For the seventh time in the last three weeks, Bitcoin has been rejected at the resistance area of $28,600. Analysts are therefore divided on whether the Bitcoin price is on the verge of another capitulation or whether the bears are running out of steam and the breakout above $30,000 is finally coming.

Bitcoin Price On the Verge Of A Breakout?

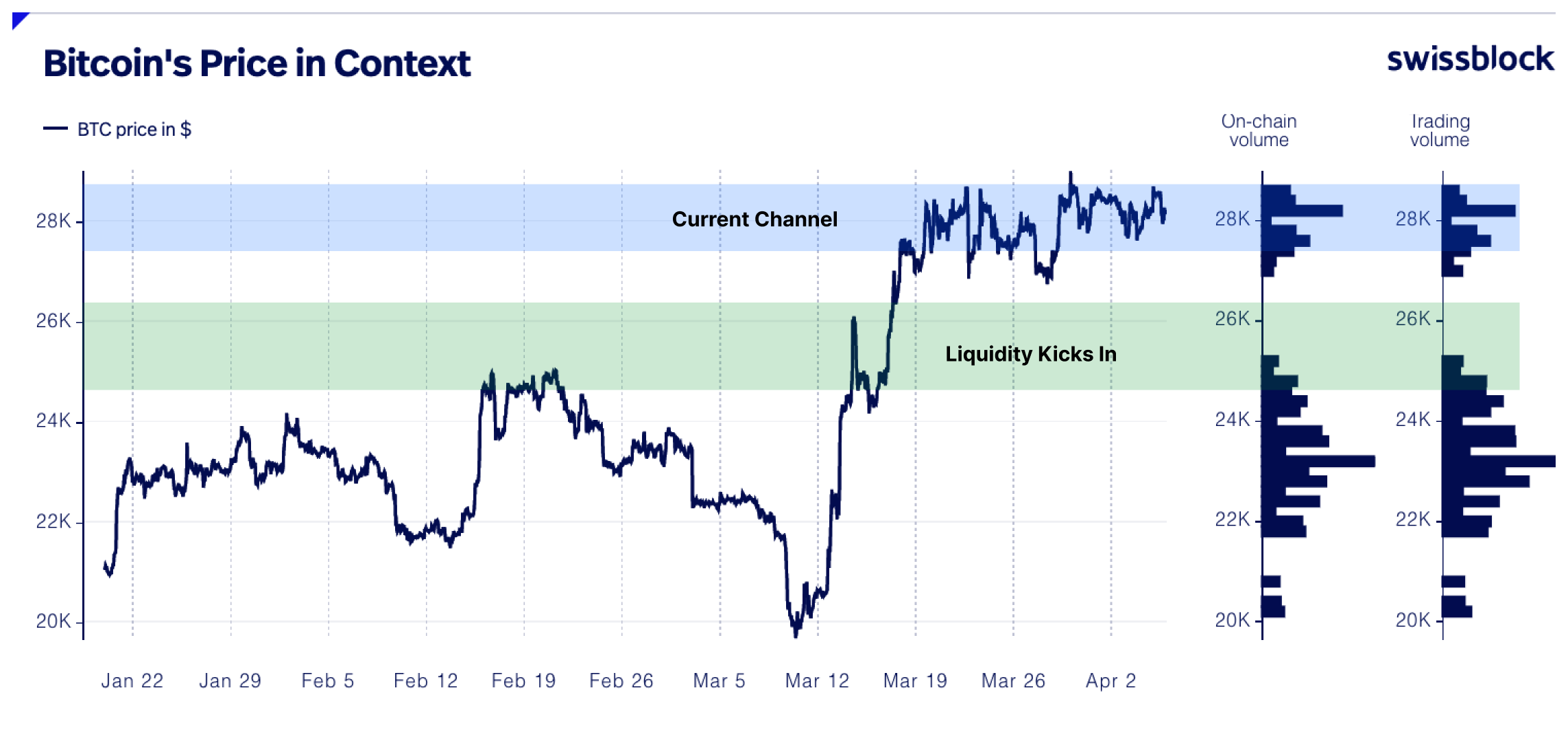

In their latest analysis, Jan Happel and Yann Allemann, co-founders of Glassnode, note that Bitcoin remains unwilling to break out to the upside or break down. According to the two experts, the consolidation poses the risk that Bitcoin will dip towards $25,000 in order to collect liquidity:

Despite the short-term shakiness, the price has been pushed to the upside of the range, consolidating between $27.7k (pivot point) and $28.6k. The longer we hover within the range, the more likely that bitcoin drops to $25-$26.5k to catch liquidity, leading to the full-blown alt season.

However, the Bitcoin risk signal remains stable at the lower extreme, suggesting that the risk of a full-blown drop to the $25,000-$26,600 range is relatively low and a max pain scenario. To the upside, the price could rise to $29,200 to $30,000, according to Glassnode founders.

