Data shows that Bitcoin investors have turned fearful again as the market sentiment has now dropped to the lowest value since early January.

Bitcoin Fear And Greed Index Is Currently Pointing At “Fear”

The “fear and greed index” is an indicator that tells us about the general sentiment among investors in the Bitcoin (and wider cryptocurrency) market. The metric makes use of a numeric scale that runs from 0-100 for displaying this sentiment.

All values of the index above the 50 mark imply that the investors are greedy right now, while those below this threshold suggest that the market is fearful currently.

Although the cutoff may be clean in theory, in actual practice the values close to 50 (between 46 and 54) are considered to represent a sort of “neutral” sentiment.

There are also two other special sentiments, called extreme fear and extreme greed. The former of these takes place at values under 25, while the latter occurs at levels greater than 75.

The significance of the extreme fear region is that bottoms in the price of Bitcoin have historically taken shape when investors have held this sentiment. Similarly, tops have formed while extreme greed has gripped the market.

Now, here is a meter that shows what the sentiment in the Bitcoin and wider cryptocurrency sector looks like at the moment:

As you can see above, the Bitcoin fear and greed index currently has a value of 34, which means that the investors share a sentiment of fear right now. This change in mentality is recent, however, as the latest price plunge in the cryptocurrency is what has pushed investors towards being fearful.

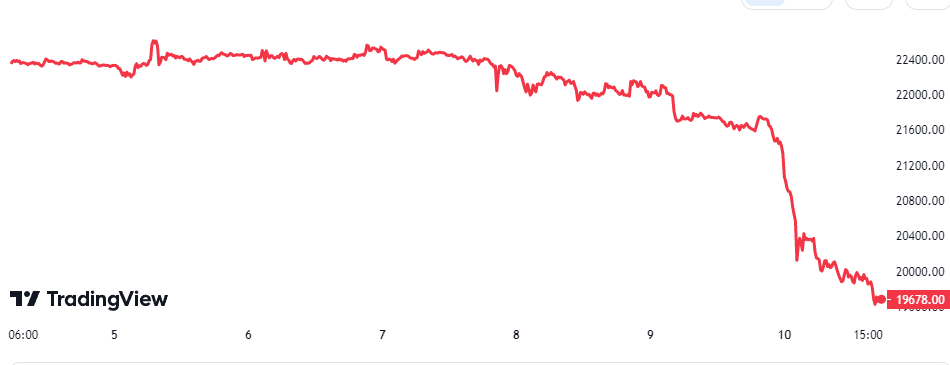

The below chart shows how the index’s value has changed during the past year:

From the graph, it’s visible that the metric had pretty low values during the Bitcoin bear market, but with the start of the rally in January, the sentiment had sharply improved and hit greed values.

The market sentiment kept between greed and neutral during the last couple of months since then, but over the past two days, the indicator has plummeted. The current values of the index are the lowest since early January when the market sentiment first started to improve. This means that the price decline has effectively reset any developments that investors made in terms of mentality during the latest rally.

A positive takeaway from the sentiment decline, however, can be that Bitcoin may be now more lucrative to buy as the chances of a bottom usually become higher the more the index goes down.

A trading philosophy called contrarian investing is in fact based on this idea, where investors prefer to buy when the market is at its worst and sell when investors are greedy. Perhaps it would be at times like now that a contrarian investor would move to buy more of the cryptocurrency.

BTC Price

At the time of writing, Bitcoin is trading around $19,700, down 12% in the last week.