A recent court filing in the FTX bankruptcy case has revealed a “$65 billion backdoor” between Alameda and FTX. The filing includes a deck detailing the current findings relative to FTX group funds.

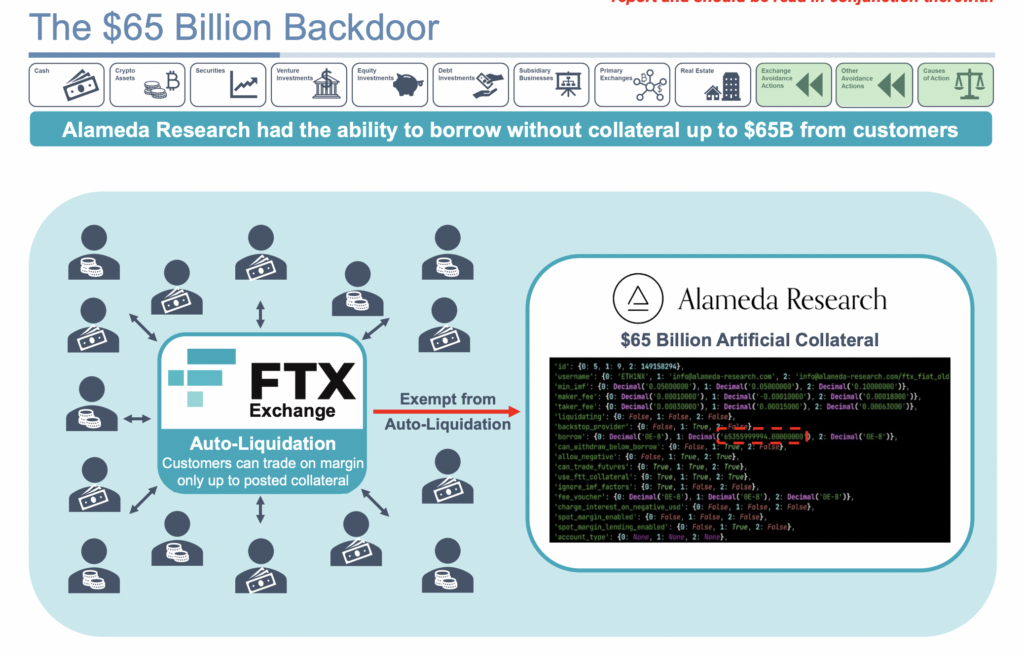

The deck includes an illustration of the FTX liquidation process alongside a code sample that allegedly represents the Alameda backdoor.

While customers were auto-liquidated based on the margin terms offered by FTX, Alameda was allegedly exempt from auto-liquidation. Further, Alameda was not required to post any real collateral for trades. Instead, it was allowed to trade with “artificial capital.” If proven true in court, this offense alone would be one of history’s most significant examples of fraud.

