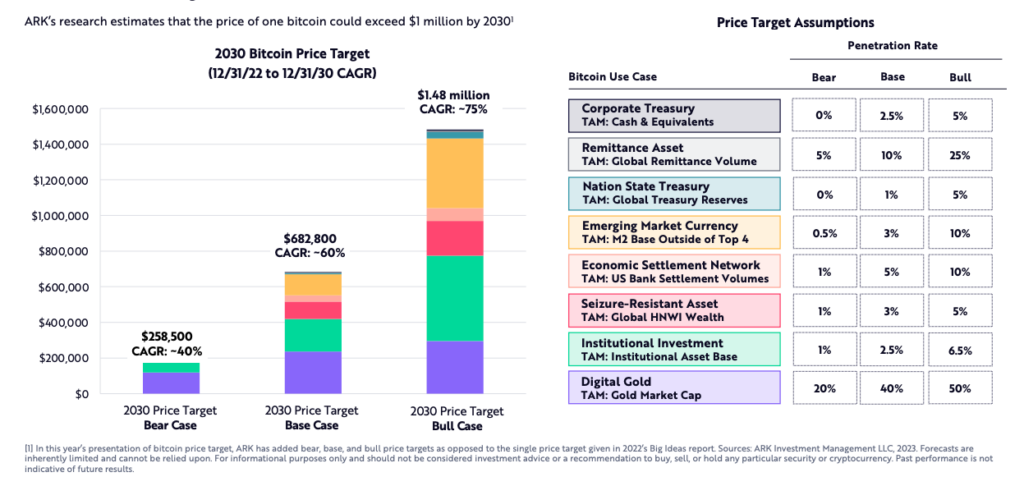

Cathie Wood’s ARK Invest expects Bitcoin’s price to rise to $1M per coin by 2030, along with a boom in annual fees of smart contract networks, according to a new report published by the investment management firm.

The highlights of the Jan. 31 report include:

- Bitcoin will hit $1 million per coin by 2030

- Smart contract networks could facilitate $450 billion in annual fees by 2030

- Utility in smart contract networks are expanding and diversifying

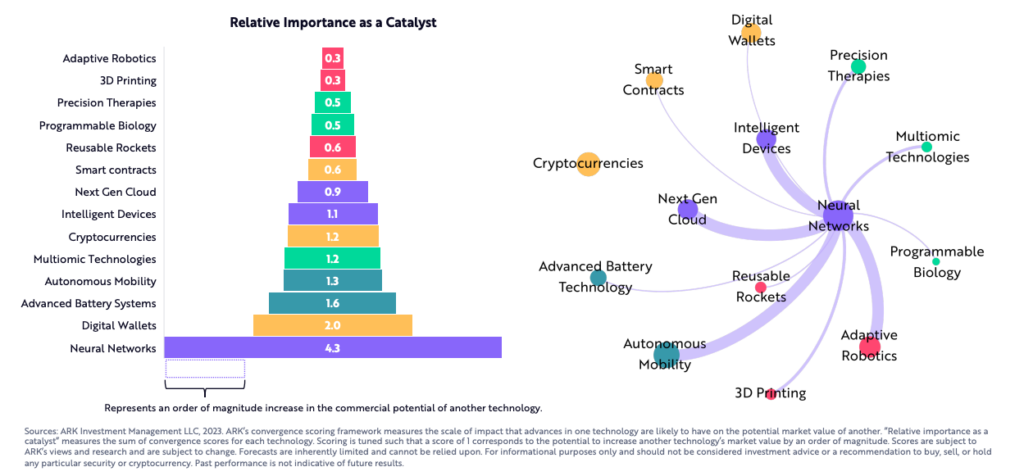

- Neural networks and AI will converge with other technologies like crypto to usher in a new world

ARK’s overall investment thesis is predicated on five converging technological innovations that will reshape the next several years, which are public blockchains, artificial intelligence, energy storage, robotics, and multiomic sequencing

Each of these is broken down into multiple sectors, industries and activities that ARK hopes will harness its investment vehicle’s economic potential.

