After the rapid rise above $30,000, the Bitcoin price is currently taking a break and hovering around the round number. In the medium term, Bitcoin looks bullish, but what about the short term? Can BTC continue to rise or is a correction looming?

Axel Adler Jr. has published an analysis of Bitcoin’s on-chain data on this matter. In a series of tweets, Adler writes that the BTC inflow/outflow ratio on the 7-day moving average (MA7) is currently in positive territory, meaning that BTC inflows to exchanges are exceeding outflows.

Adler concludes from this that investors may be preparing to sell BTC. However, he says that this value should be interpreted with caution, as it does not always correlate with future price changes. Nevertheless, the interpretation is confirmed by the BTC Netflow 7-day Simple Moving Average (SMA 7), which is also in the red zone.

On the other hand, bullish signals are sent by the Bitcoin Net Taker Volume MA7, which is positive and indicates that the buying volume exceeds the selling volume. This could indicate increased demand and a short-term rise in the BTC price, the analyst said.

Also supporting short-term price growth is the Futures Sentiment Index, which is based on average open interest and average funding rate. Currently, the index is rising, suggesting growth potential. Thus, Adler concludes, “Mixed BTC market situation!”

Will Bitcoin Bulls Or Bears Win In The Short-Term?

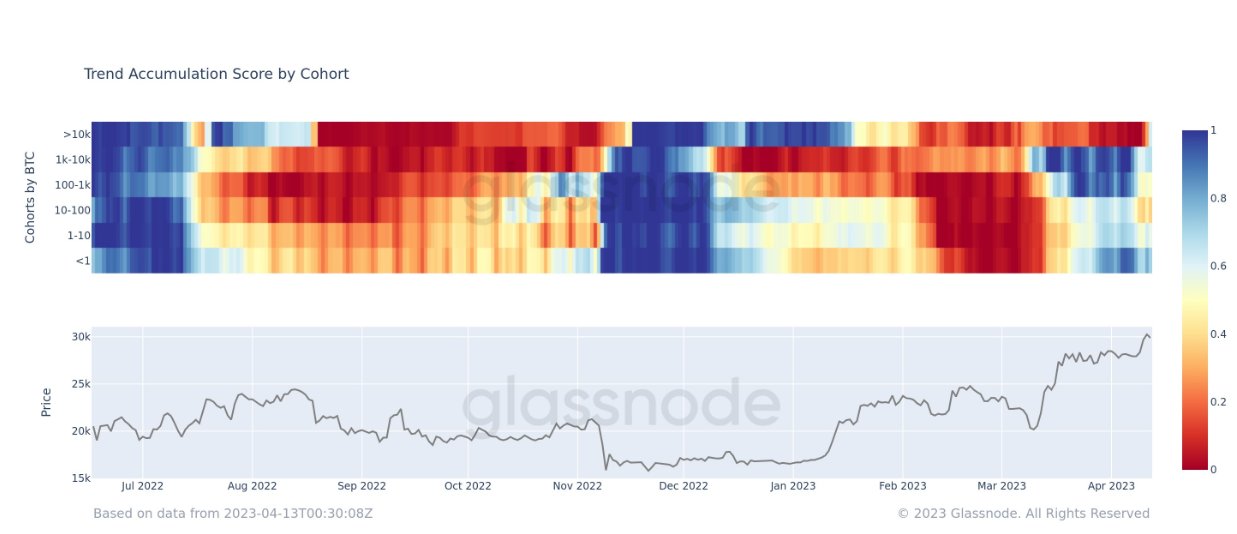

However, on-chain analyst James V. Straten has discovered another bullish signal. Via Twitter, the analyst shared the chart below and stated:

Interesting developments from #Bitcoin whales. They have started accumulating again, while all other cohorts slow down accumulation. Whales buy value. $30k the new floor?

