Data shows the so-called Bitcoin “diamond hands” have shed 84.5k BTC from their holdings since the collapse of crypto exchange FTX.

Bitcoin Long-Term Holder Supply Has Sharply Declined Recently

According to the latest weekly report from Glassnode, the long-term holder supply has observed one of its most significant declines this year in recent days.

The “long-term holder” (LTH) group is a Bitcoin cohort that includes all those investors who have been holding onto their coins since at least 155 days ago, without having sold or moved them.

Statistically, the longer an investor keeps their coins still, the less likely they become to sell them at any moment. Since LTHs make up the group that keeps their coins dormant the most, they are the cohort that’s least probable to dump amid times of pressure.

The “long-term holder supply” is an indicator that measures the total amount of BTC that this group as a whole is holding in their wallets right now.

When the value of this metric slips down, it means LTHs have moved their coins, possibly for selling purposes. While an increase suggests these holders have been expanding their treasuries recently.

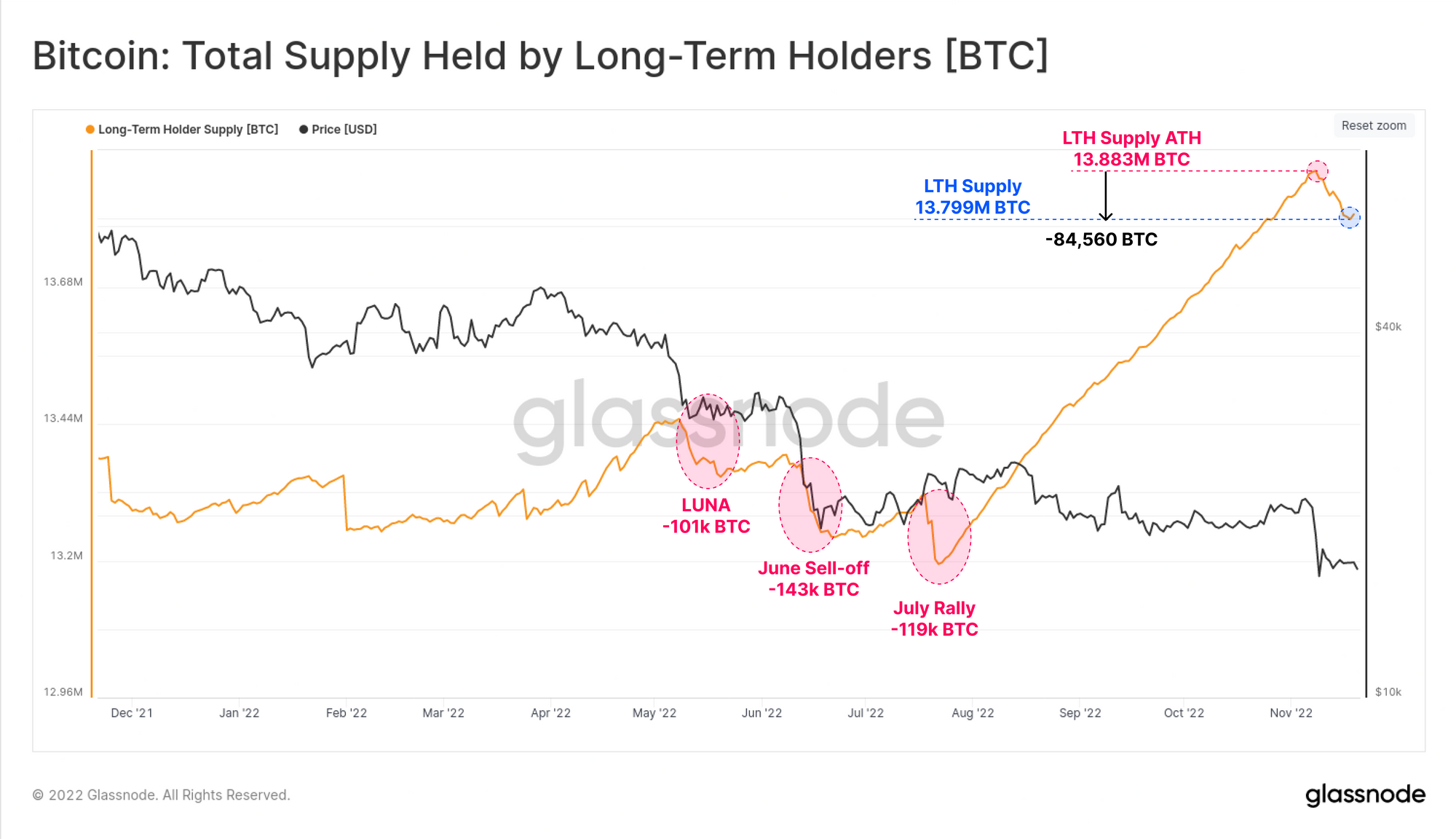

Now, here is a chart that shows the trend in the Bitcoin LTH supply over the past year:

The value of the metric seems to have been on the decline in recent days | Source: Glassnode’s The Week Onchain – Week 47, 2022

As you can see in the above graph, the Bitcoin LTH supply set a new all-time high of around 13.883 million BTC just a couple of weeks or so ago.

This peak was just before the crash triggered by the fall of crypto exchange FTX initiated. As soon as the price plunge started, however, the indicator’s value also began to go down.

This means that the LTHs were dumping their coins, contributing to the price decline. The decrease in their supply has been consistently happening in the last two weeks, suggesting that these resolute holders didn’t slow down even after the initial crash was over.

So far, the Bitcoin LTH supply has gone down by about 84.56k BTC since the ATH was set, taking the metric’s value to 13.799 million BTC.

While this drawdown is significant, it’s still less than the previous three selloffs seen in May, June, and July.

Nonetheless, this is still a sign of weakness from what should be the most resolute holder group in the Bitcoin market, and the selloff also still seems to be underway so it can can possibly even deepen.

BTC Price

At the time of writing, Bitcoin’s price floats around $15.7k, down 6% in the last week.

Looks like BTC has gone down during the past two days | Source: BTCUSD on TradingView

Featured image from Vasilis Chatzopoulos on Unsplash.com, charts from TradingView.com, Glassnode.com