“Neural Networks are the most important catalyst”

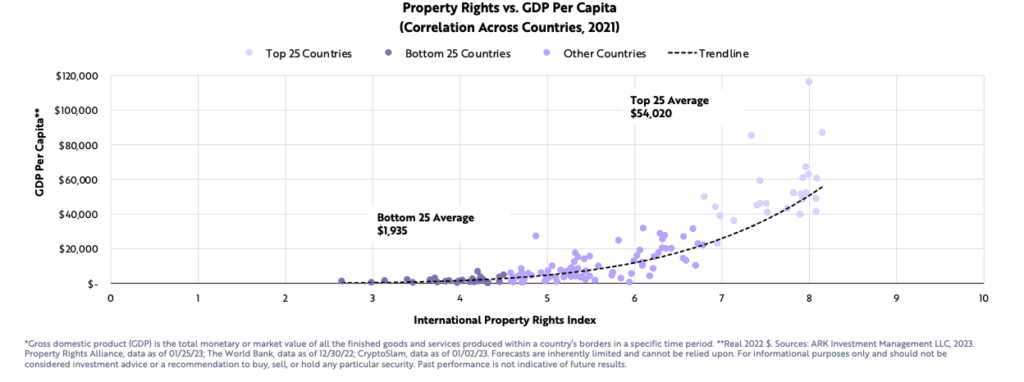

The establishment of property rights is expected to bolster the value of digital assets in the coming years as well, per the ARK Invest report. Historically, property rights, both physical and intellectual, have shown a positive relationship with GDP per capita, which is commonly used as a measure of standard of living. Digital assets, with decentralized proof of ownership, are likely to drive an increase in online spending per capita. ARK predicts that global NFT transaction volume will skyrocket from today’s $22 billion to $120 billion by 2027, a more than five-fold increase.

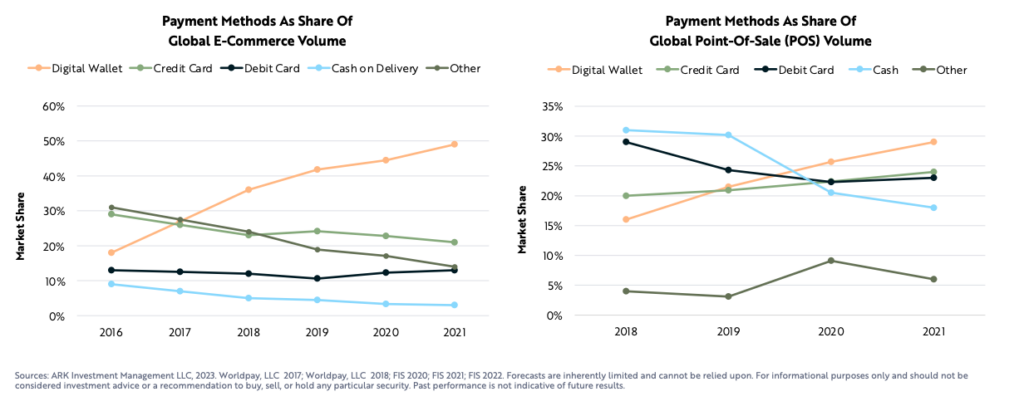

By onboarding billions of consumers and millions of merchants, digital wallets are poised to disrupt traditional banking by saving payment transactions nearly $50 billion in costs, ARK predicts. With 3.2 billion users, digital wallets have reached 40% of the world’s population. According to ARK research, the number of digital wallet users is expected to grow at an annual rate of 8%, penetrating 65% of the global population by 2030.

