Goldman Sachs has filed a patent with the US Patent office for a piece of blockchain technology it hopes to integrate with its settling mechanism — outlining the technical and computational requirements for the bank to use blockchain.

Blockchain with joint claims on tokens

The document, Patent no: US 11, 605, 143 2B, was filed by the bank on March 14.

It sets forth the technical aspects of smart contracts applied to financial instruments such as fractional reserve banking, insurance, bonds, securitized products, and margin loans.

The patent application includes a computer-implemented method of providing joint claims to tokens.

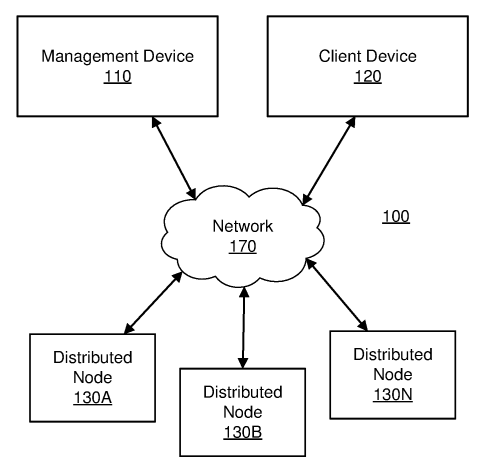

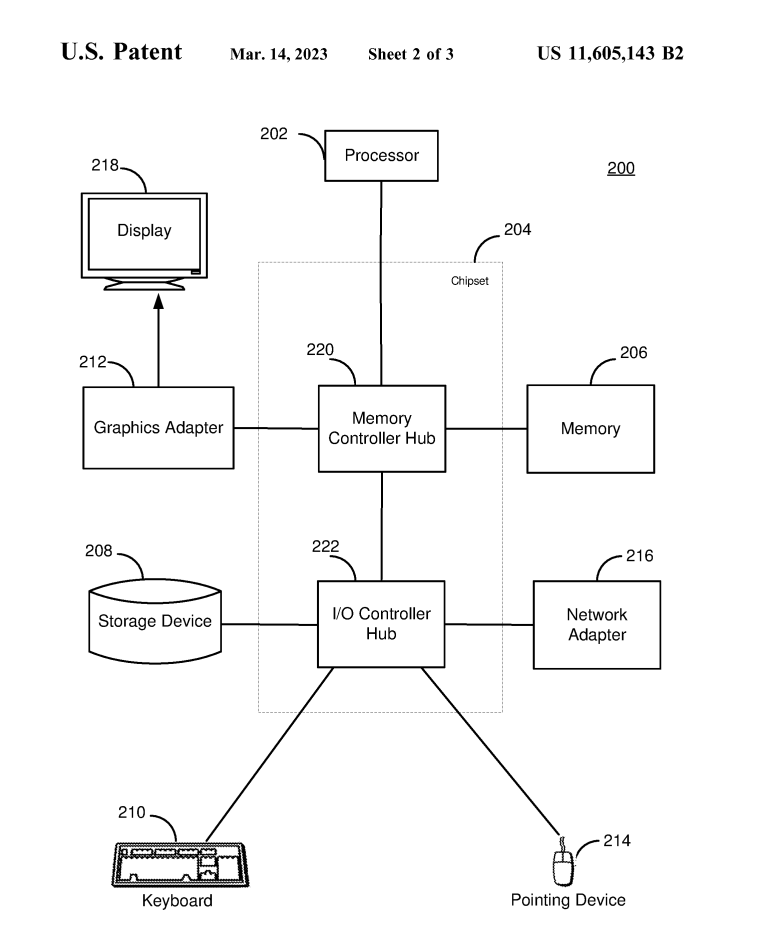

The patent serves to facilitate a networked computing environment suitable for providing joint claims to a token. This is facilitated by a computing system architecture.

Goldman’s blockchain push

Goldman Sachs’ global head of the digital assets team, Mathew McDermott, expressed strong support for blockchain applications during a recent interview with Bloomberg.

McDermott also stated that the team of about 70 members would consider hiring additional personnel as needed in 2023. Last week, Hong Kong employed Goldman’s private tokenization platform, GS DAP, to sell digital green bonds, selling $102 million of the bonds and reducing settlement time from five days to just one.

The bigger race to patent blockchain technology

It’s the first time Goldman Sachs has signaled an interest in blockchain technology.

As recently as February, Goldman Sachs reportedly stated that it is willing to expand its digital assets team by hiring more personnel, adding to its base-level assortment of blockchain offerings.

Meanwhile, some analysts claim that there is a patent “arms race” brewing in the blockchain sector.

The post Goldman Sachs has a patent granted focusing on blockchain technology appeared first on CryptoSlate.