The Bitcoin price has currently stabilized strongly around the $17,000 mark. However, the price could face further headwinds in the coming days, as the VIX exposes.

The VIX is a real-time volatility index from the Chicago Board Options Exchange (CBOE). It was created to quantify market expectations of volatility.

In doing so, the VIX is forward-looking, meaning that it only shows the implied volatility of the S&P 500 (SPX) for the next 30 days.

Basically, if the VIX value goes up, the S&P 500 will likely go down, and if the VIX value goes down, the S&P 500 will likely remain stable or go up.

This is exactly what was seen yesterday. The VIX bounced up to 19, a level that was last seen in mid-August. As a result, the S&P 500 lost the weekly support area at 4040 and fell 1.8%. In August, the last time the VIX was this low, it rebounded, and the S&P 500 fell 15%.

The Importance Of The VIX For Bitcoin

Besides the VIX and the S&P 500, it is important to understand that Bitcoin, with higher beta, is highly correlated with the S&P 500. This means that the Bitcoin price is more sensitive to changes in the market in both directions.

As predicted by the VIX, BTC bounced off the $17,400 horizontal resistance yesterday and dropped below $17,000.

In October, when the VIX was down, and the S&P 500 was up, Bitcoin experienced a black swan event with the FTX collapse, after which BTC fell to $15,500. Thus, the Bitcoin price did not enjoy the momentum of the VIX.

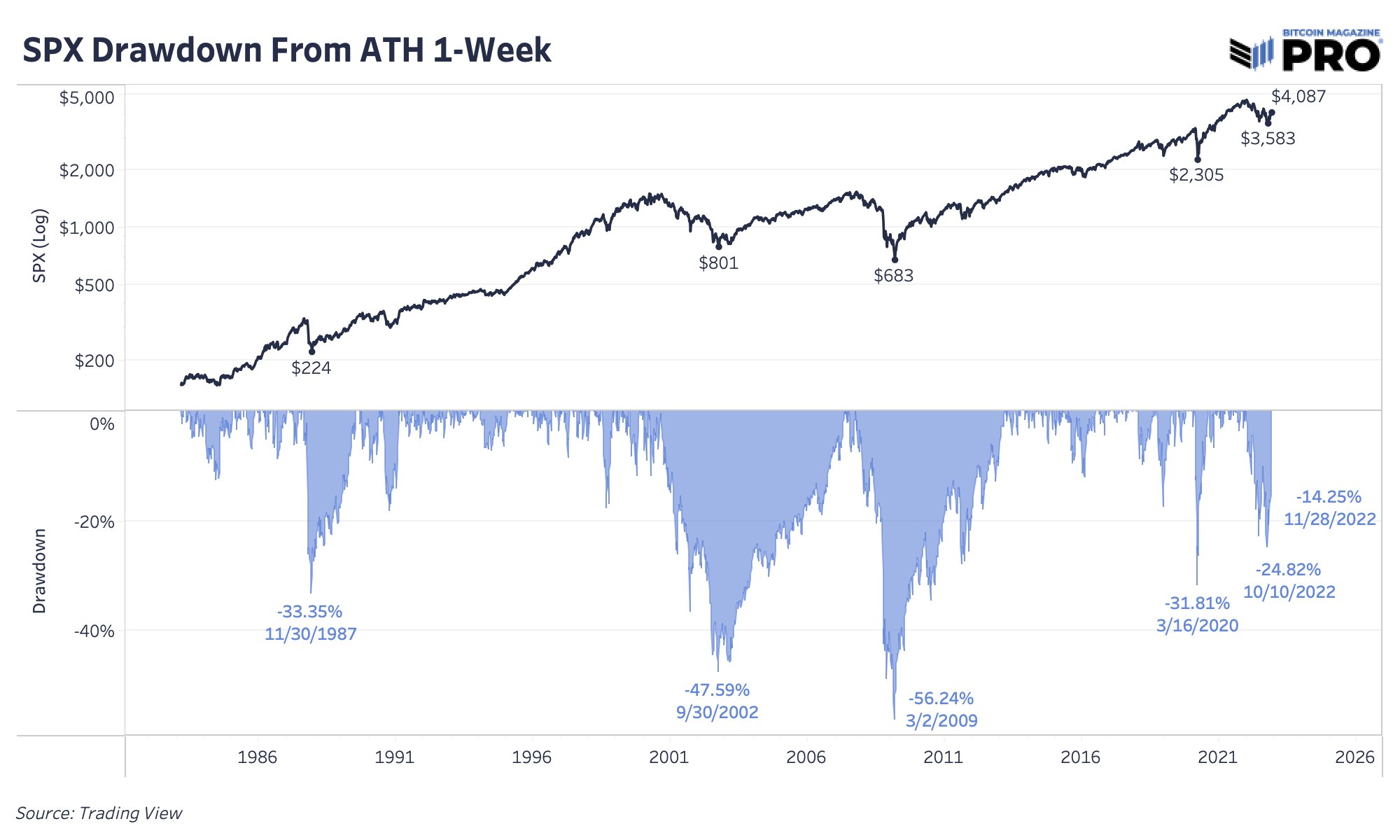

At the moment, a possible reversal of the VIX at 19 could serve as a kind of sentiment barometer for the S&P 500 and Bitcoin for the next few weeks. The VIX is being compared to the 2006-2009 crash, a nasty outlook that would mean much lower prices.

Analyst Sam Rule writes that the recent BTC rally following stocks is occurring at a time when the VIX is depressed to a level of 20. Although there has been a massive industry leverage wipe-out in the crypto industry, the stock market has yet to experience such an event.

Given Bitcoin’s correlation with the S&P 500, this could mean another price drop, as Rule writes:

Is 25% drawdown from ATH all we’re getting in S&P 500 this cycle during the popping of the great everything bubble? Would you expect #BTC to bottom here if SPX scenario fell >40% from ATH in coming months?

SPX drawdowns from ATH 1-week, Source: Twitter

Why VIX Has Limited Applicability To BTC

However, the VIX should not be used as the sole deterministic indicator of future market direction. Why?

The VIX relies on expectations set by past events rather than what will happen in the future. Investors are notoriously prone to irrational exuberance.

In addition, the VIX cannot account for sudden, unexpected events that can cause strong market reactions. However, these events are key to identifying a change in market direction, such as a bear market bottom.

Therefore, Bitcoin investors should also keep an eye on other factors, such as the upcoming decision by the U.S. Federal Reserve on further interest rate policy, further contagion effects in the crypto market, and other intrinsic factors, such as miner capitulation.