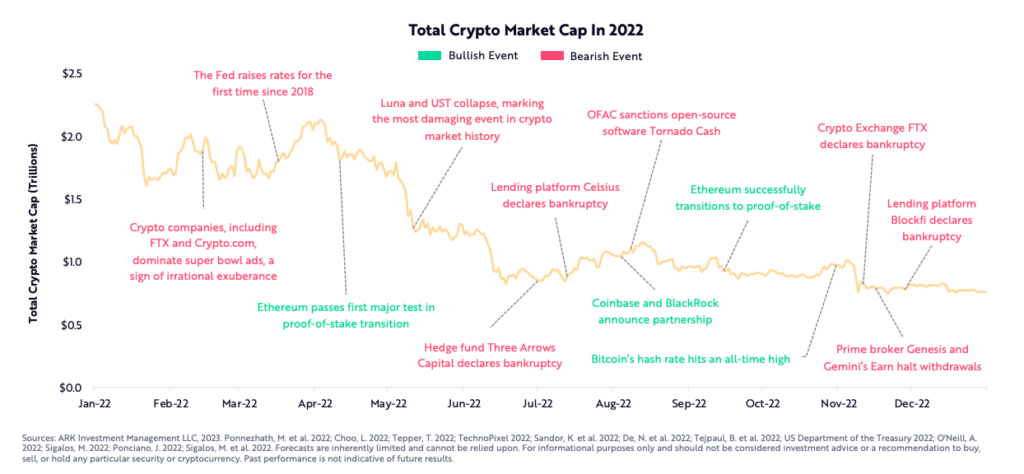

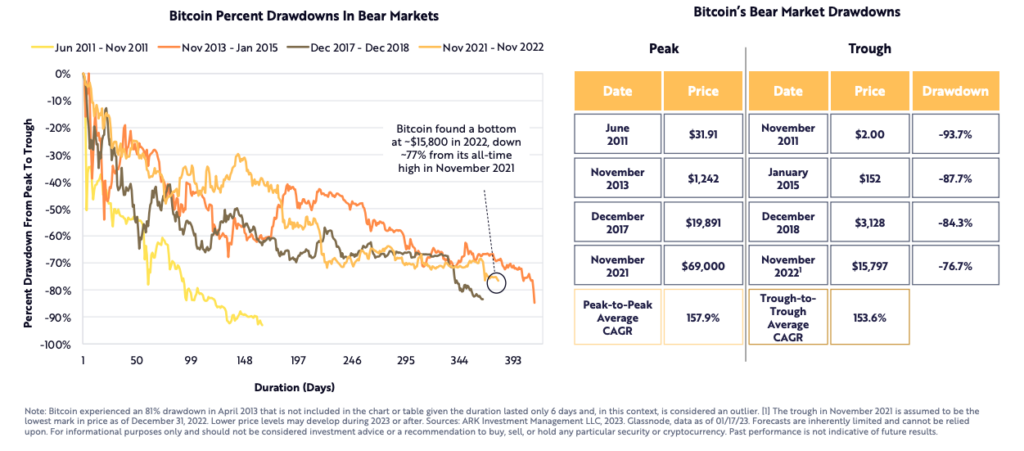

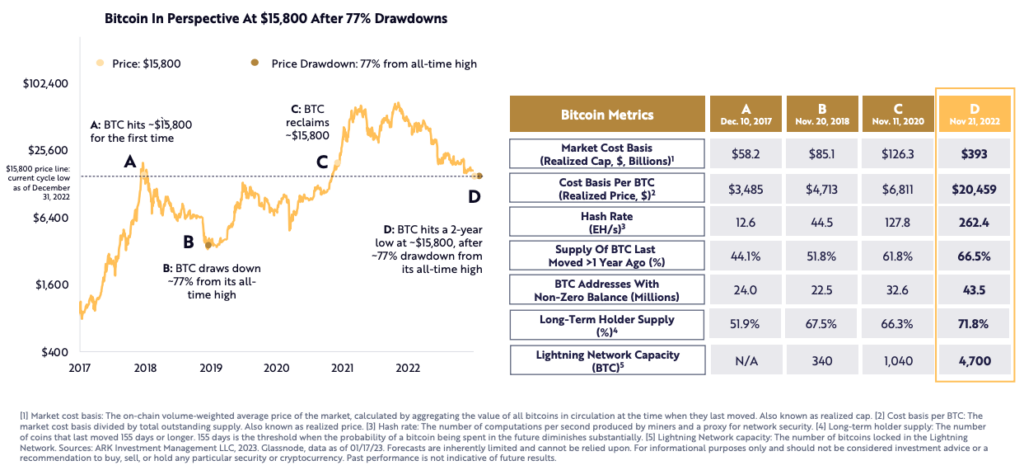

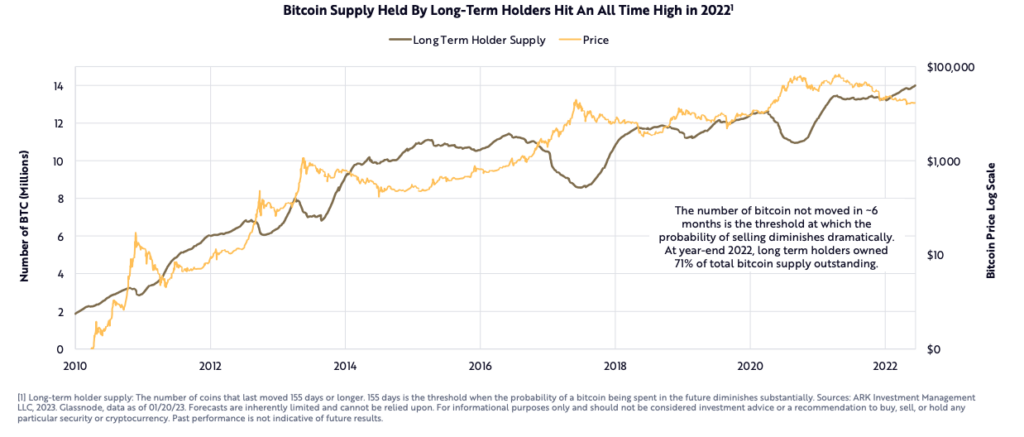

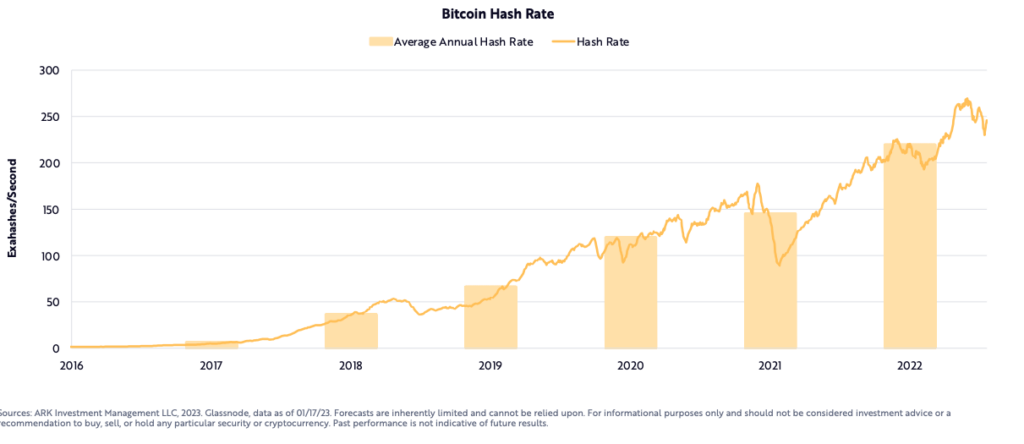

“We believe Bitcoin’s long-term opportunity is strengthening […]its network fundamentals have strengthened and its holder base has become more long-term focused. Contagion caused by centralized counterparties has elevated Bitcoin’s value propositions: decentralization, auditability, and transparency. The price of one bitcoin could exceed $1 million in the next decade.”

