Digital asset investment products saw minor outflows totaling $17 million from Feb. 27 to March 3, which marks the fourth consecutive week of outflows, according to CoinShares data.

“Volumes across investment products were low at $844 million for the week,” the report cites, as regional sentiments start to change. Last week, the U.S. recorded $7.6 million in inflows, while Europe recorded $23 million worth of outflows.

Blockchain equity investors also showed a bullish sentiment throughout the week, recording $1.6 million worth of inflows.

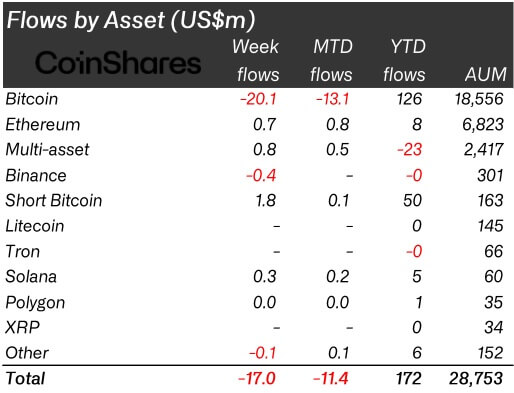

Flows by asset

Bitcoin (BTC) – based investment products recorded $20.1 million worth of outflows, while short-bitcoin saw inflows totaling $1.8 million, as CoinShares data revealed.

According to the data, Binance (BNB) and Cosmos (ATOM) also recorded outflows worth $0.38 million and $0.21 million, respectively.

On the other hand, the majority of altcoins saw inflows during the same week. Ethereum (ETH) and Solana (SOL) based investment products recorded $0.7 million and $0.3 million in inflows, respectively. Multi-asset products also grew by an additional $0.8 million.

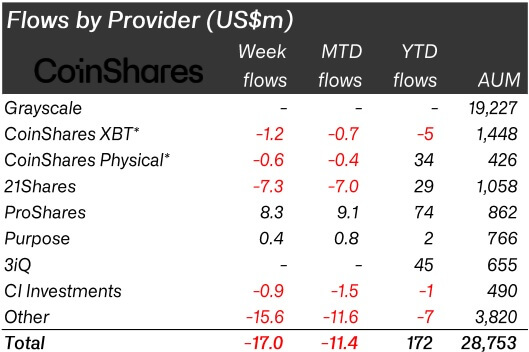

Flows by provider

The report also revealed that the majority of the providers recorded outflows despite the positive sentiment altcoins experienced.

All significant providers, except for ProShares and Purpose, have recorded outflows during the week of Feb. 26 to Mar. 3. CoinShares XBT and Physical saw a combined $1.8 million in outflows.

21Shares, CI Investments, and others recorded $7.3 million, $0.9 million, and $15.6 million, respectively. ProShares and Purpose, on the other hand, grew by an additional $8.3 million and $0.4 million, respectively.

The post Crypto investment products saw $17M outflows last week appeared first on CryptoSlate.