Definition

What is M2 in money supply? M2 is a metric used to gauge the quantity of money supply in the United States. It comprises a broader range of financial assets compared to the more limited M1 measure, which includes currency and coins held by the non-bank public, checkable deposits, and travelers’ checks. The M2 measure also adds savings deposits such as money market deposit accounts, small-time deposits that are below $100,000, and shares in retail money market mutual funds.

Quick Take

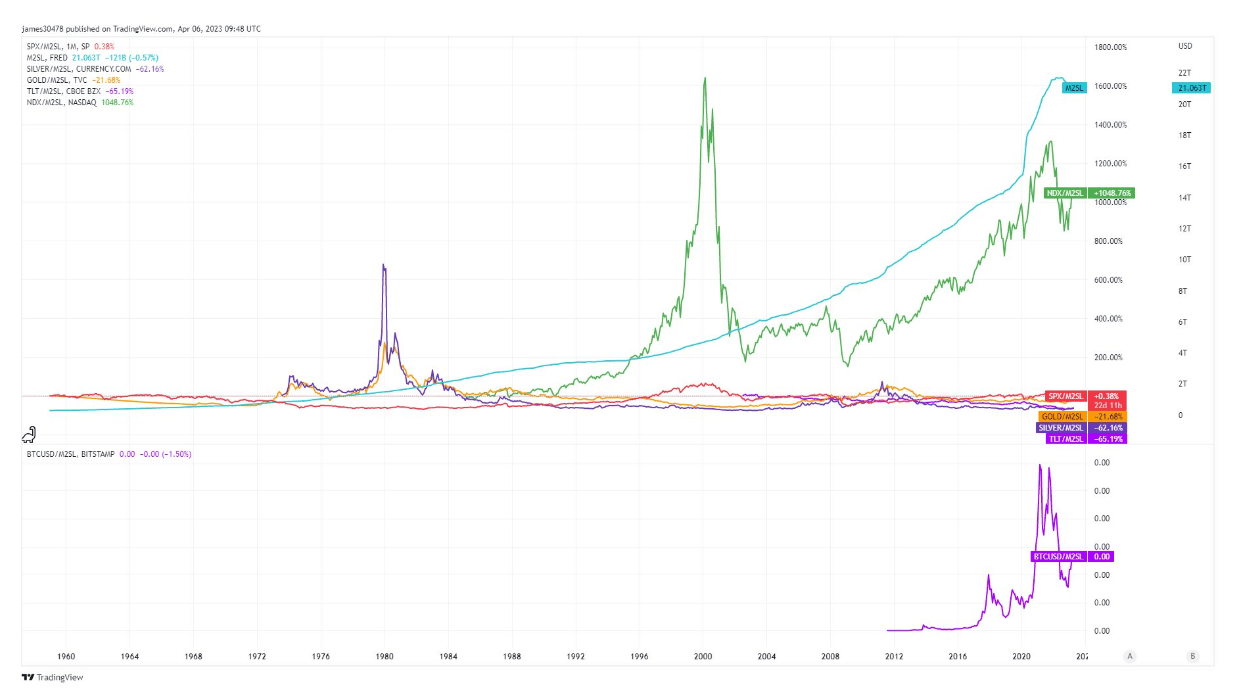

- Investors talk about % gain in both nominal and real terms. Nominal does not consider inflation, but real terms consider inflation.

- Historically, over time, assets such as S&P, gold, house prices, and even Bitcoin have tended to go up in value in nominal terms.

- However, when you adjust for inflation or the money supply, you get a very different return on your investment.

- The M2 money supply has grown rapidly and has now surpassed 21 trillion. Yet, asset performance looks rather different when you adjust for money supply growth.

- Bitcoin is the only asset that has eclipsed its previous all-time high, while the next best performer is the Nasdaq. However, that failed to break its all-time high in 2000, and we suggest no reason for it to break it in the future.

- Given Bitcoin’s supply dynamics and the upcoming halving, there is potential for a new all-time high to be reached even after adjusting for the money supply, which could have significant impacts on the market.

Asset Returns: (Source: Trading View)Key figures:

- TLT: -65%

- Silver: -62%

- Gold: -22%

- SPX: +0.38%

- Nasdaq: 1068%

- BTC-USD: 108,000%

The post M2 money supply analysis shows one clear winner in race appeared first on CryptoSlate.