Quick Take

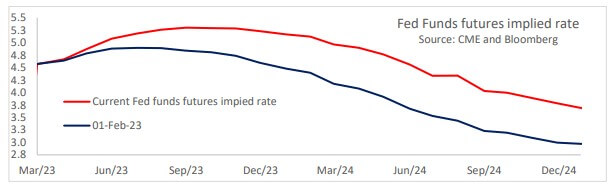

- The change in expectations from the market of the future fed policy during February has been significant. The fed funds rate is expected to peak above 5.25% in the year’s second half — with a slim to no chance of rate cuts this year.

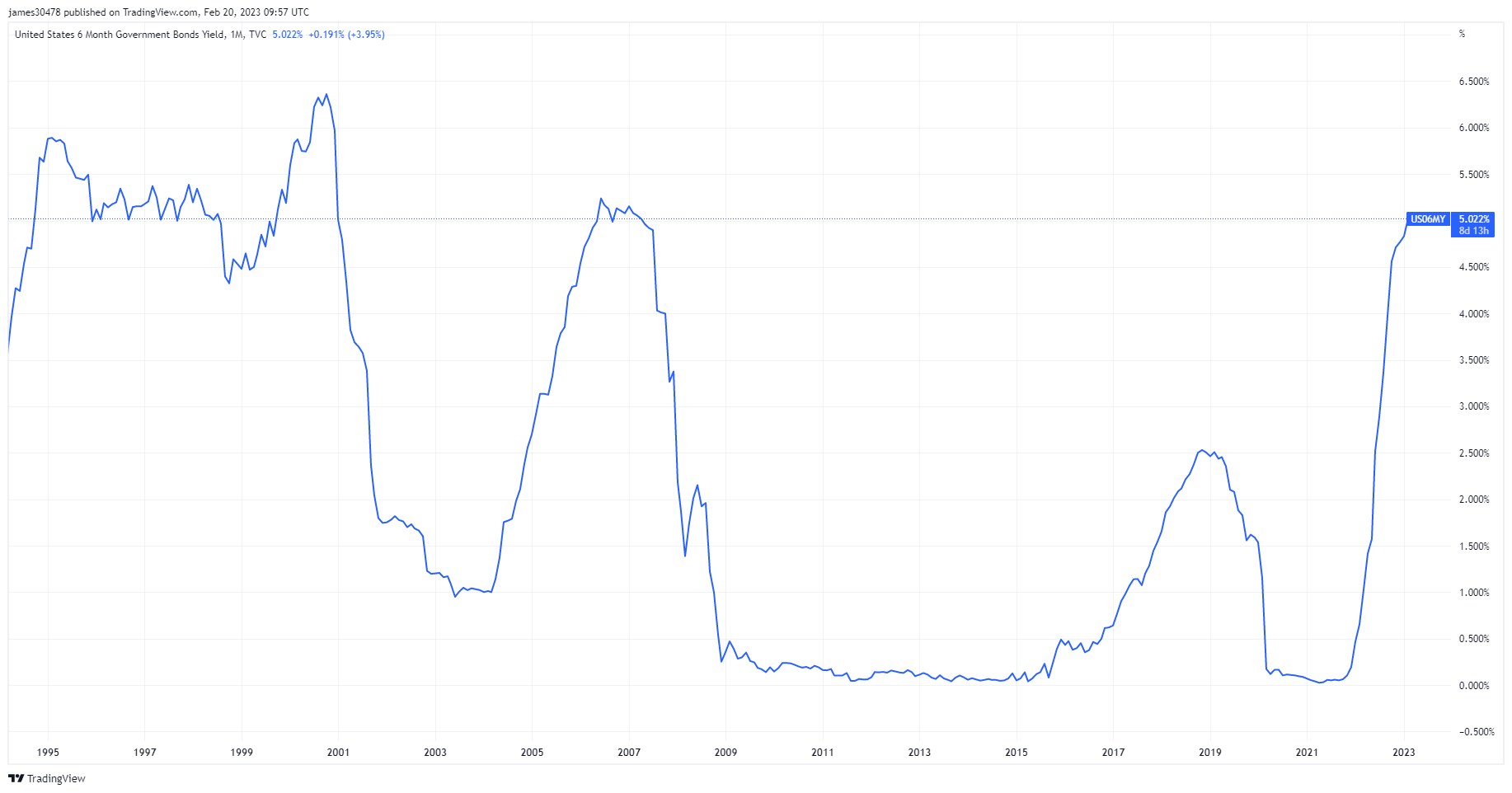

- The six-month treasury bill is yielding more than 5% for the first time since the GFC.

- Retail sales jumped the most since covid due to the introduction of stimulus checks, according to the January inflation report.

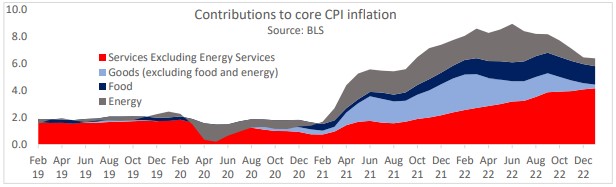

- In addition, the January inflation report showed the pace of declines in good prices is slowing; shelter inflation has yet to be factored in as rent increases still show positive upwards momentum.

- This is followed by a second consecutive monthly increase of .4% in the core index.

The post Nail in the coffin for 2023 rate cut hopes in light of January inflation report appeared first on CryptoSlate.