The Bitcoin price has increased over the past week as a result of the escalating banking crisis in the United States and the federal government’s efforts to mitigate its effects.

Bitcoin (BTC) was able to breach the $24,000 barrier on Tuesday, indicating a degree of stability in the cryptocurrency market.

After falling to its lowest point since January, the value of the alpha cryptocurrency increased by 10% during the past 24 hours, according to data from crypto market tracker Coingecko.

Following the failure of three banks, the Federal Reserve has launched an emergency lending strategy to assuage public concern. Silvergate Bank, which was heavily engaged in the cryptocurrency industry, shuttered its cryptocurrency payment platform on March 3 and announced liquidation last Wednesday.

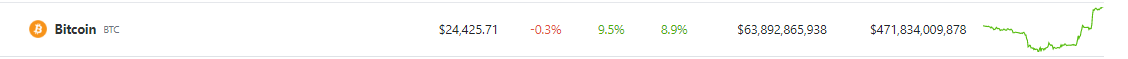

Bitcoin Price Trading At $24,425

Silicon Valley Bank announced on Monday that it will be unable to meet its financial commitments. After a few days, federal regulators closed Signature Bank. In the midst of this, Bitcoin soared by 9% in a single week.

At the time of writing, the price of Bitcoin was trading at $24,425, latest data shows.

Bitcoin’s advance continued on Tuesday, aided by the US authorities’ decision that they would act as a lender of last resort, effectively guaranteeing all uninsured US bank accounts.

Bitcoin, the largest cryptocurrency by market capitalization, has increased around 25% since last Friday. Given the downfall of SVB and Signature bank, both of which were perceived as crypto-friendly organizations, the rally is quite unexpected.

How USDC Fared

The broader market also witnessed the weakening of USDC over the weekend, with the cryptocurrency losing its anchor against the US dollar and falling below the 0.92 level on Saturday as news of the banks’ woes spread to the cryptocurrency market, before recovering its peg on Monday.

Meanwhile, data from Nansen shows the quantity of USDC on exchanges has surged in recent days. The total supply on exchanges is 8% higher than it was a week ago. Incidentally, the biggest USDC deposit in the previous day was 18.3 million, a 41% rise from the previous record of 13 million.

According to Oanda’s senior market analyst Edward Moya:

“Bitcoin is increasing in value as financial stability concerns cause Treasury yields to plummet. In an effort to prevent another huge bank run, federal officials intervened as skepticism about traditional banking rose among some Americans.”

Crypto Market Cap Reclaims $1 Trillion Level

Bitcoin, Ether Show Signs of Recovery, Crypto Reclaims Trillion-Dollar Market Cap #TechNews

— NIDE India (@nideindia) March 13, 2023

After a dramatic dip, the global cryptocurrency market rallied over the weekend and hit $1.02 trillion. The recent government announcement to protect all Silicon Valley Bank depositors’ funds was a crucial element that positively affected the entire cryptocurrency market.

Considering the current data, it is difficult to argue against the notion that the spectacular failure of SVB and Signature bank may serve as an advertorial for the adoption of self-custody and the promotion of digital currencies in a world where the ownership of fiat has become somewhat outdated and, in some cases, ‘strongly discouraged.’

-Featured image from Science News