Definition

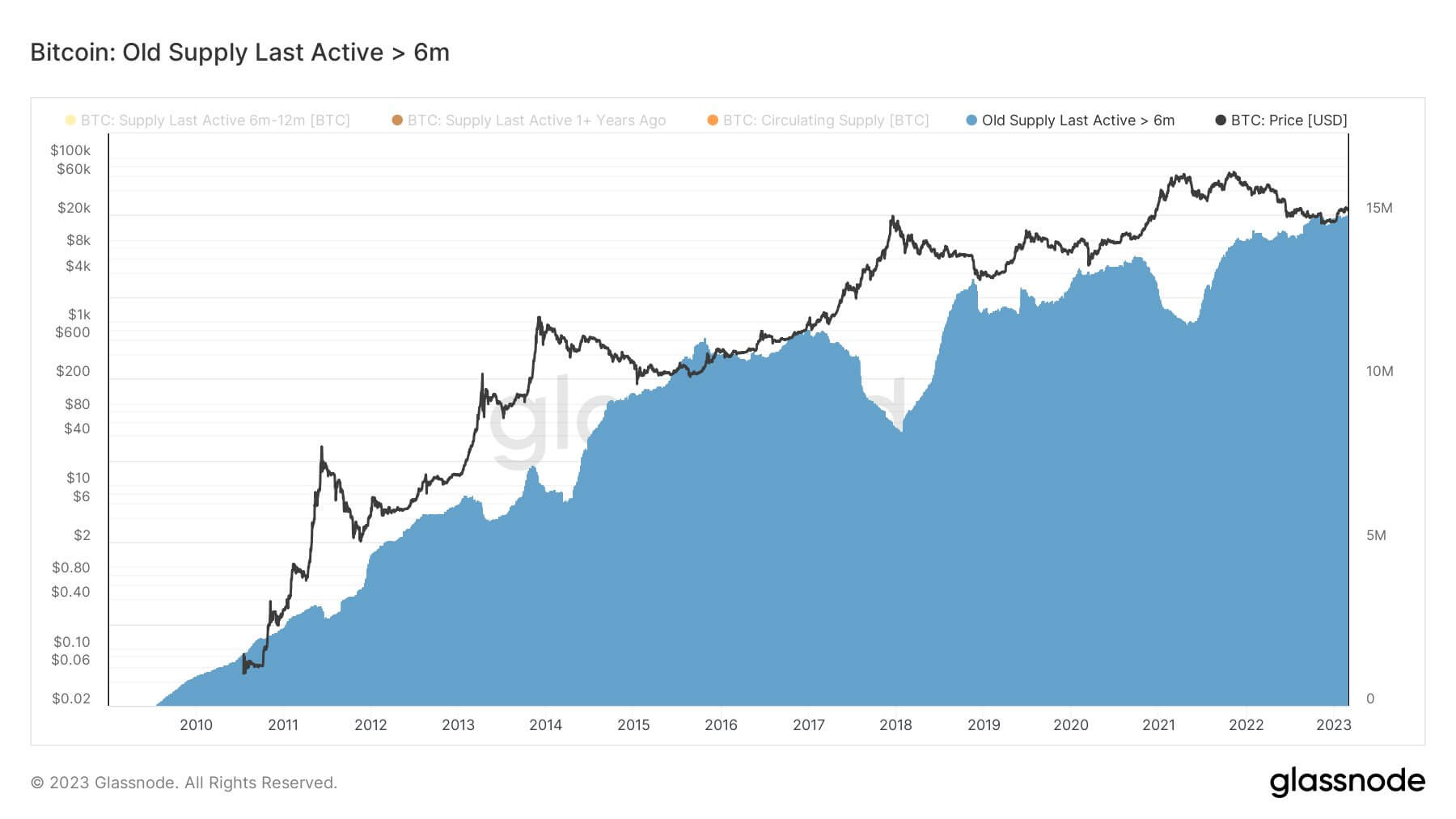

This chart presents the BTC supply which is Older than 6m

This broad cohort of coins tends to swell and contract in line with market cycles:

- Old Coins typically swell in volume

during bearish market trends — reflecting a net transfer of coin wealth from newer investors and speculators back towards patient longer-term investors (HODLers). It signifies a decreasing volume of active supply and is often associated with declining on-chain economic activity.

during bearish market trends — reflecting a net transfer of coin wealth from newer investors and speculators back towards patient longer-term investors (HODLers). It signifies a decreasing volume of active supply and is often associated with declining on-chain economic activity. - Old Coins typically contract in volume

during bullish market trends, as profits are taken, and coin wealth transfers from longer-term investors back towards newer market participants and speculators. It signifies a growing volume of active supply and is often associated with elevated on-chain economic activity.

during bullish market trends, as profits are taken, and coin wealth transfers from longer-term investors back towards newer market participants and speculators. It signifies a growing volume of active supply and is often associated with elevated on-chain economic activity.

