What does it mean for Bitcoin if the US dollar loses its reserve status? Is it even possible? In light of the dramatic political developments, a debate is currently raging about exactly that. Whether Bitcoin can be a beneficiary or even the salvation is heavily disputed.

USD Losing Its Reserve Status?

Even Tesla CEO Elon Musk is worried about it. In a response to a thread by Genevieve Roch-Decter, CEO of GRIT, in which she philosophized about whether the US dollar is losing its reserve currency status, Musk wrote:

Serious issue. US policy has been too heavy-handed, making countries want to ditch the dollar. Combined with excess government spending, which forces other countries to absorb a significant part of our inflation.

Serious issue. US policy has been too heavy-handed, making countries want to ditch the dollar.

— Elon Musk (@elonmusk) March 29, 2023

In the mentioned thread, Roch-Decter states that 2014 marked a turning point, with Russia and China initiating “de-dollarization.” Both countries no longer wanted to rely on the US dollar for international trade and investment.

Globally, this trend is evident. As Roch-Decter noted, central banks bought more gold last year than in any year since 1987, yet China and Russia are the driving forces.

With the Russian central bank’s freeze of foreign reserves on the occasion of the Ukraine war, the United States has taken a step that has sent a wake-up call to other nations like China regarding their USD reserves. Since early 2022, the volume of Chinese-Russian trade in Yuan has skyrocketed.

“Russia has turned to China’s yuan to reduce reliance on the US dollar. Other markets are shifting to the yuan as China becomes a more influential superpower,” writes Roch-Decter, who explains, however, that the dollar “is far from doomed.” The analysts at The Kobeissi Letter see a similar trend:

