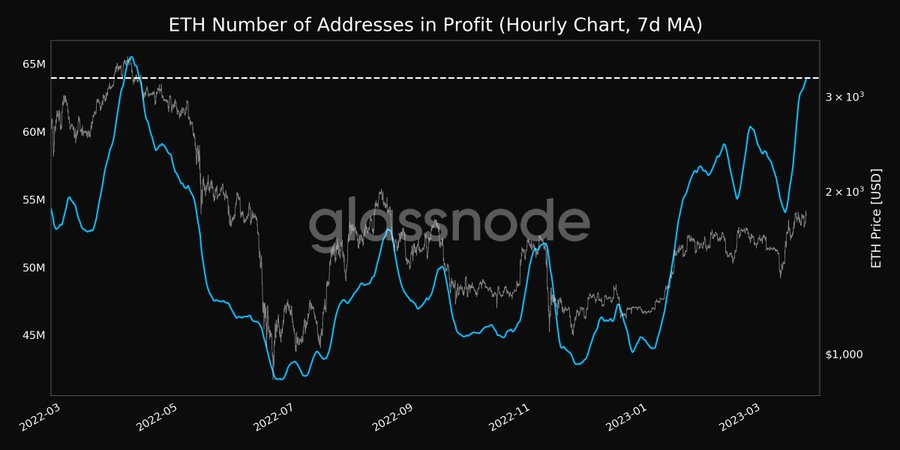

After several spikes since the beginning of the year, up over 40% from January, Ethereum investors have profited, translating into key metrics. According to the on-chain analysis firm Glassnode, the number of Ethereum addresses in profit has now hit a 10-month high of nearly 64 million.

This comes after ETH dipped below $1,200 last year, allowing investors to accumulate more cryptocurrency. These investors are profiting from its price spike to above $1,800 on Thursday.

Profitable Ethereum Addresses Increasing

According to data from Glassnode, the total number of addresses that are in profit (7D MA) has now surged to a 10-month high of approximately 63 million. Notably, this is not the first time Ethereum will push its total number of addresses in gain to a figure nearing 64 million.

Before the latest recorded number of addresses in profit, the previous 10-month high sat at around 63.9 million as of March 23, according to the same source. Meanwhile, Ethereum hasn’t been the only crypto to see a spike in profitable investors.

Earlier this month, Glassnode reported that the total number of Bitcoin (BTC) addresses worth a million dollars or more surged to more than 67,000, slightly higher than the amount of 65,000 in January earlier this year when BTC first crossed $20,000 in months.

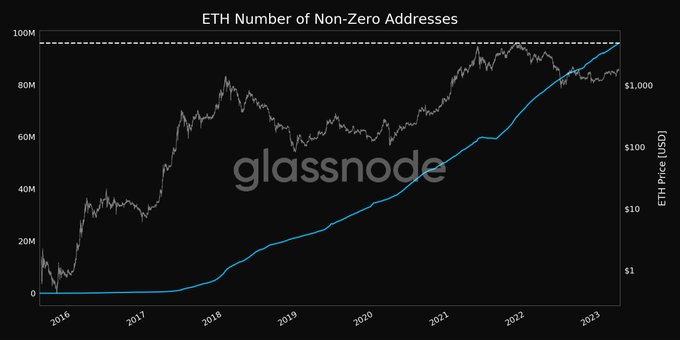

Furthermore, Glassnode announced earlier today that Ethereum non-zero addresses had reached a new ATH of 96 million. This data suggests that more people are buying the cryptocurrency amid the bullish price action.

ETH To Continue Rally?

Over the past two weeks, ETH price has rallied by nearly 10%, from a low of $1,723 on March 17 to as high as trading at $1,845 on March 23. Though at the time of writing, the asset is seeing a retracement down by 3.7% in the last 24 hours with a trading price of $1,775.

Meanwhile, looking at the 1-day time frame, it seems as though the asset’s slight retracement may not last for long as the price would still need to hit the external high just above the $2,000 region.

Moreover, Ethereum’s trading volume hasn’t made any significant move in the past 7 days. Still, the range between $12 billion indicated a possible accumulation which may result in another rally that may happen soon, given the upcoming Shanghai upgrade set to occur next month.

Interestingly, the asset’s market capitalization has added over $5 billion in the past week, moving from a $207 billion last week to $212 billion as of today.

Featured image from Unsplash, Chart from TradingView