After the recently released inflation data, Bitcoin has reacted positively to the upside. Market participants expected an inflation rate of 6.2%, but the US government reported an inflation rate of 6.4%.

Pantera Capital looks at Bitcoin’s current position in a recent newsletter and suggests that the crypto is entering a new bull cycle. So, what signaled the arrival of a seventh bull cycle for BTC?

Is The Seventh Bitcoin Bull Run In Progress?

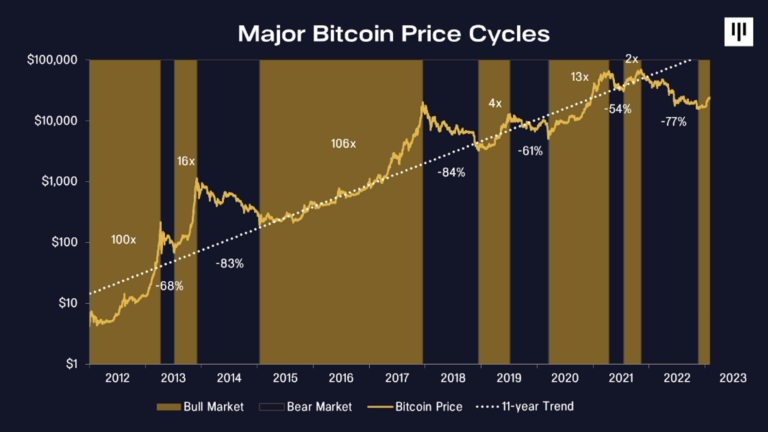

According to Pantera Capital, over the long-term, Bitcoin has been in a secular uptrend of 2.3x annually over the past twelve years, on average.

According to Pantera Capital, the decline from November 2021 to November 2022 was the median of the typical bear market. The last bear market was the only one to more than completely wipe out the previous bull market gains. In this case, giving back 136% of the previous rally. Pantera Capital states:

Pantera has been through ten years of bitcoin cycles and I’ve traded through 35 years of similar cycles. I believe that blockchain assets have seen the lows and that we’re in the next bull market cycle – regardless of what happens in the interest-rate-sensitive asset classes.

Bear Market Frozen?

According to data compiled by Pantera Capital, the median drawdown of the most recent bear market was 307 days, while the previous bear market lasted 376 days. The median drawdown was -73%, and the last bear market ended at -77%.

For Pantera Capital, the beginning of 2023 marks the end of the bear market and the crypto winter that froze the price of Bitcoin and the rest of the crypto assets in the ecosystem. This is where prices start to grind higher, and digital assets have seen the lows, marking the beginning of a new bull market cycle. Pantera Capital concludes:

Blockchain will change the world. Unfortunately, that massive promise causes market participants to go wild – both too bullish at times and too bearish at times. We’ve invested through four “crypto winters” already.

The price of Bitcoin has remained in the green zone after the recent news; it went to $21,500 minutes after the released inflation rates and managed to climb once again to the $22,000 level.

The support line of Bitcoin at the $21,500 level has withstood the news. The market has seen some upside volatility due to speculation by investors on future profits for the BTC/USDT trading pair.

Bitcoin has narrowed the seven-day gap, trading slightly in the red with a -3.5% over the past week. Still, Bitcoin has gained 4.6% in its price in the last 30 days.

Investors in the flagship crypto asset are looking for better news to continue the uptrend that characterized the beginning of 2023. Meanwhile, investors are keeping an eye on the upcoming U.S. Federal Reserve (Fed) meetings in March and May to see if inflation slows and can lead to the seventh bull market for the crypto market.

Featured image from Unsplash, chart from Trading View.