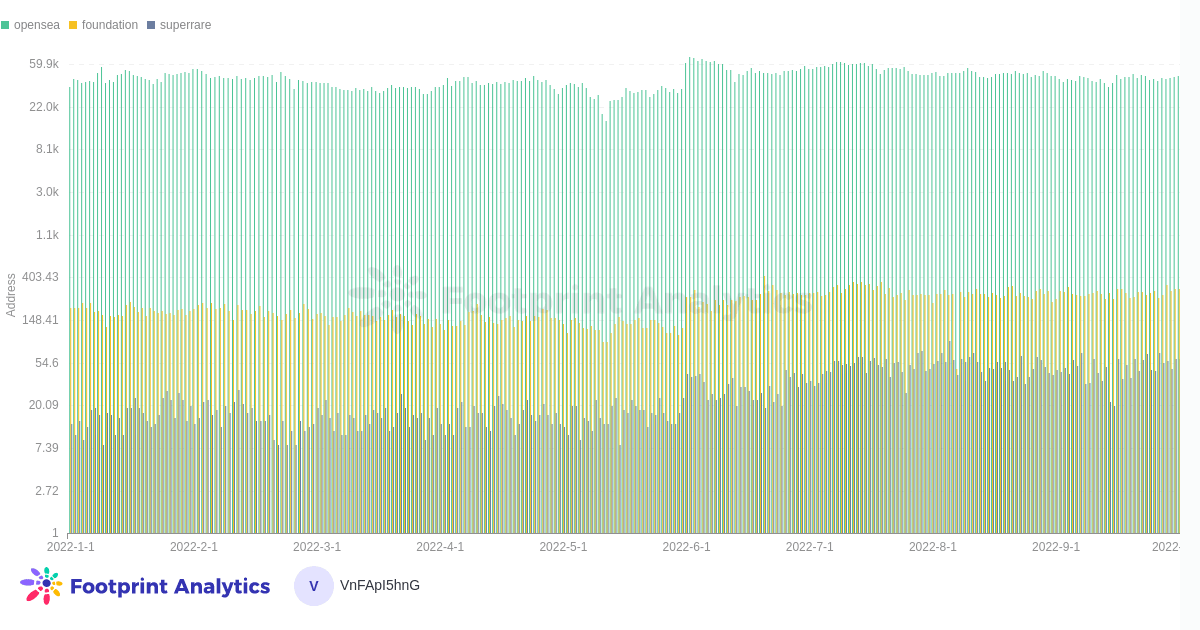

The option to only work with exclusive collections makes the daily trading volume of the curated NFT marketplaces lower than the benchmark.

This difference in the daily volumes is explained by the number of users, as OpenSea has no restrictions on collections being traded there.

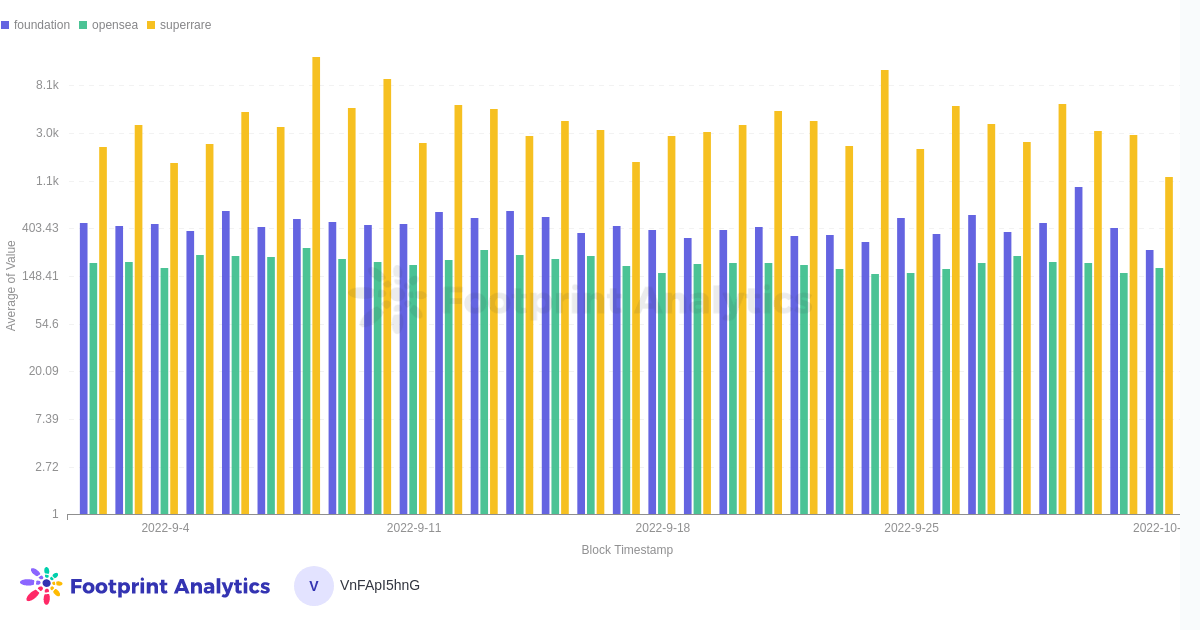

However, as the collections are curated, the average sale price is higher on the selected markets (Foundation and SuperRare) than on the benchmark.

The average sale price is over $2,000 on SuperRare, $400 on Foundation, and around $200 on OpenSea.

October 2022, Thiago Freitas

Data Source: Footprint Analytics – Curated NFT MarketPlaces Overview

Main Takeaways

Curated NFT marketplaces established themselves in a niche where their community drives the adoption of the collections. Because of their value proposition, they can close partnerships with other companies, increasing the collections’ uniqueness. In addition, SuperRare offers an extra incentive with their token ($RARE) used for governance (treasury management and curation at the platform).

This piece is contributed by Footprint Analytics community.

The Footprint Community is a place where data and crypto enthusiasts worldwide help each other understand and gain insights about Web3, the metaverse, DeFi, GameFi, or any other area of the fledgling world of blockchain. Here you’ll find active, diverse voices supporting each other and driving the community forward.

Footprint Website: https://www.footprint.network

Discord: https://discord.gg/3HYaR6USM7

Twitter: https://twitter.com/Footprint_Data

The post Meet the NFT platforms where not just anybody can sell their collections appeared first on CryptoSlate.