Data shows Bitcoin miners have found some relief recently as their mining revenue has now shot up to the highest level since June 2022.

Bitcoin Mining Revenues Have Significantly Deviated From Yearly Average

According to the latest weekly report from Glassnode, miners are now raking in $22.6 million per day. The relevant indicator here is the “BTC miner revenue,” which measures the total amount of daily USD income that Bitcoin miners are making currently.

The income of the miners here is defined as the block rewards that these chain validators are receiving for mining blocks, plus the transaction fees that they are receiving from individual transfers.

However, for a long time now, the average transaction fees on the BTC blockchain have stayed at pretty low values, due to which the vast majority of the revenue of the miners is contributed by the block rewards alone.

While block rewards stay mostly constant (until a halving arrives, where they are cut in half permanently), their USD value obviously fluctuates with the price of the asset. Miners are a cohort that has to pay continuous running expenses for their operations (like electricity bills), and since they make these payments in the USD, the dollar-converted revenue is what’s relevant for them.

Hence, whenever the value of the miner revenue metric dips low, miners may start struggling to make ends meet, and hence, they may be forced to sell their existing Bitcoin reserves in order to pay off their running costs or might even have to close their operations.

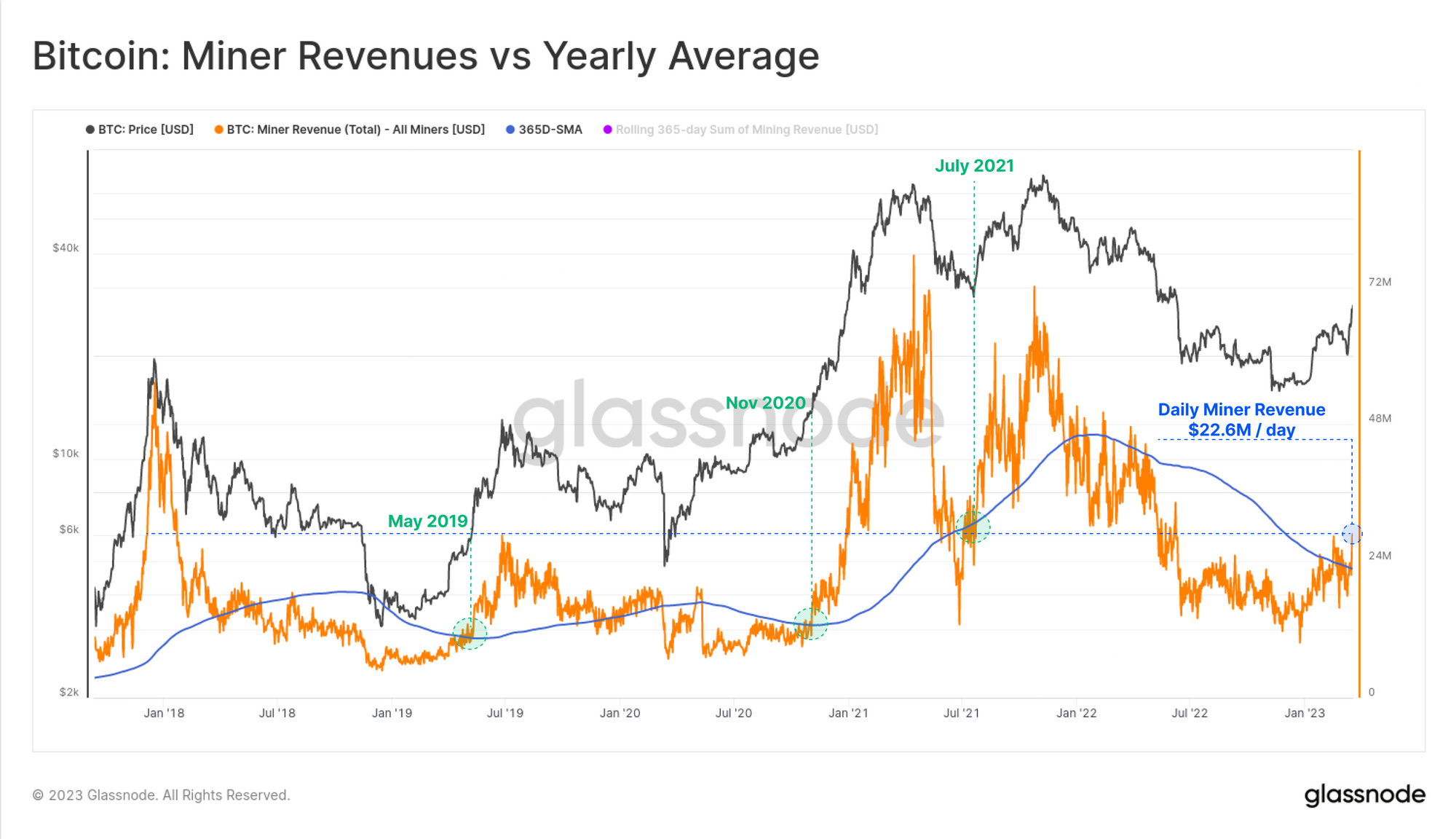

Now, here is a chart that shows the trend in the Bitcoin miner revenue, as well as its 365-day simple moving average (SMA), over the last few years:

As displayed in the above graph, the daily Bitcoin miner revenue had plunged to pretty low values below its 365-day SMA last year as the bear market set in. With the rally this year, however, the indicator’s value has observed some fresh rise and has crossed above its yearly average again.

And with the latest sharp rise of the cryptocurrency above the $28,000 level, the indicator has hit a value of $22.6 million per day, meaning that miners are now making the highest revenue since June 2022.

In the chart, Glassnode has also highlighted the trend in the indicator that has followed during the buildup to the last few bull rallies in the asset. It seems like the metric had major breaks above its yearly average in the last few years during three instances: May 2019, November 2020, and July 2021.

As is clearly visible in the graph, Bitcoin went on to see some major rallies following the formation of this pattern. The reason why surging miner revenues have a constructive effect on the market is that healthy miner finances mean they are less likely to put selling pressure on the coin. They may also invest in expanding their facilities during such periods.

If this previous pattern in the indicator is anything to consider, then the current break above the metric’s yearly average may be a sign that the market is transitioning towards a more bullish environment now.

BTC Price

At the time of writing, Bitcoin is trading around $28,000, up 14% in the last week.