According to ARK, Bitcoin investors are now more focused on long-term investments than ever before. Despite market fear fueled by the failure of several major crypto organizations, on-chain data suggests that Bitcoin holders remain steadfast in their commitment to long-term prospects.

Institutional investment remained bullish throughout 2022, despite contagion from major scandals and collapses across the industry. Highlighted by:

- Blackrock: In June 2022, Aladdin by BlackRock partnered with Coinbase Prime to offer institutional clients direct access to cryptocurrencies, starting with Bitcoin. This collaboration has the potential to bring trillions of dollars into the crypto asset class in the upcoming years.

- BNY Mellon: In October 2022, BNY Mellon introduced a crypto asset custody platform to secure assets for institutional investors. As the company manages over 20% of the world’s investable assets, it has the potential to expand financial services efficiently using Bitcoin.

- Eaglebrook Advisors: In October 2022, Eaglebrook Advisors and ARK Investment Management joined forces to provide financial advisors with access to actively managed crypto strategies, including direct ownership of crypto assets, low investment minimums, and seamless portfolio reporting integration.

- Fidelity: In November 2022, Fidelity officially introduced retail trading accounts for Bitcoin and Ether, allowing investors to trade and securely hold these assets on its platform.

“Bitcoin is likely to scale into a multi-trillion dollar market.”

