Quick Take

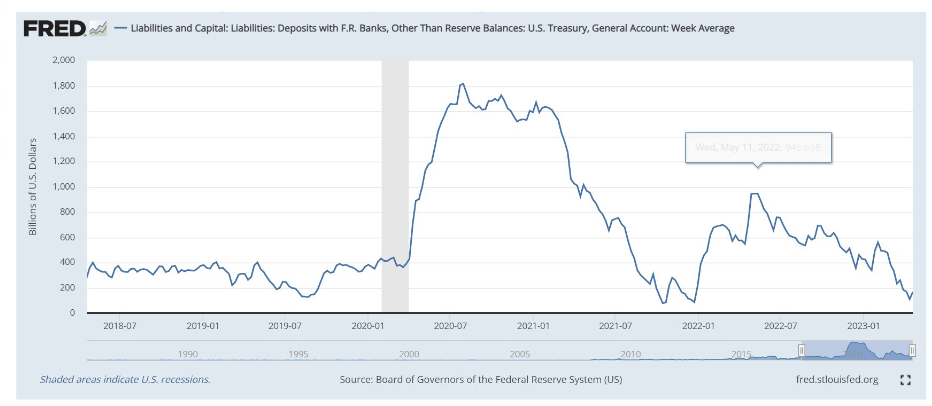

- The Treasury General Account (TGA) at the Federal Reserve represents the government’s checking account. For further details, see previous insight on TGA.

- At the beginning of the year, the federal reserve was injecting liquidity into the markets and, as a result, drawing down on the U.S. treasury account.

- It is now almost depleted; the bounce was tax day on April 18 — which saw roughly $100 billion of tax receipts. The path is not sustainable.

- The treasury should stay solvent until the end of May — while tax receipts continue until June.

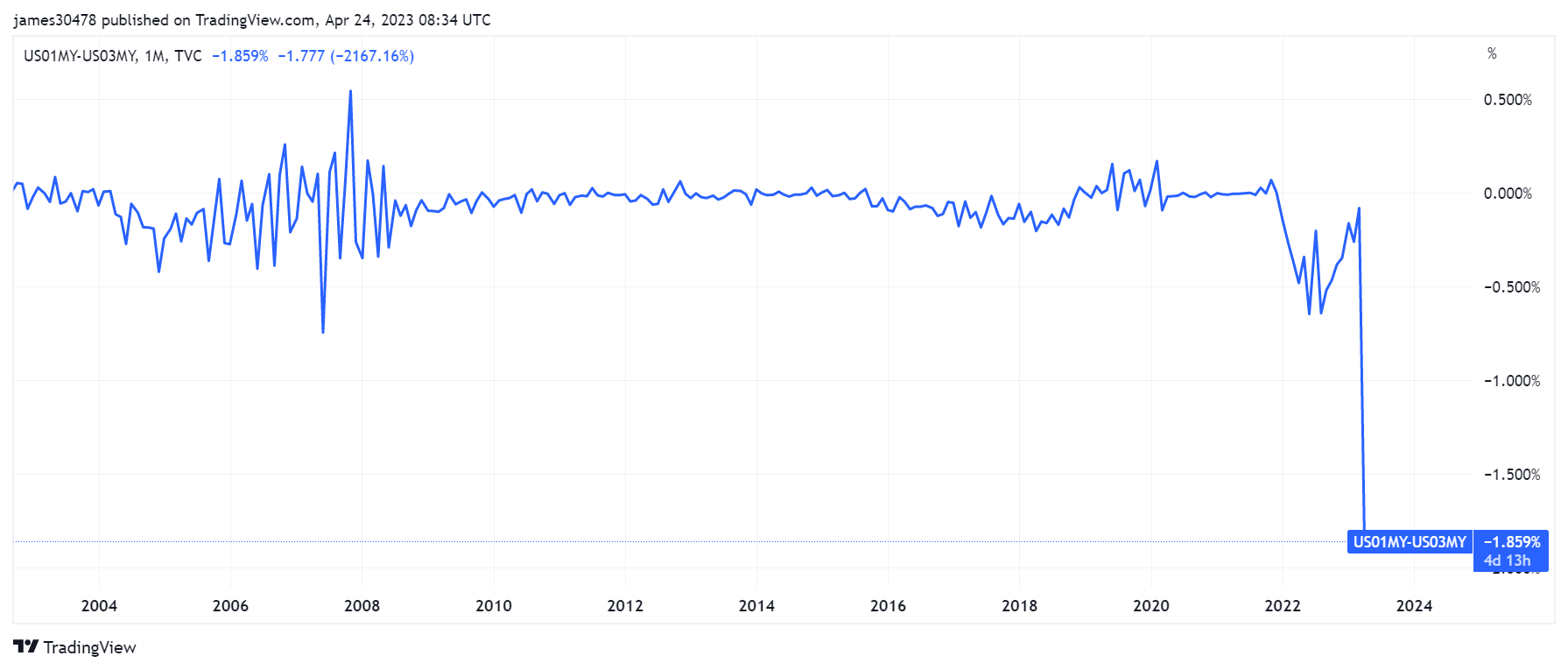

- The spread between the 1-month and 3-month treasury bills signals concern from an investor point of view.

- The one-month yield plummeted — showing investors’ demand before a potential default. The spread widened as far as -1.859%.

The post Bitcoin’s price volatility continues amidst U.S. debt ceiling uncertainty appeared first on CryptoSlate.