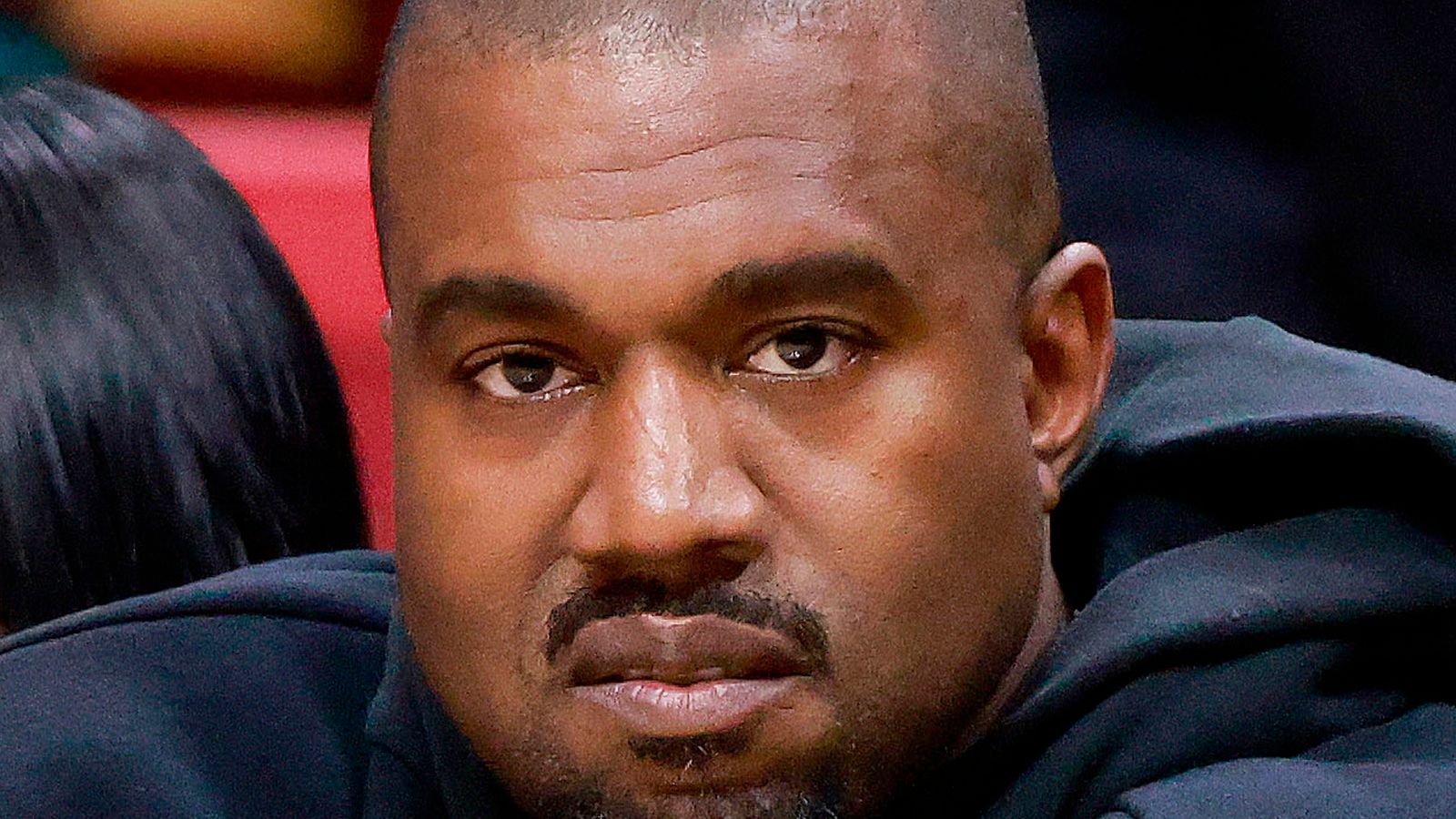

Adidas has revealed plans for a huge cut to its dividend as it battles the costly fallout from its failed partnership with rapper and fashion designer Kanye West.

The company admitted on Wednesday that it was still yet to decide what to do with a mountain of unsold Yeezy trainers, the legacy of its split from West, following antisemitic, and other offensive remarks, he made last October.

It had a book value of $500m (£442m) and could, potentially, be written off entirely or re-purposed.

Adidas warned the issues could push the company to its first annual loss in three decades this year.

It also revealed it is having to pay its former chief executive nearly €16m (£14.25m) after he stepped down from the business prematurely in the wake of the partnership’s end and other troubles including a perceived reliance on China sales.

Kasper Rorsted left the German sportswear giant last November – almost four years before the end of his contract.

Chief executive Bjorn Gulden, who took the reins at the start of 2023, pledged to rebuild the bruised brand but admitted Adidas faced a “transition” year with the value of its total inventories standing at $600m, up by almost half on the same period last year.

He denied rumours of an agreement with West to sell the Yeezy inventory.

Please use Chrome browser for a more accessible video player

Shares fell by more than 2%.

Full year sales for 2022 rose by 6% but Chloe Collins, head of apparel at data firm GlobalData, pointed out that they remained 4.8% behind pre-pandemic levels despite the global sportswear market growing 9.6% during the three years.

Read more from business:

RMT union suspends Network Rail strikes after new pay offer

Manufacturing sector demands ‘reset’ in EU relationship on supply chain woes

Heathrow ‘considering next steps’ as airlines secure victory on passenger charges

Be the first to get Breaking News

Install the Sky News app for free

“In Q4, despite Adidas’s sponsorship of winning team Argentina, the presence of the FIFA Men’s World Cup was not enough to offset the negative impact of the Yeezy controversy on the brand or the fact that its designs lag behind rivals Nike and Puma,” she wrote.

“A catastrophic performance in China was partially to blame for Adidas’s performance in FY2022, as further lockdowns and a shift to local sportswear brands like Li-Ning and ANTA caused currency-neutral sales to topple 35.8%.”

Click to subscribe to Backstage wherever you get your podcasts

She added: “Adidas is still deciding what to do with its remaining Yeezy inventory, despite reaching an agreement with West allowing the brand to sell it.

“It faces a difficult choice, as selling the stock could damage its brand perception even further, and not selling it will have a disastrous effect on profit.”