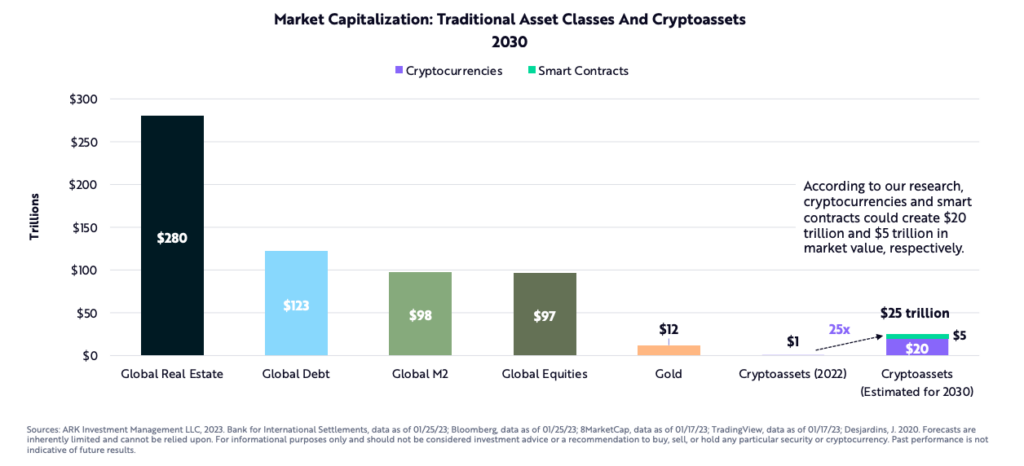

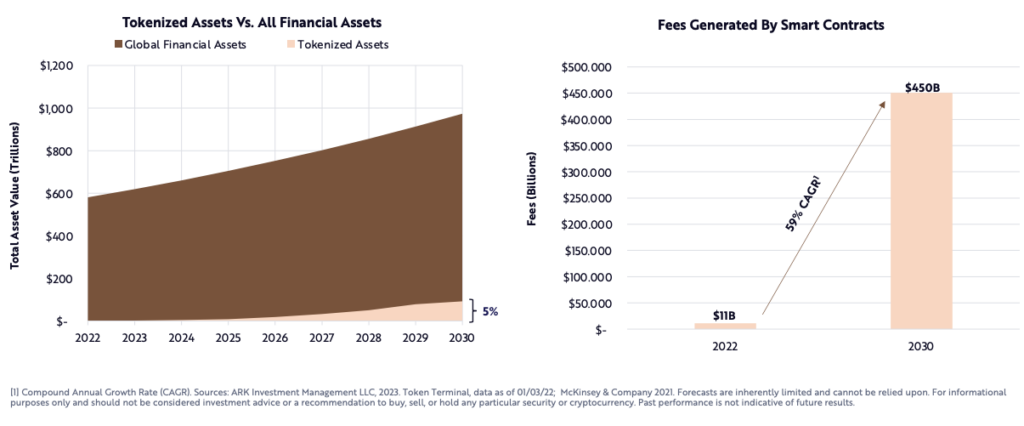

ARK’s research predicts that as the value of tokenized financial assets grows on blockchain, decentralized applications and the smart contract networks supporting them have the potential to earn $450 billion in annual revenue and attain a market value of $5.3 trillion by 2030.

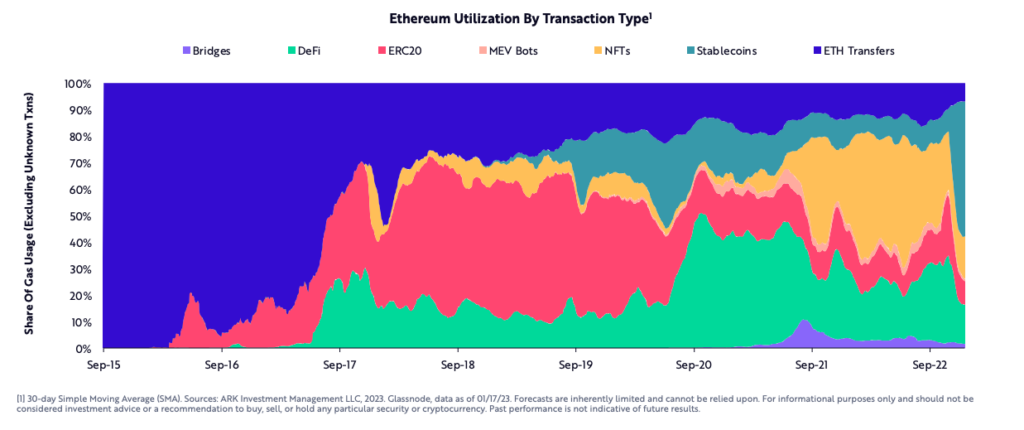

“The utility of smart contract networks is expanding and diversifying.”

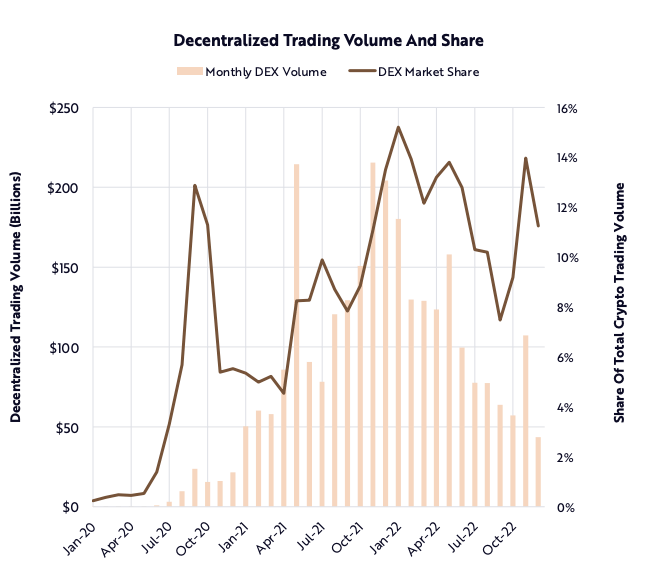

According to the report, traders are opting for self-custody solutions and moving away from centralized intermediaries, as they increasingly prefer the transparency offered by decentralized exchanges. Since 2020, the trading volume of decentralized exchanges (DEXs) has been growing as a proportion of total crypto trading volume, though CEX still control most of the market, the report predicts DEXs will only get stronger.

