Quick Take

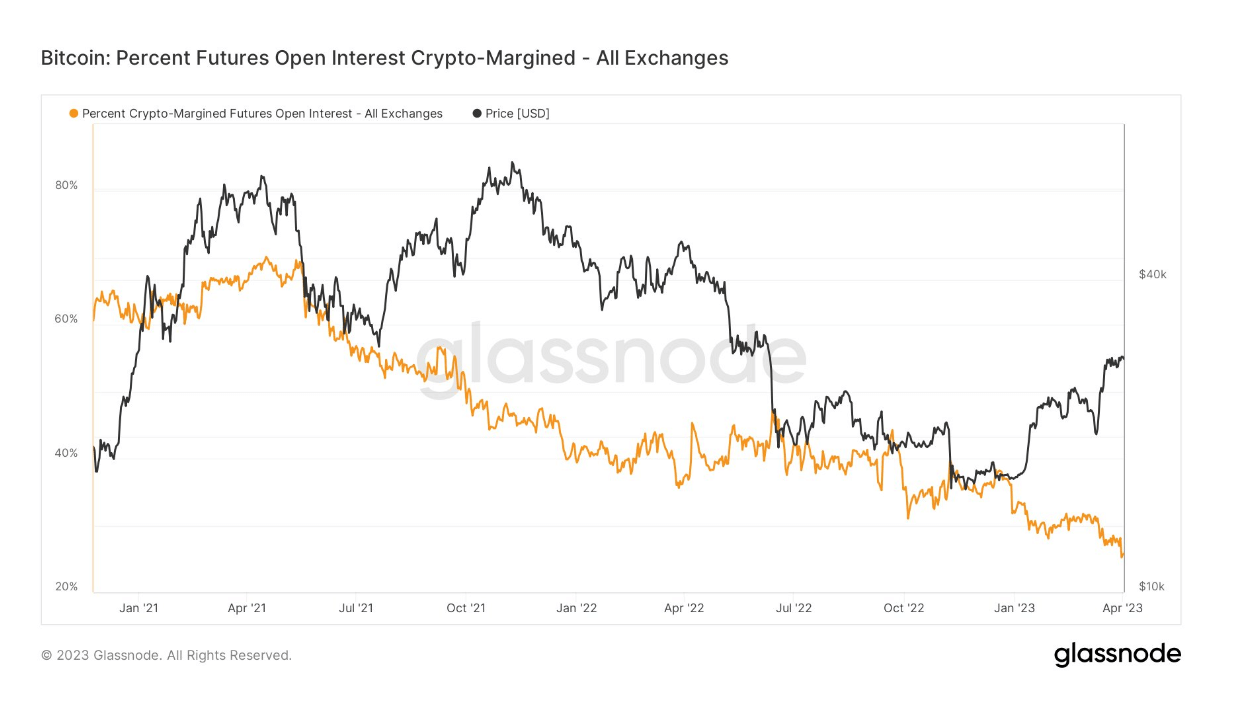

- In the first-quarter review of derivatives, CryptoSlate showed that futures open interest had hit a one-year low.

- We can break this data down further. Currently, the allocation of Bitcoin to futures open contracts is 361,000 BTC.

- While allocation via crypto-margin, i.e., using the native coin (Bitcoin), is 92,000 BTC.

- This puts the percentage in terms of futures contracts at roughly 26%, which can be seen trending down from the top of the 2021 bull run in January, starting at 64%.

- The other 75% allocated in futures contracts is used via stablecoins or USD. As these instruments are not volatile, there is less risk than using a margin such as Bitcoin due to its volatility.

- This is a signal that risk-on appetite has evaporated, and we expect this ratio to continue to play out into the short term.

The post Risk-off sentiment evident as crypto-margin plummets to all-time low appeared first on CryptoSlate.