Bitcoin began Q1 on a bright note – recording 70% trough-to-peak gains to top out at $29,200 during the period.

This performance came off the back of a challenging year that was fraught with macroeconomic and geopolitical uncertainty, not forgetting the numerous CeFi bankruptcies.

Although it seems the worst is behind us, as evidenced by the retreat of short-term speculators and the unwinding of leverage through the shrinking derivatives market, uncertainty continues to linger.

Throughout Q1, Bitcoin miners have had a strong incentive to sell, particularly those who misjudged the severity and duration of the ongoing bear market. But Glassnode data analyzed by CryptoSlate showed miners held firm during the last quarter.

Bitcoin Hash Rate and mining difficulty

Bitcoin Hash Rate is a measure of computing power on the network. Specifically, Hash Rate refers to the number of guesses made each second to match the target hash and “win” the block to earn mining rewards.

An increasing Hash Rate signifies more computers joining the network and/or more powerful mining machines, capable of outputting more guesses per second, participating. The higher the Hash Rate, the more secure and healthy the network.

Related to this is mining difficulty, a method to algorithmically regulate the time it takes to guess the target hash correctly.

When the Hash Rate increases, more guesses are made, resulting in the target hash being found faster. Maintaining a consistent 10 minutes block time requires the mining difficulty to increase.

Conversely, when the Hash Rate decreases, it is necessary to make mining easier to prevent the time it takes to match the target hash from taking longer than 10 minutes.

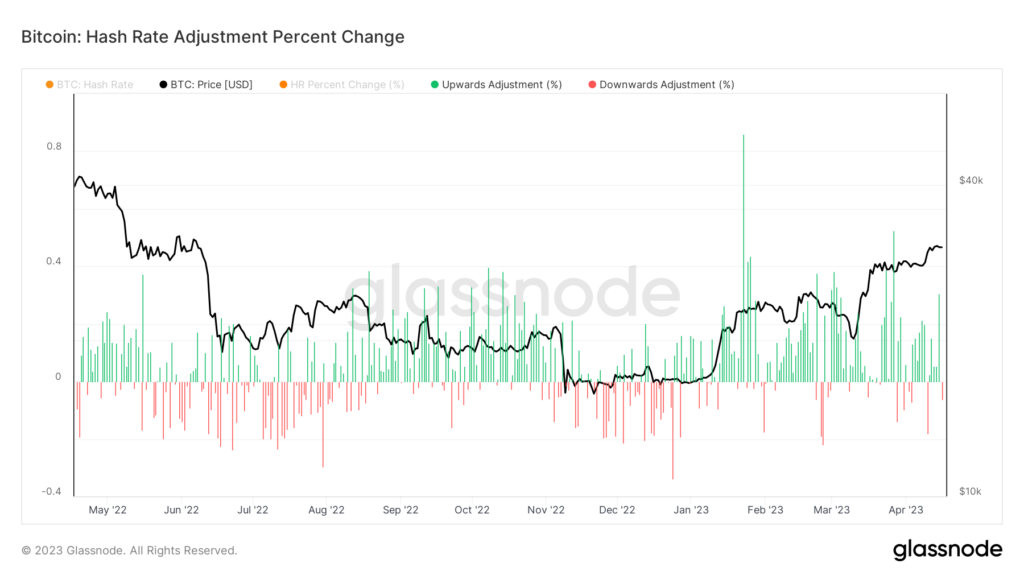

The chart below shows the Hash Rate Adjustment Percentage Change over one year. The majority of the movement has been an adjustment higher – with Q1 standing out as a period of significant adjustments higher – particularly during late January.

During Q1, the Hash Rate spiked as high as 340 TH/s – or 340 trillion hashes per second – marking a new all-time high that continues to climb going into Q2.

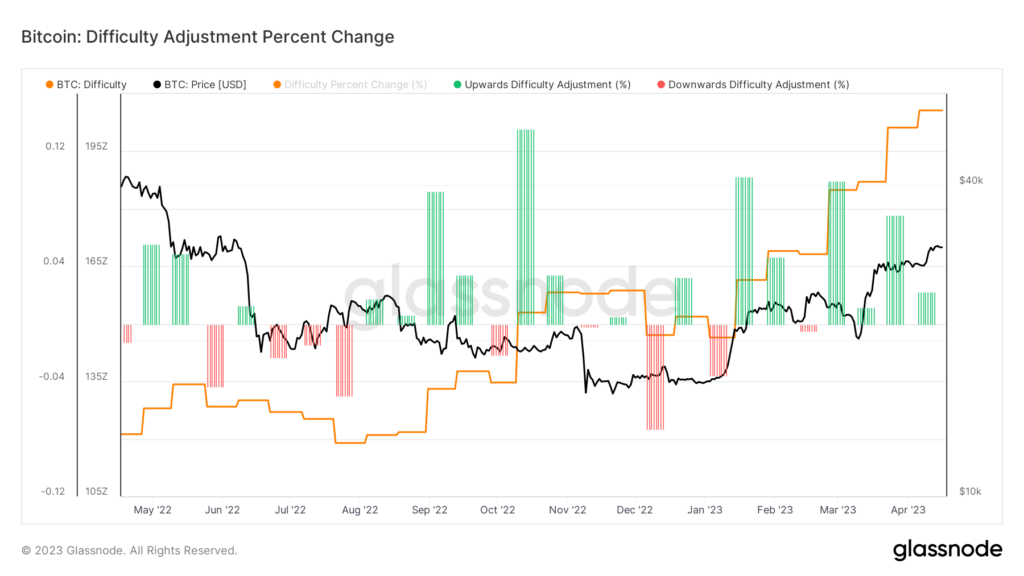

Likewise, Difficulty Adjustment Percentage Change over the past year gradually increased, in line with expectations per the rising Hash Rate.

