Quick Take

- The market uncertainty of what the Federal Reserve will do next is obvious, as expectations are now almost a 50/50 split between a pause or a 25bps rate hike at the upcoming FOMC on May 3.

- But it gets even more uncertain as we go through the futures of the fed funds rate.

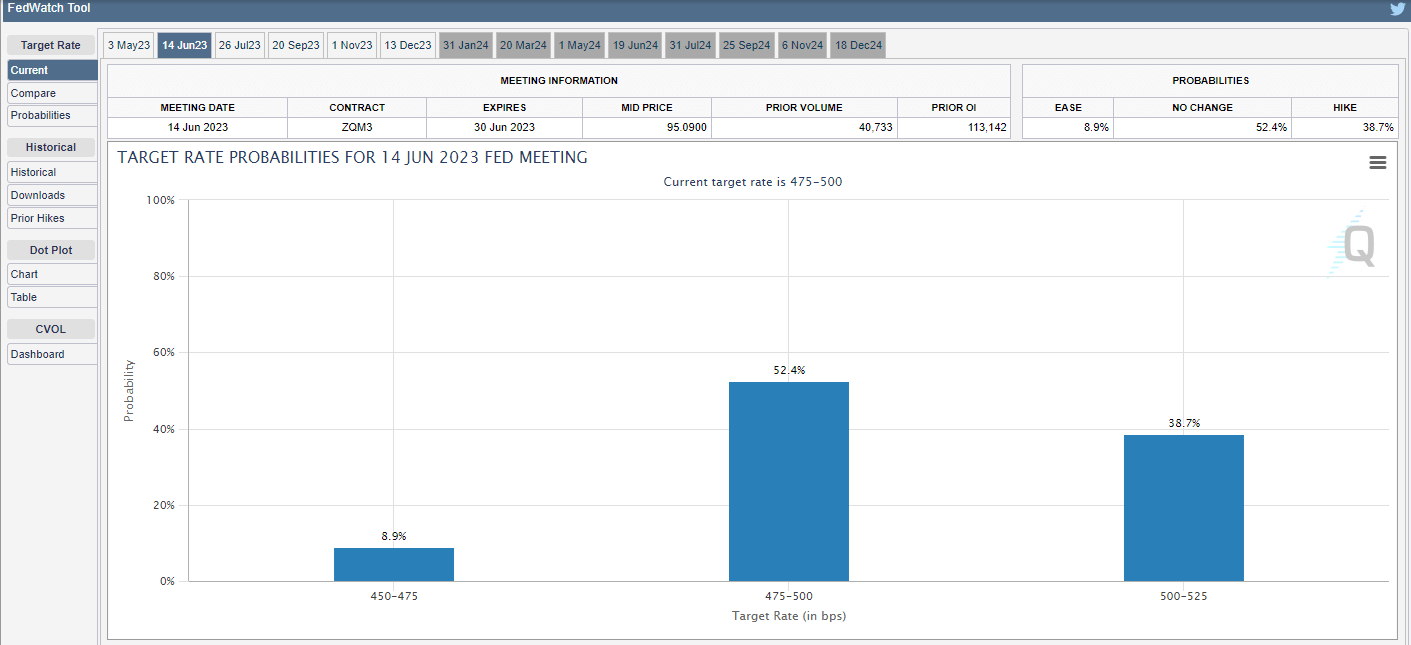

- In June, the market is pricing in three different options a cut, hold, and a hike simultaneously. A pause is the most favored option currently.

- Today, the rate across the yield curve has spiked from US03M to US30Y.

- Even with stubbornly high core inflation, the fed may opt to pause due to the financial instability.

The post Market uncertainty on Fed rate decision persists as yields rise appeared first on CryptoSlate.