Quick Take

- Long-term holders now hold over 15 million Bitcoin, roughly 78% of the circulating supply.

- A higher high has occurred after each cycle, and the cycle’s peak occurs in each bear market.

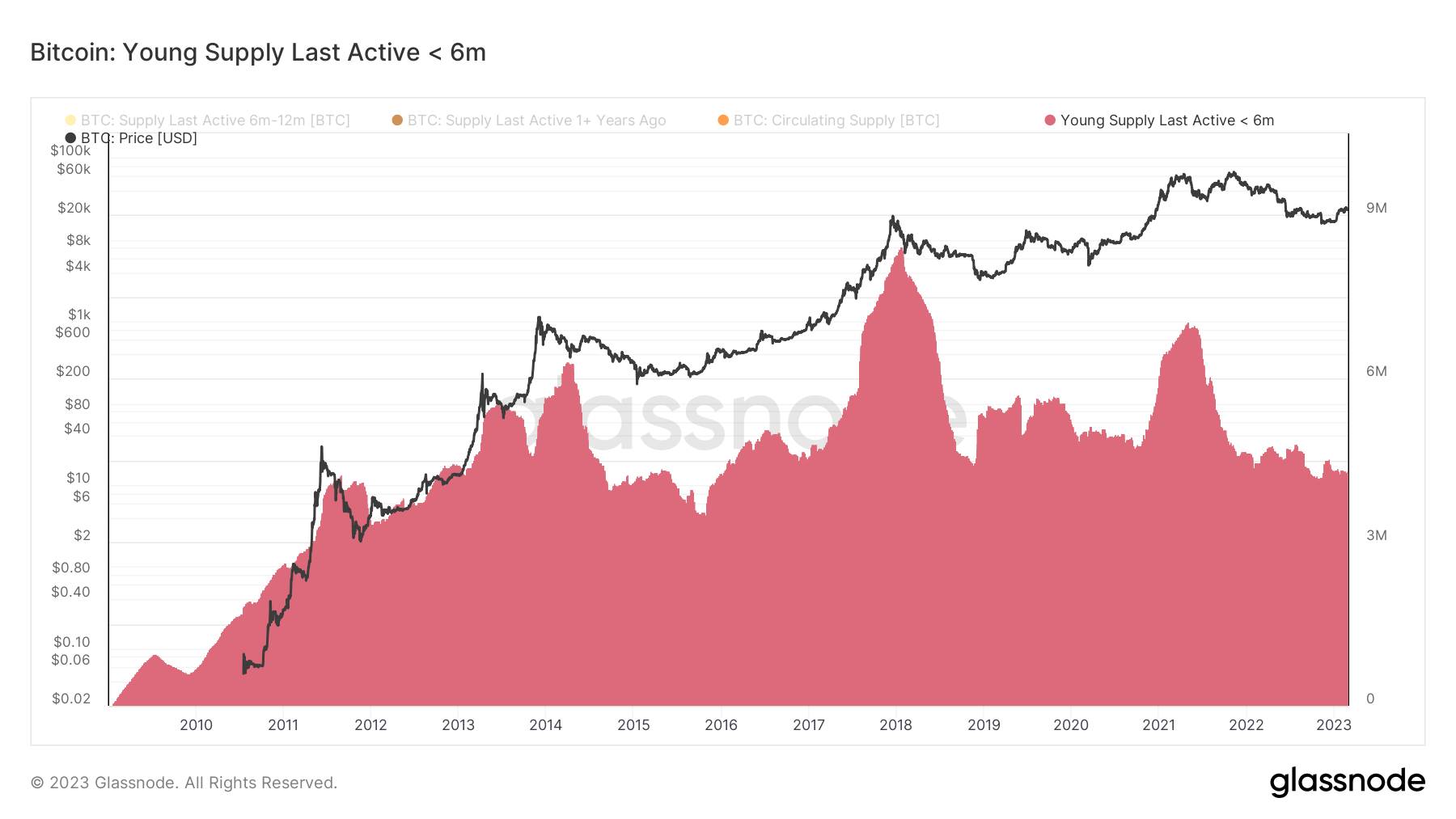

- This puts roughly 4.3m coins in the hands of holders who have held Bitcoin for less than six months.

- Young supply peaks during bull markets — as seen in 2013, 2017, and 2021 — and has descended since the 2021 bull market.

The post Bitcoin old supply has just surpassed 15 million coins – 78% of the circulating supply appeared first on CryptoSlate.