The crypto industry has seen a significant increase in fund flows since the beginning of 2023. This has been reflected in the recent price action, which has led the market to what appears to be the beginning of a new bull cycle.

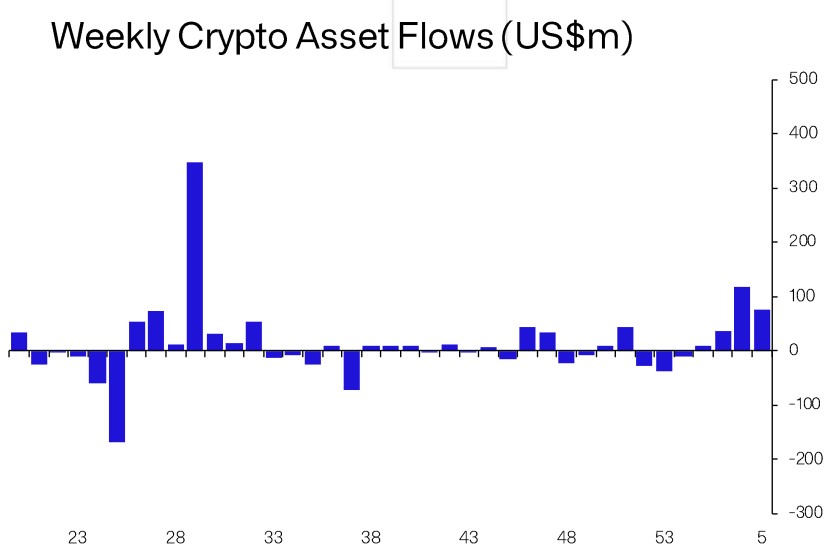

According to a report from investment firm CoinShares, investor sentiment is improving, leading to a $230 spike in inflows year-to-date. Digital asset investment products saw total inflows of $76 million last week alone.

A Decisive Shift In Investor Sentiment

With reports of inflation and expectations of looser monetary policy in 2023, investors are returning to the crypto market. Last week was the 4th consecutive week of inflows, with year-to-date inflows reaching a new high in recent months. According to CoinShares, this highlights a decisive shift in investor sentiment for 2023.

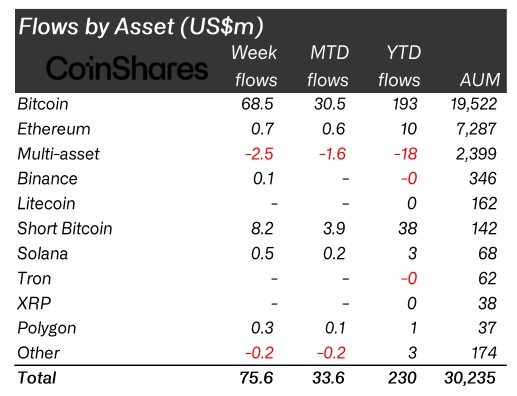

According to CoinShares, total investment assets under management (AuM) are up 39% year-to-date to $30.3 billion, the highest level since mid-August 2022. Regionally, the inflows were primarily concentrated in the U.S., Canada, and Germany, with inflows of $38 million, $25 million, and $24 million, respectively.

Bitcoin continues to be the primary focus of investors and holders in the crypto ecosystem, with inflows increasing last month to $69 million, representing 90% of the week’s total flows.

The rest of the inflows came from short-Bitcoin, selling positions, which totaled $8.2 million over the same period, highlighting that opinions remain divided on the sustainability of the current rally and whether Bitcoin will overcome the following obstacles in its price action.

Short-Bitcoin positions inflows remain relatively small compared to long-Bitcoin inflows, data shows, with the last three weeks of inflows totaling $38 million, or 26% of total assets under management, according to CoinShares.

For CoinShares, from a relative scaling perspective, this is meaningful, although this trade hasn’t worked well so far year-to-date, with total short-Bitcoin assets under management falling by 9.2%.

Is The Current Bullish Trend Sustainable

The improving clarity around the upcoming Shanghai upgrade scheduled for March and the withdrawal of staked Ethereum (ETH) can fuel a bullish trend in Ethereum’s price action; the second-largest cryptocurrency on the market has seen only $0.7 million in inflows.

According to CoinShares, altcoins saw small inflows of $0.5 million for Solana (SOL), $0.6 million for Cardano (ADA), and $0.3 million for Polygon (MATIC), while Polygon saw outflows of $0.5 million.

The global cryptocurrency market cap at press time is $1.1 trillion, with a 1.35% loss in the last 24 hours and a 44.97% loss year-to-date. Bitcoin’s market cap stands at $440 billion, with a 40% dominance over the sector.

On the other hand, stablecoin’s market cap stands at $138 billion, with a 12.51% share of the total crypto market cap.

Bitcoin is trading at $22,780, with a 1.6% loss in the past 24 hours and a 3% setback in the past seven days. Currently, Bitcoin’s Relative Strength Index (RSI) is sitting in the oversold zone, suggesting a high probability of continuing the bullish trend it has been experiencing since the beginning of 2023.