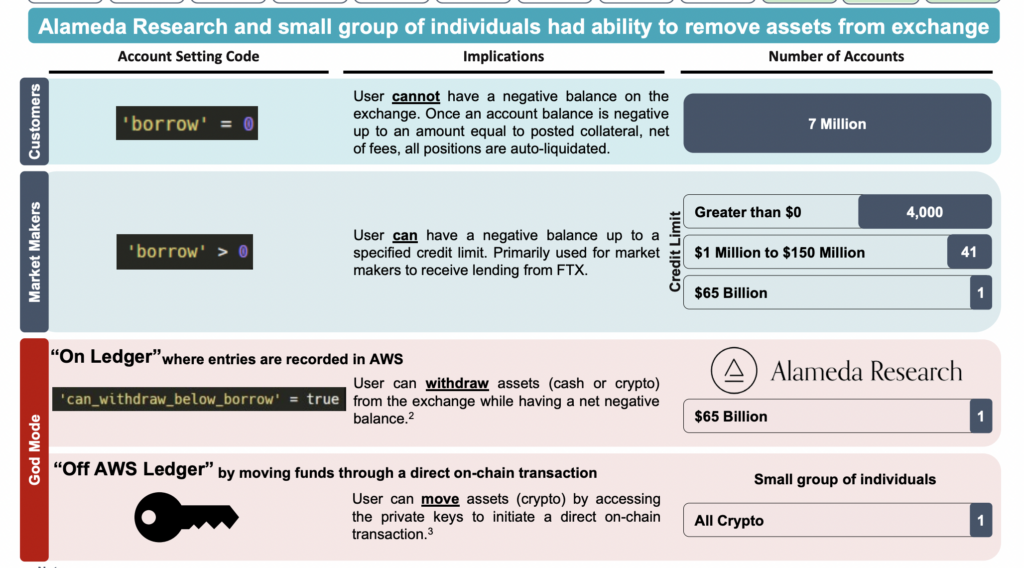

Even more damningly, the deck also confirms the existence of a ‘god mode’ by which a small group of individuals were able to move funds off the exchange. Examples of the code for each group were illustrated via a specific “account setting code” in the exchange’s codebase.

Seven million standard customers’ access codes were set so they could not borrow if their balances were zero. Market makers for the company had credit limits of up to $150 million. Seemingly, 4,000 market markets had credit limits up to $1 million, with a further 41 between $1 million and $150 million.

However, Alameda had access to $65 billion, some 43,000% more than the largest credit limit given to other market makers. In addition, Alameda’s credit line was categorized as a part of the ‘god mode’ that allowed special privileges. The facility also allowed Alameda to withdraw cash or crypto while having a negative balance. All of these transactions were recorded on FTX’s Amazon AWS servers.

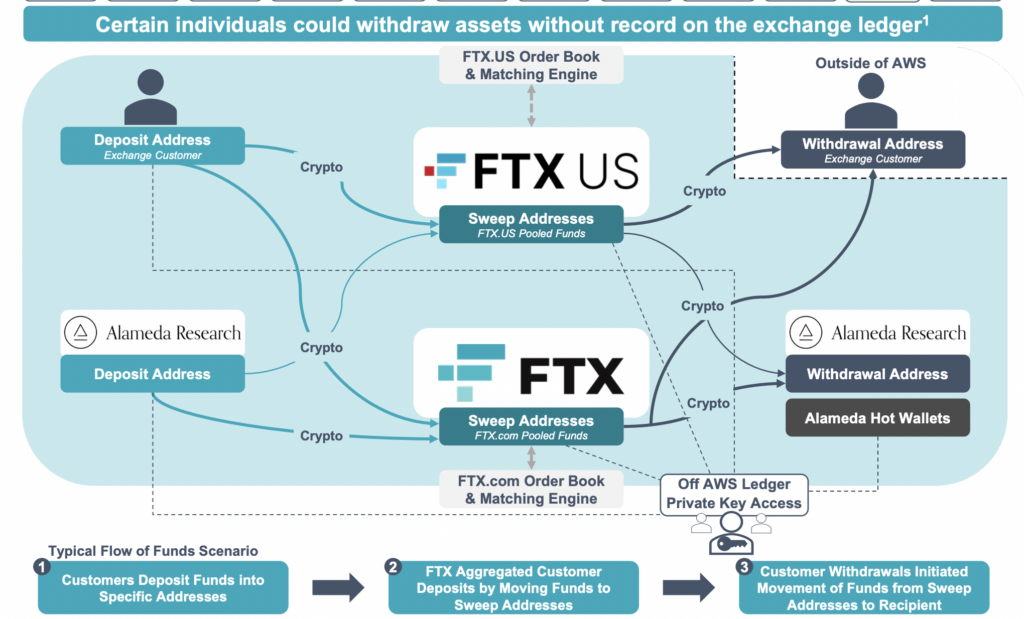

Additionally, a “small group of individuals” had an “off AWS Ledger” transfer ability allowing them to move funds without a trace. These transfers were available across any crypto held by FTX but not cash. Users with this level of clearance had access to specific wallets’ private keys, allowing them to initiate on-chain transactions directly.

The flowchart of FTX’s AWS money flow is also illustrated within the deck. The chart below shows how funds were coming across several parties between FTX and FTX.US.

During his appearance before the House of Representatives in December, FTX CEO John Ray III described the financial record keeping at FTX as some of the worst he’d seen in his career and noted unacceptable management practices, including the commingling of assets and lack of internal controls

The post Alameda had $65B artificial credit line, 43,000% more than FTX market makers appeared first on CryptoSlate.