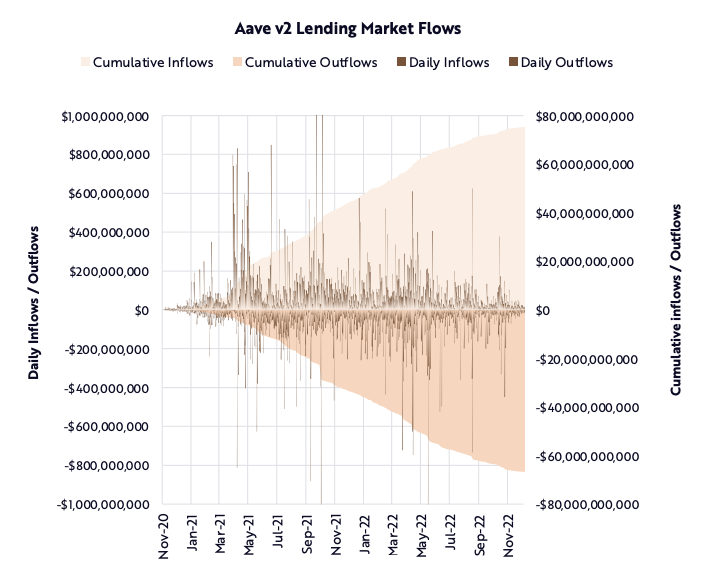

While several crypto lending companies, such as Celsius and Voyager, experienced insolvencies, decentralized lending markets like Aave remained operational. These markets continued to process deposits, withdrawals, originations, and liquidations without any service disruptions. From November 2020 to present, Aave has processed over $75 billion in inflows and $66 billion in outflows, all through automated smart contracts.

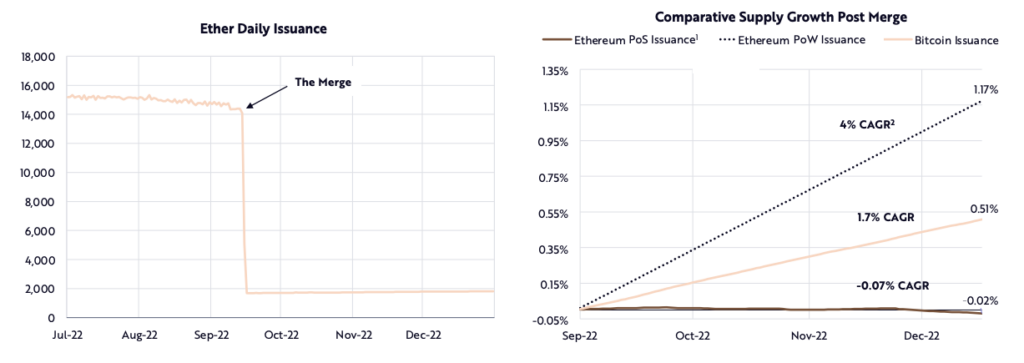

Changes in the Ethereum network entered a new phase with its merge in September 2022, which marked its transition from Proof-of-Work (PoW) to Proof-of-Stake (PoS). With this change, Ethereum eliminated the need for energy-intensive mining to secure its network, thereby improving its monetary policy and reducing the issuance of new tokens. This new token model has resulted in a flattening of Ethereum’s net annual token issuance, which is now lower than Bitcoin’s 1.7% and lower than the 4% in Ethereum’s previous PoW model. As a result of the stable network, the supply of Ether is expected to decrease into the coming years, illustrated by ARK in terms of projected supply growth post-merge.