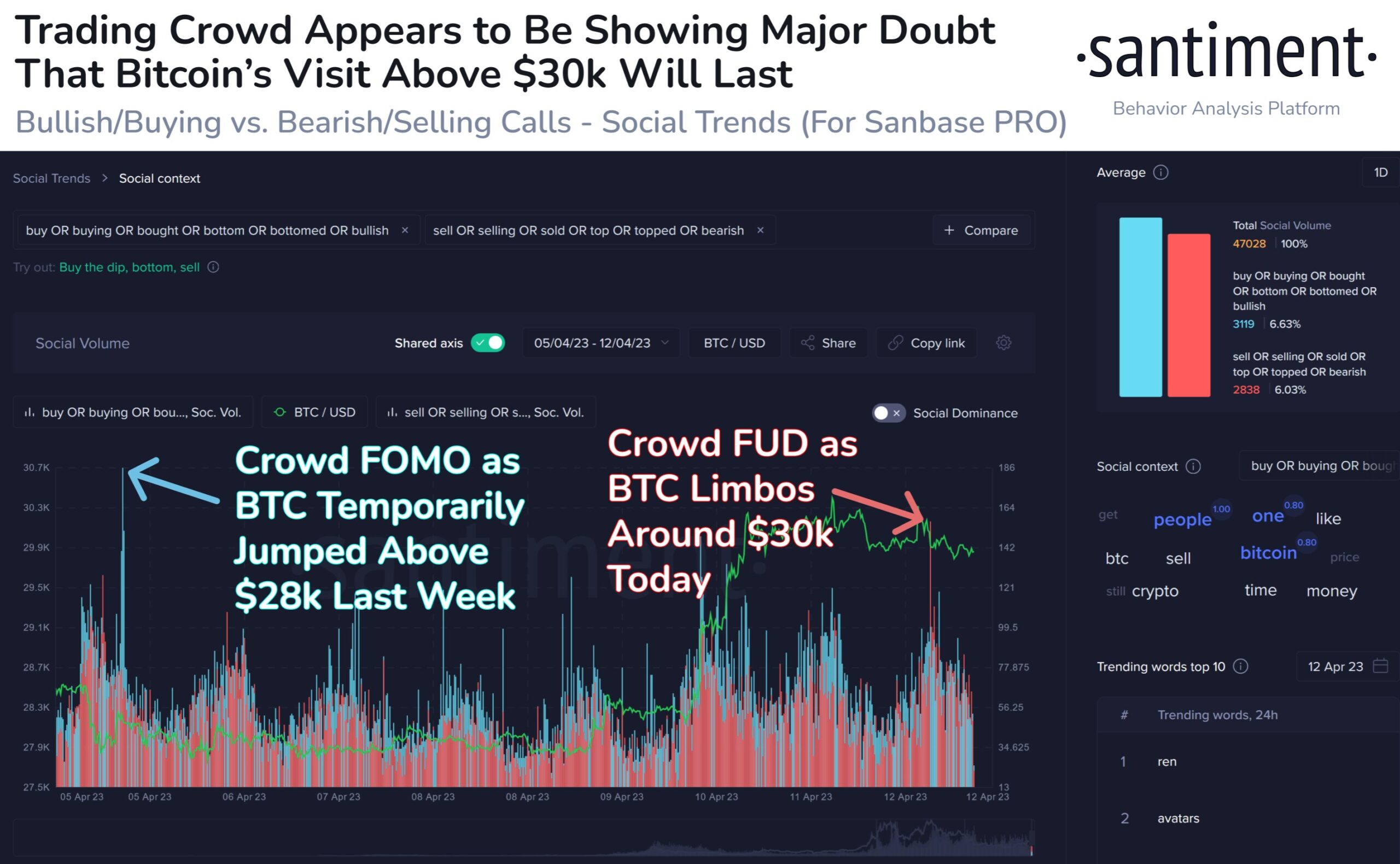

In addition, according to on-chain data provider Santiment, social metrics are showing a bullish signal as the crowd is still skeptical of the rally. “Traders are beginning to show signs of FUD. Historically, this is a good sign for patient bulls, as markets typically move the opposite direction of the crowd’s expectation,” Santiment states.

Technical analyst Michaël van de Poppe also believes that Bitcoin can continue to rise. As long as the BTC price stays above $28,600 or $27,800, the analyst expects that the markets will not decline too much.

On the lower time frame, van de Poppe sees $29,300 as a good entry opportunity. The analyst gives the price range between $32,400 and $33,000 as a continuation target.

Meanwhile, Bitcoin pioneer Scott Melker has his eye on BTC dominance. According to him, there is currently a clear case for altcoins to outperform. Melker shared the chart below and explained that dominance has been in this range for years.

Currently, it is at the upper edge, which is why he expects the rally to shift from Bitcoin to altcoins in a base scenario if the RSI is overbought and reaches the top.

We are the top of the range with overbought RSI (again a bit of a meme) and bearish divergence. Dominance should drop here unless we see a MAJOR breakout and Bitcoin crushes everything.

At press time, the BTC price was still hovering around $30,000, trading at $30,223.