In recent trading sessions, the price of Litecoin has remained stagnant below a significant resistance level while Bitcoin has experienced consistent fluctuations. Although Litecoin showed a slight increase of 2% in the last 24 hours, it lost 1% over the week, indicating consolidation.

The altcoin’s technical outlook suggests a potential bearish takeover, as demand and accumulation for the altcoin have both declined. The crucial overhead resistance level of Litecoin has been a barrier that the coin has failed to surpass previously. In the event of another rejection over the coming trading sessions, bears could successfully take over.

As Bitcoin approaches the $30,000 mark, major altcoins are following a similar price trend. If BTC successfully crosses this resistance level, Litecoin could experience a rally. However, the market capitalization of LTC has decreased in the last 24 hours, indicating a decline in buying strength.

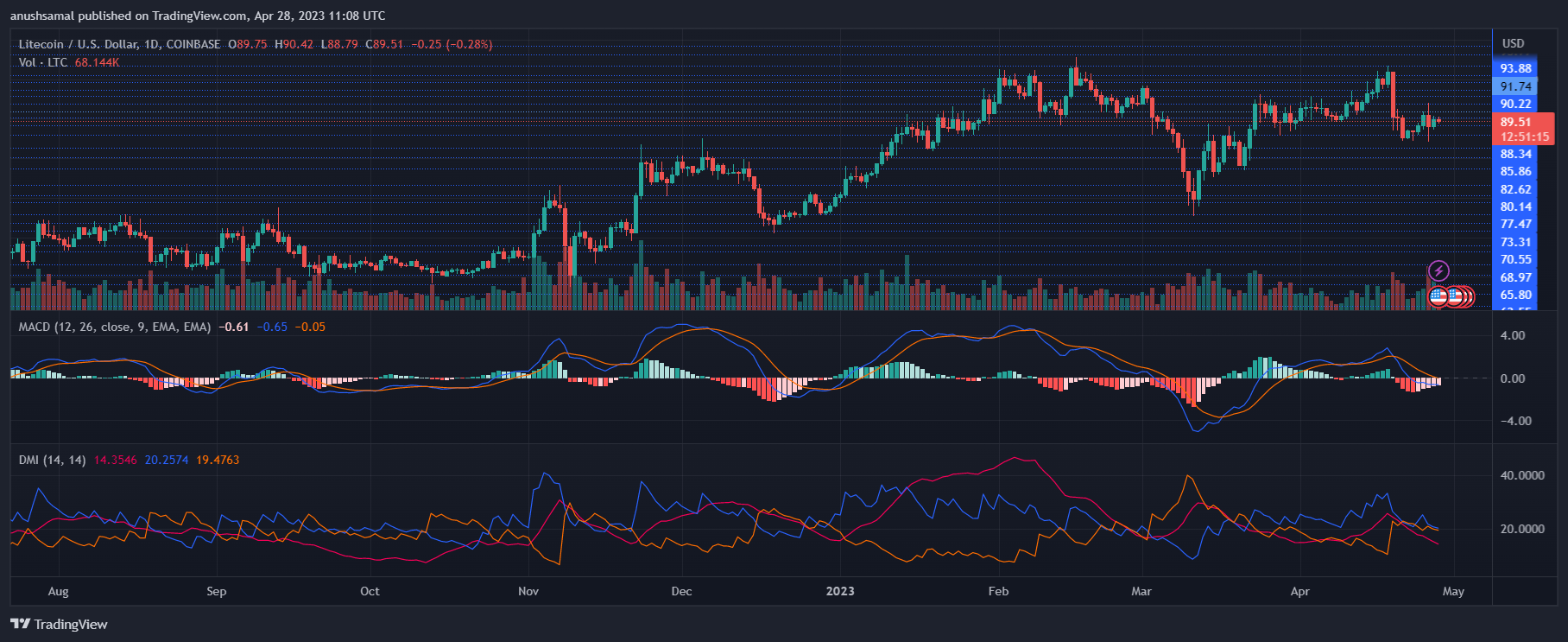

Litecoin Price Analysis: One-Day Chart

At the time of writing, LTC was trading at $89.58, and the overhead resistance level was at $90, which the coin has attempted to break through over the past few weeks. If LTC manages to surpass this level, it could potentially trade near the $100 mark.

However, for a recovery on the chart to occur, selling pressure needs to decrease. On the flip side, if LTC falls from the $89 mark, it could reach $88. Failing to stay above that level could drag the price down to $84. The last trading session showed a red volume of LTC traded, indicating that sellers were dominating the market.

Technical Analysis

Following the formation of a tall bearish engulfing candlestick, the price of LTC has been steadily decreasing, and demand has also diminished. The Relative Strength Index (RSI) remains below the 50-mark, indicating that there is more selling pressure than buying strength.

Additionally, LTC has fallen below the 20-Simple Moving Average line, indicating that sellers are driving the price momentum. However, the price has moved above the 50-SMA line (yellow), suggesting that LTC might attempt to recover over the next trading session.

In line with other indicators, LTC has shown sell signals associated with negative price action. The Moving Average Convergence Divergence (MACD), which indicates price momentum and reversals, has continued to form red histograms, signaling sellers to the table.

The Directional Movement Index has also been negative, with the +DI line (blue) below the -DI line (orange). Furthermore, the Average Directional Index has fallen below the 20-mark, indicating that the current price trend lacks strength. However, with an increase in demand and broader market strength, LTC may be able to break through its overhead resistance level in the coming trading sessions.