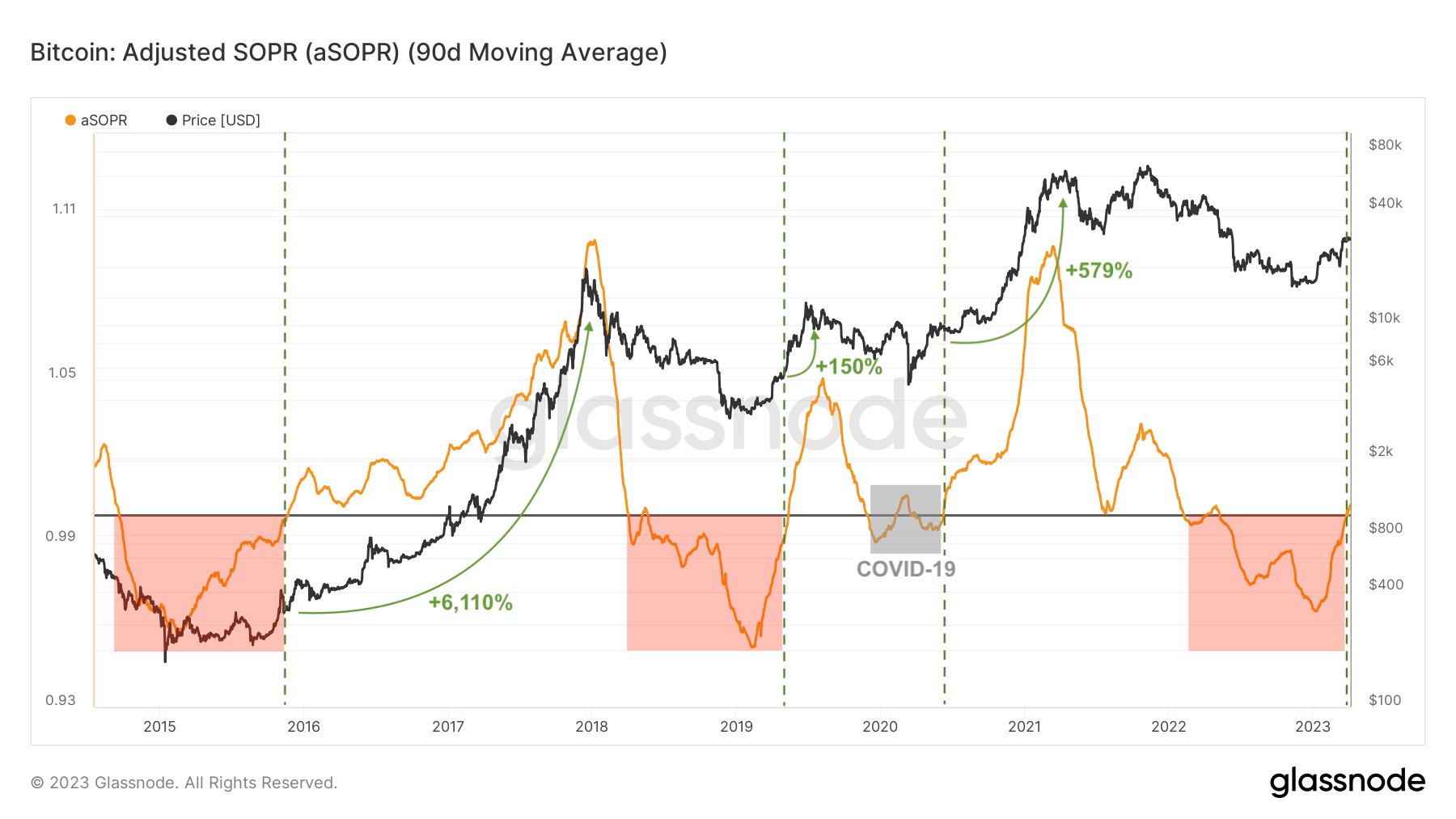

On the other hand, on-chain analyst Ali Martinez is much more bullish. “Another Bitcoin indicator hints at explosive growth!” wrote the analyst yesterday, referring to the aSORP.

Historically, an aSORP (90-day moving average) below 1 has signaled a bear market. When above 1, it has always marked the beginning of a new bull market. Martinez explained:

In 2015, 2019 & 2020, it led to 6,110%, 150%, & 579% gains. aSORP recently moved above 1, suggesting $BTC readies to go parabolic.

Technical chart analyst and founder of Eight Global, Michaël van de Poppe, agreed with Glassnode founders today that Bitcoin is still stuck in the range of the last three weeks and continues to consolidate. But he is bullish too:

Big event this week with CPI, probably the market mover. If another test of $28,600 takes place, I’m assuming we’ll be breaking out upwards.

While numerous experts expect another dip and want to buy only at $25,000, van der Poppe believes that this will not happen. His reasoning: there are currently no clear bearish divergences on higher time scales.

Jesse Colombo, economic analyst and Forbes contributor is currently observing a pennant pattern that currently appears to be forming below the crucial $30,000 resistance level. Via Twitter, Colombo shared the chart below and elaborated:

If Bitcoin can break out of that pennant pattern & above $30,000 with strong trading volume, it would be a bullish confirmation signal.

Bears Warn Of Another Capitulation

On the other hand, the pseudonymous analyst “@52skew” warns of a time-based capitulation after Bitcoin failed to sustainably break through the $28,600 mark in higher time frames in recent weeks. The analyst speculates that investors are losing faith in Bitcoin’s strength (as evidenced by falling volume).

At press time, the Bitcoin price was at $28,313, consolidating below key resistance.