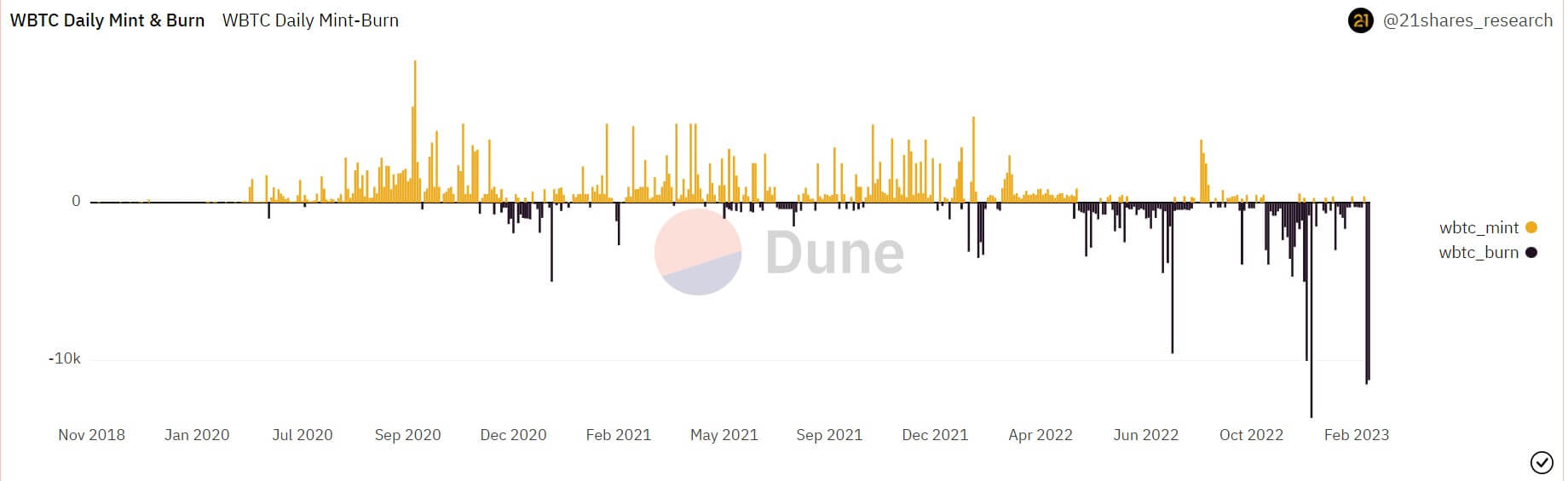

Wrapped Bitcoin’s (WBTC) supply on Ethereum shrunk by 23,384 — roughly 15% — to 153,164 in February — its lowest level since March 2021, according to Dune analytics data.

According to the asset’s order book, there were ten transactions involving WBTC — eight were burns, while the other two transactions were a cumulative mint of 798.72 WBTC by imToken.

Bankrupt crypto lender Celsius — a major WBTC whale — was responsible for a huge volume of the burns. The firm burnt 22,732 WBTC (worth $533 million) in 2 days via FalconX.

The lender’s redemption is reminiscent of the burns recorded in December 2022 when the crypto market was still smarting from FTX’s collapse.

At the time, there were fears that the crypto exchange’s collapse would significantly impact WBTC’s reserves because it was a top merchant of the asset.

WBTC is an Ethereum-based token that mirrors Bitcoin’s price performance and is pegged 1:1 with the flagship digital asset. WBTC gained popularity during the 2022 bull run when its supply peaked at 285,000. At the time, BTC was trading for around $48,000.

At WBTC’s current price, its market cap stands at $3.63 billion, a far cry from its peak of $13.03 billion, according to CryptoSlate’s data.

The post WBTC supply declined 15% in February appeared first on CryptoSlate.