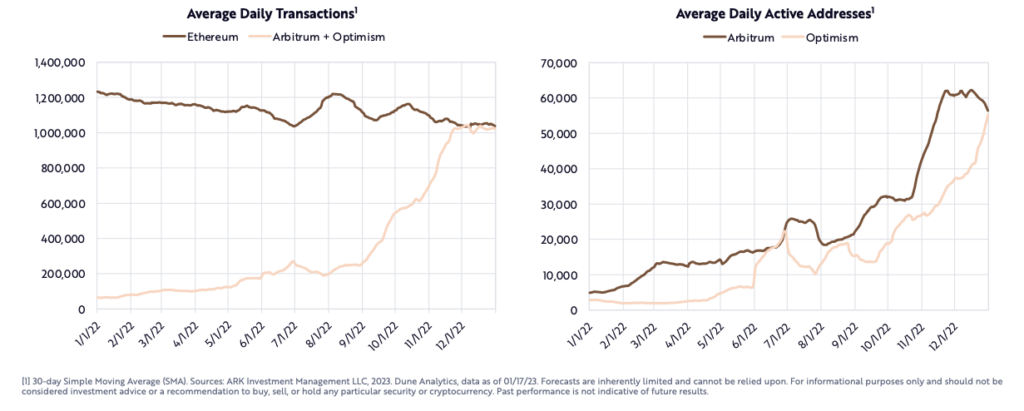

Ethereum’s layer 2 scaling solution seems to be improving network activity. In 2022, the number of transactions on Arbitrum and Optimism, two widely used layer 2 networks, reached the same level as those on Ethereum’s base layer. Additionally, the number of active addresses on each network grew significantly, with an increase of 11 times for Arbitrum and 19 times for Optimism.

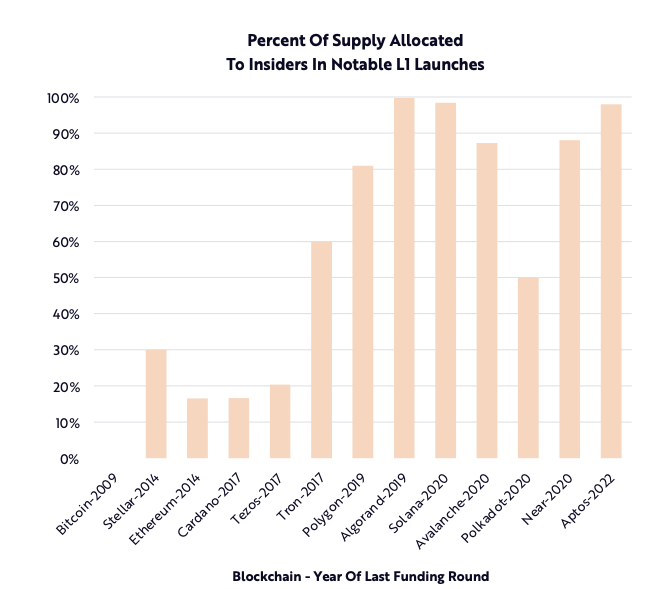

Some cause for concern remains the percentage of token supply taken by some layer 1 networks. On layer 1 blockchains, there has been a rise in the proportion of token supply controlled by insiders such as founding teams, private investors, and private foundations and funds. This trend is due to the accumulation of larger reserves by founders to compete with established players, as well as increased investment from venture capital in base layer protocols. Additionally, regulatory considerations have led to a decrease in the use of Initial Coin Offerings as a means of open distribution, ARK points out.

“Smart contract networks could facilitate $450 billion in annual fees by 2030.”

Following the collapse of centralized crypto intermediaries in the past year, decentralized public blockchains with self-executing contracts provide a more transparent and non-custodial solution for financial services. Decentralization is becoming a crucial factor in upholding the original purpose of public blockchain infrastructure. ARK research indicates that as the value of tokenized financial assets increases on the blockchain, decentralized applications and the smart contract networks driving them could generate $450 billion in annual revenue and reach a market value of $5.3 trillion by 2030.

The post Cathie Wood’s ARK Invest expects BTC at $1M by 2030 appeared first on CryptoSlate.