During Q1, mining difficulty reached as high as 47 T – a new all-time high and continues to rise into the next quarter.

New all-time highs in Hash Rate and mining difficulty have not triggered a mass sell-off from public miners so far, with holdings remaining relatively stable since May 2022 – suggesting miners expect the price of BTC to go higher.

Public miners

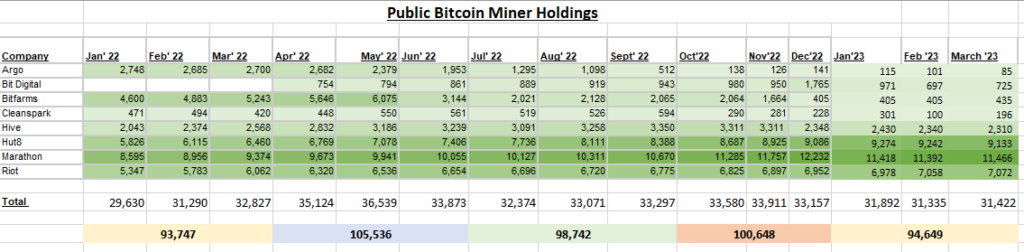

Since January 2022, CryptoSlate has tracked financial disclosures of the eight biggest publically listed mining companies, including their BTC holdings – giving further insight into miner sentiment above on-chain analysis.

The table below shows Q2 2022 had the largest collective holdings, at 105,536 BTC. The latest quarter is down 10,887 coins from this peak to 94,649 BTC.

However, considering that Bitcoin had dropped from a $48,000 peak at the end of Q1 2022, in addition to the spate of bearish events compounding sell pressure as the year went on, expectations for a mass sell-off were not realized – demonstrated a degree of resilience.

Meanwhile, mid-March saw mining company share prices rise – with many now up to triple digits. Argo investors saw the least gains, but the stock is still up 12% YTD.

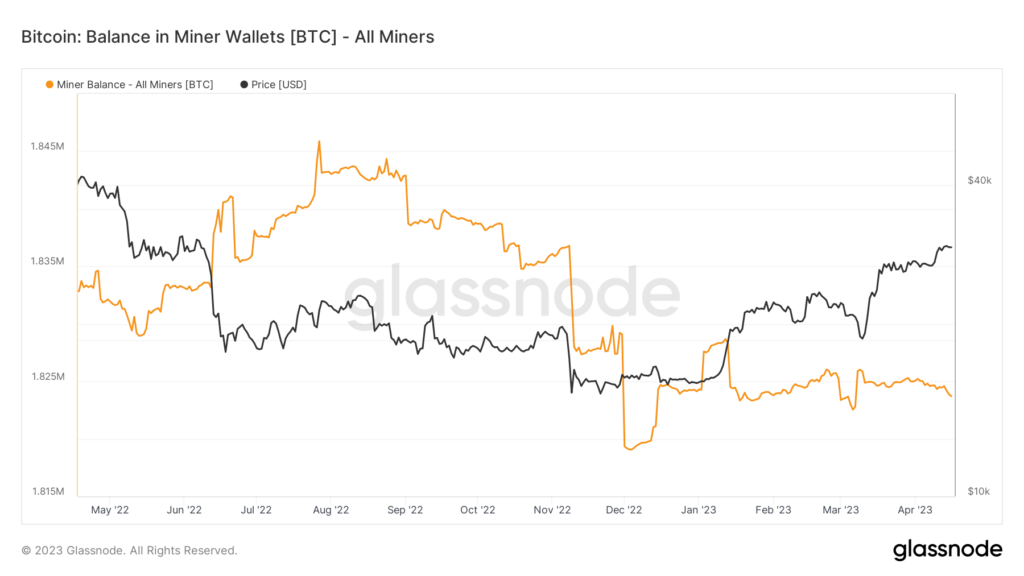

The chart below shows the Bitcoin held in miners’ wallets peaked in July 2022 at around 1.85 million. The resulting downtrend saw an acceleration in outflows in November 2022 (FTX collapse).

Since bottoming in December 2022, a sharp rise to near pre-FTX levels occurred but soon lost momentum, falling into a relatively static balance.

Miners currently hold 1.82 million BTC, comparable with June 2022’s low – further displaying a robust response to recent events.

The post Research: Bitcoin miners hold strong during Q1, signaling bullish outlook for BTC appeared first on CryptoSlate.