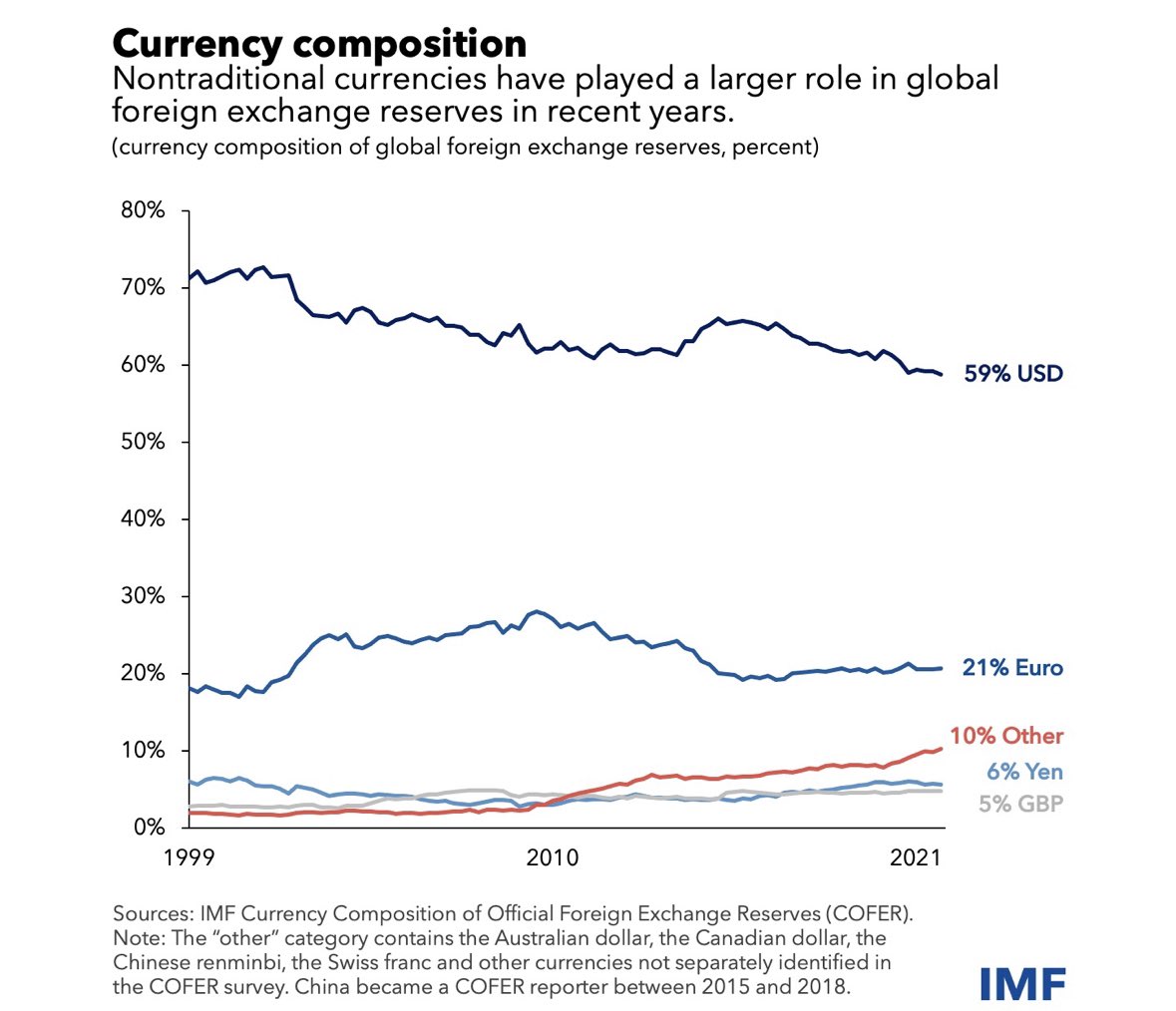

Over the last ~25 years, the use of the U.S. dollar for foreign exchange reserves has steadily declined from 72% to 59%. Meanwhile, Euro usage is up slightly from 19% to 21%. The most important part? Other currencies, including the Chinese Yuan, soared from 4% to 10%.

The chart below shows that the dollar still dominates foreign exchange reserves, but that lead is slowly being eroded.

The inflation and the collapse of the banking system are making people question the system, the analysts said, pointing to the many alternatives to the US dollar. Nations such as China, Brazil and Russia (generally the BRICS nations) are currently doing much to move away from the USD.

The list is long, as The Kobeissi Letter notes. In the last two weeks alone, it has been announced that Saudi Arabia is considering accepting the Chinese yuan for oil sales. China and France completed their first LNG trade in yuan.

Russia is also considering using the Chinese yuan as a reserve currency. Saudi Arabia is building a $12.2 billion refinery jointly with China. China and Brazil have agreed to use the Chinese yuan in cross-border transactions.

For Roch-Decter, however, it is clear: “There is still a strong demand for US dollars. But now, the dollar has some serious competition.”

Meanwhile, Monica Elizabeth Crowley, the former assistant secretary for public affairs for the US Department of the Treasury, noted the boundary of such competition in an interview that went viral on Fox News. If Saudi Arabia, Iran, Russia, China and other countries start trading oil in yuan, she predicts a collapse of the US dollar.

If that were to happen, there would be a complete implosion of the global economic system, but certainly the American economic system. You would be looking at sky-high inflation, just raging Weimar Republic kind of inflation.

Fared Zakaria (CNN) & Monica Crowley (FOX) this past weekend both ran segments discussing the end of the U.S. Dollar reserve currency status. The president of Kenya warned his country to “get rid of dollars” and Xi and Putin just said civilizational change is coming.

Got gold? https://t.co/QKuyWGJdac

— Dave Shuck

(@dshuckit) March 28, 2023

Is Bitcoin Or Gold The Answer?

Die-hard Bitcoiners will probably answer “Yes.” What is clear is that Bitcoin was developed as a hedge against the irresponsible policy of the US Federal Reserve and other central banks around the world. Due to its permissionless nature, it can be used by anyone.

But it’s not quite that simple, even if there are initial signs. Russia is on the verge of legalizing Bitcoin and cryptocurrencies for international trade. According to the latest news, the Russian Central Bank and the Ministry of Finance have reached an agreement on this.

Bitcoin bull Max Keiser already predicted this in March 2019: “The sooner Russia starts adding Bitcoin to its strategic reserves alongside Gold, the sooner the various sanctions levied against it start to become meaningless. It’s not enough to dump $USD, you gotta drive a stake through its heart with BTC.”

Renowned analyst Will Clemente stated yesterday: “The more headlines we see of countries making efforts to move away from the dollar, the higher the likelihood is that there’s nation-state level Bitcoin accumulation that is going on or has gone on.”

Critics doubt this. Keith Weiner, founder and CEO of Monetary Metals, recently expressed that ironically, Bitcoin hasn’t even entered the field of finance yet, and certainly won’t disrupt it.”Yeah, if it ever enters the field. Bitcoin finances nothing,” the analyst said.

Economists such as Lukas Gromen, founder and president of Forest for the Trees (FFTT), and also Peter Brandt see the answer in gold (as also shown by the buying activity of central banks).

CNY/USD is flat since 3q18 and so are Chinese FX reserves. However: You know what’s NOT flat since 3q18? CNY/Gold.

So, what does that imply about what some sellers are exchanging CNY (CNH) for? Gold.

Ultimately, only history will be able to tell who is right.

At press time, the Bitcoin price extended its consolidation phase and traded at $28,521.