Quick Take

- Last week, CryptoSlate analyzed that illiquid supply hit an all-time high as short-term holders started to hold more Bitcoin off exchanges.

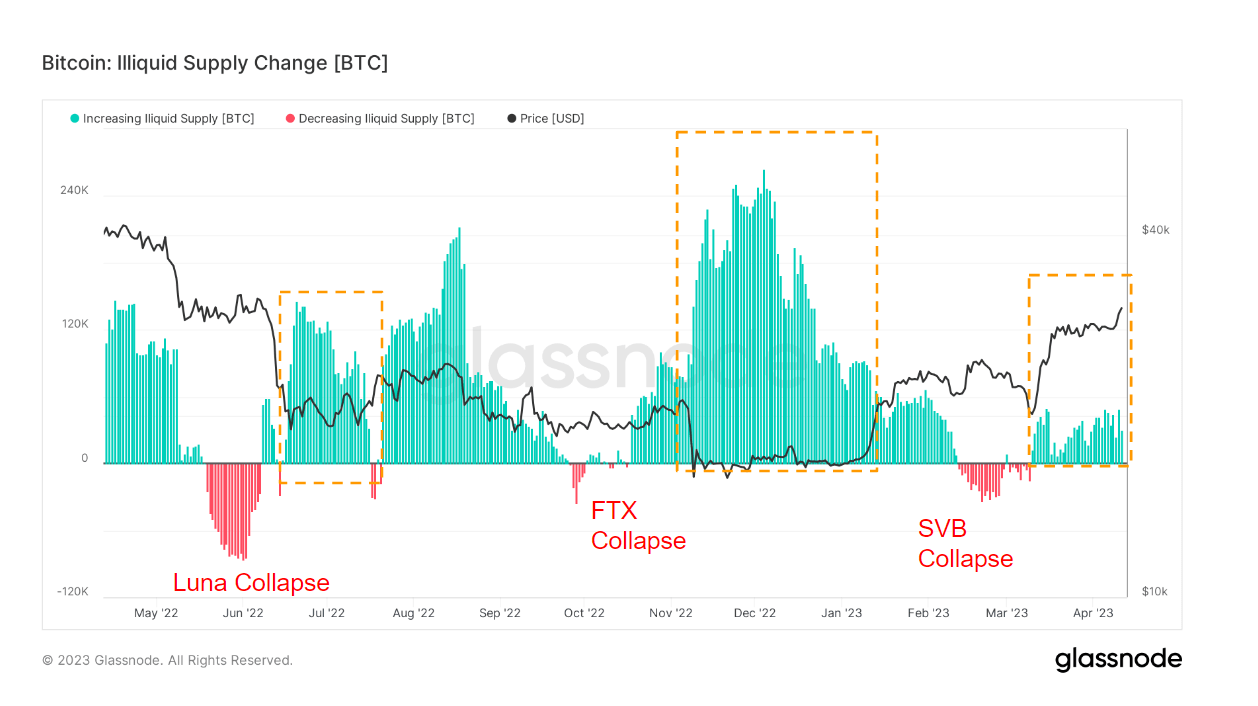

- A further deep dive shows; after each crisis, albeit the crypto or tradfi industry, illiquid supply surges for Bitocin.

- The more investors get burnt due to liabilities outside their control; they rush to take self-custody of their Bitcoin off exchanges.

- We expect this long-term trend to continue as humans are inherently greedy and corrupt, so that self-custody will become even more important.

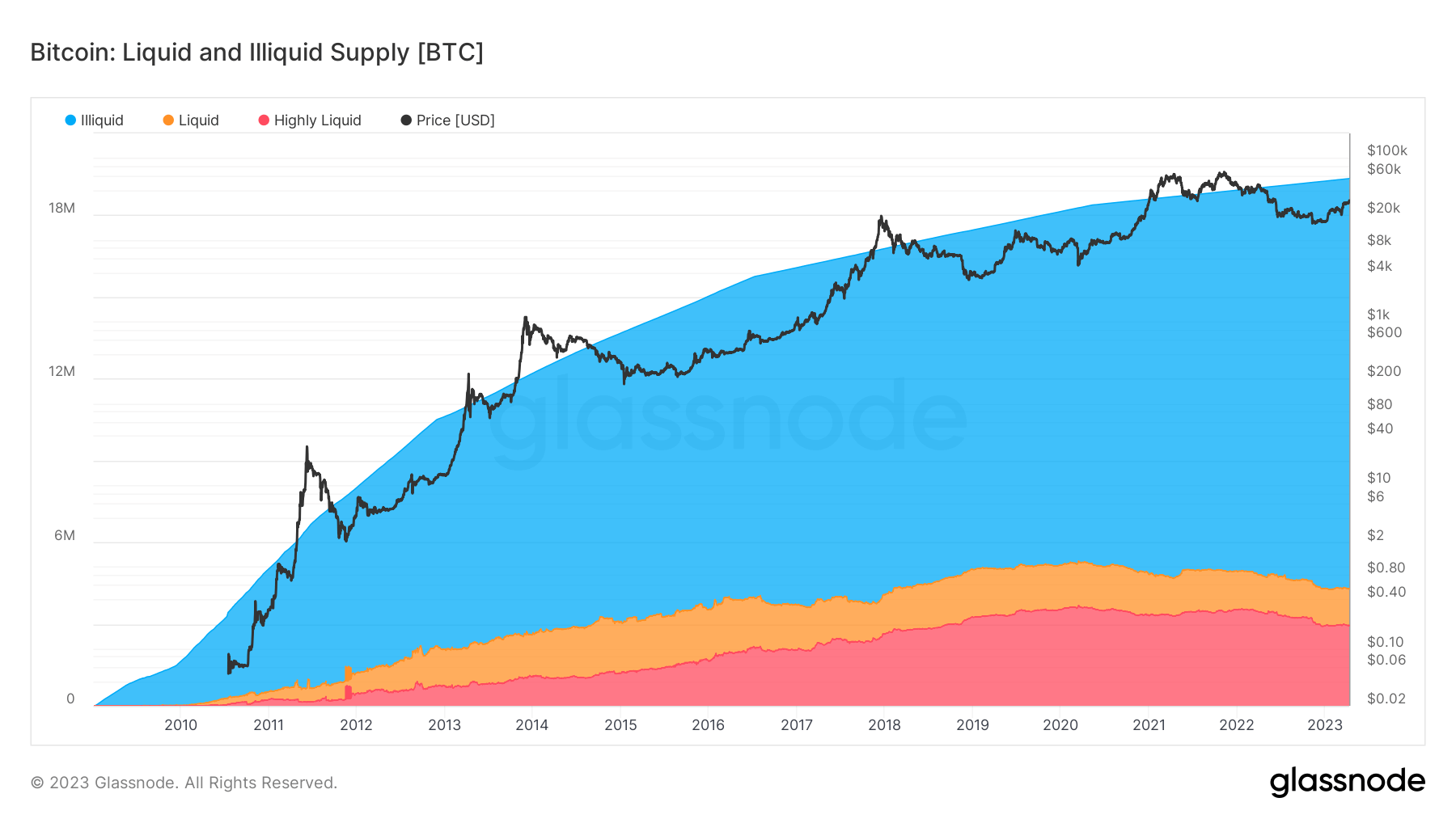

- Roughly 15 million Bitcoin in illiquid supply, divided by 19.3 million Bitcoins in circulating supply which gives us 78% of the circulating supply is illiquid.

The post Bitcoin’s illiquid supply surges after market turmoil appeared first on CryptoSlate.