On-chain data shows Bitcoin investors have been withdrawing large amounts from exchanges as distrust around them has grown recently.

FTX Debacle Leads To More Bitcoin Investors Distrusting Exchanges

As pointed out by an analyst in a CryptoQuant post, investors who have become afraid to hold on exchanges are sending their BTC to personal wallets.

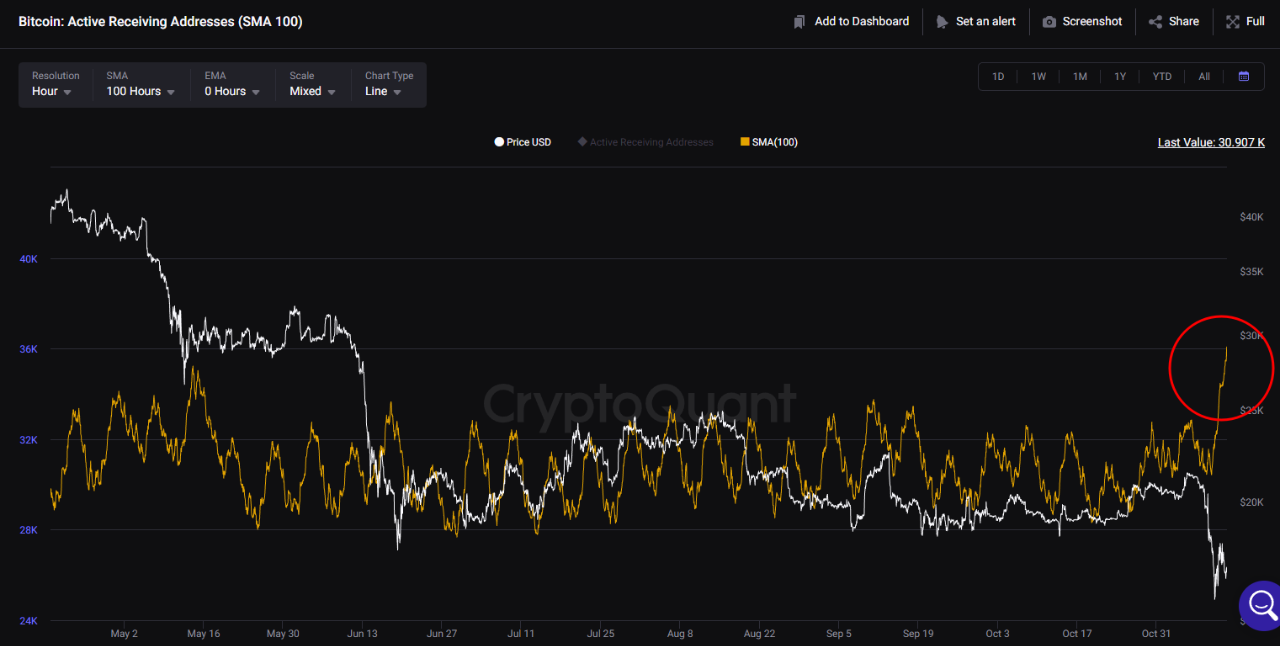

There are a couple of relevant indicators here; the first is the “Active Receiving Addresses,” which tells us the total number of wallet addresses that were active as receivers during a specific period of time.

The below chart shows the trend in the 100-day simple moving average value of this Bitcoin indicator over the last six months:

The 100-day SMA value of the metric seems to have spiked up in recent days | Source: CryptoQuant

As you can see in the above graph, the value of the Bitcoin Active Receiving Addresses has been very high in the last few days.

This means that investors have been sending coins to a large number of individual wallets since the crash due to the FTX debacle.

The other indicator of interest is the “all exchanges reserve,” which measures the total amount of BTC currently sitting in the wallets of all centralized exchanges.

Here is a chart that shows the trend in this Bitcoin metric:

Looks like the value of the metric has been going down recently | Source: CryptoQuant

From the graph, it’s apparent that the Bitcoin exchange reserves had been following an overall downwards trajectory for more than a year now, but the metric has plunged especially hard in recent days.

This plummet in the indicator has also coincided with the collapse of FTX. Usually, the exchange reserves spike up during major crashes as investors transfer their coins to exchanges for dumping.

The recent trend in the metric has clearly, however, not followed this pattern. The exchange reserve going down, combined with the fact that a large number of wallets are active right now, suggests individual investors are taking the coins out to their personal wallets.

This shows that the FTX crisis has once again made Bitcoin holders wary about keeping their coins in the custody of centralized exchanges, as they are preferring to withdraw them to individual wallets.

BTC Price

At the time of writing, Bitcoin’s price floats around $16.5k, down 20% in the last seven days. Over the past month, the crypto has lost 15% in value.

BTC has been moving sideways in the last few days | Source: BTCUSD on TradingView

Featured image from Kanchanara on Unsplash.com, charts from TradingView.com, CryptoQuant.com