A total of $76 million was invested in digital asset products during the week of Jan. 30 to Feb., according to a CoinShares report.

Around 90% of the inflows were directed toward Bitcoin (BTC) related products, which equate to about $69 million, data from CoinShares stated.

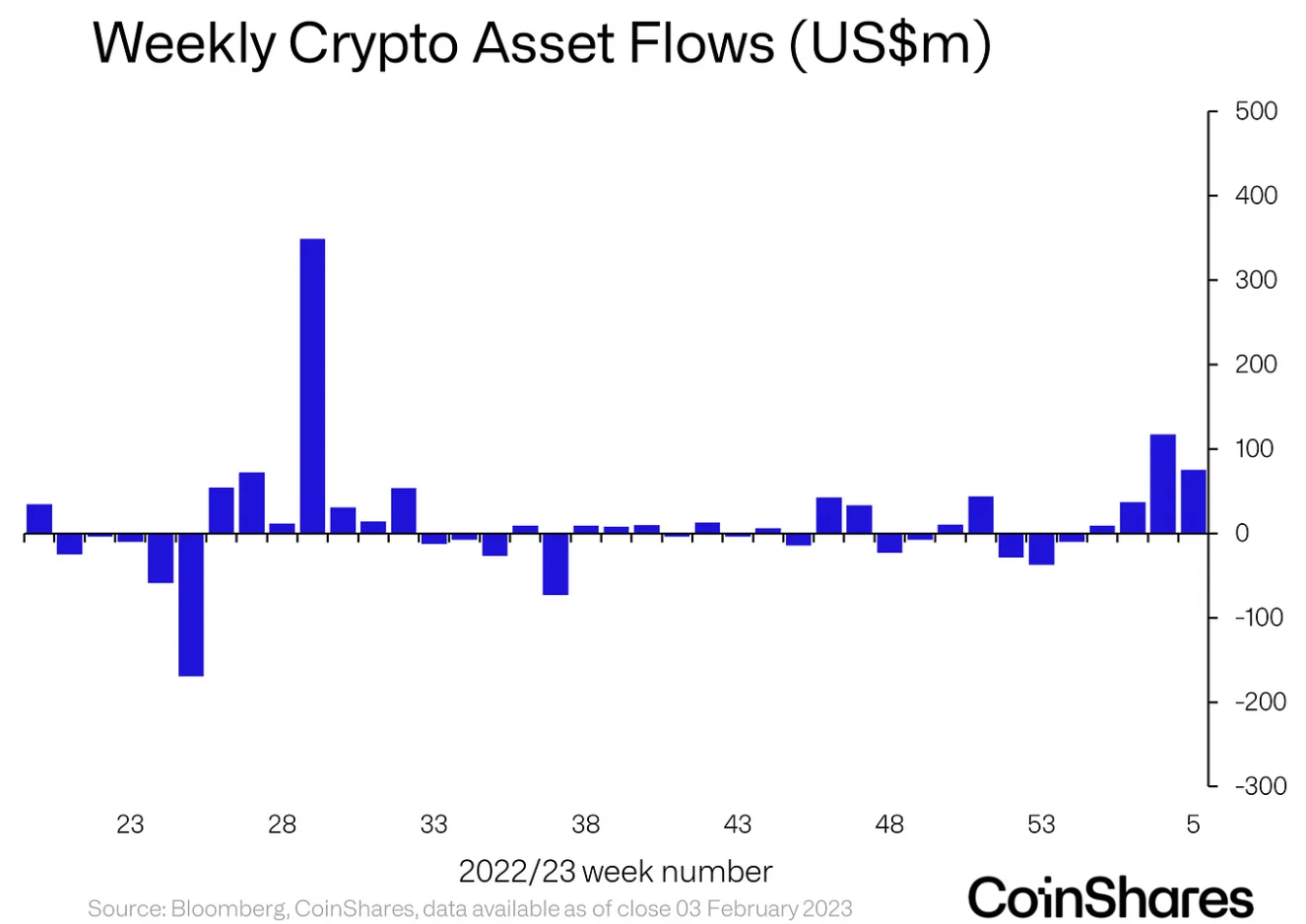

This week marks the fourth consecutive week that recorded inflows to crypto-related investment products. The total amount invested during these four weeks is over $230 million.

The week of Jan. 23 recorded the most significant inflows since July 2022, with $117 million.

Total investment assets under management (AuM) have also reached $30.3 billion, which makes a 39% increase year-to-date.

Flows by provider and asset

BTC-related products collected a total of $68.5 million worth of investment last week, claiming first place in the rankings. Short BTC followed as a second with $8.2 million, while Ethereum (ETH) and Solana (SOL) came third and fourth with $700,000 and $500,000, respectively.

In terms of facilitators, ProShares is ranked first by collecting $37.4 million from investors last week. 3iQ and CoinShares Physical followed as second and third with $20.4 million, and $16.3 million, respectively.

The post Over $76M invested in crypto funds in past 7 days appeared first on CryptoSlate.