Litecoin has continued to decline and has now slipped under the $80 level, but if a metric is anything to go by, the coin may be near the bottom.

Litecoin Is Now In The MVRV Opportunity Zone

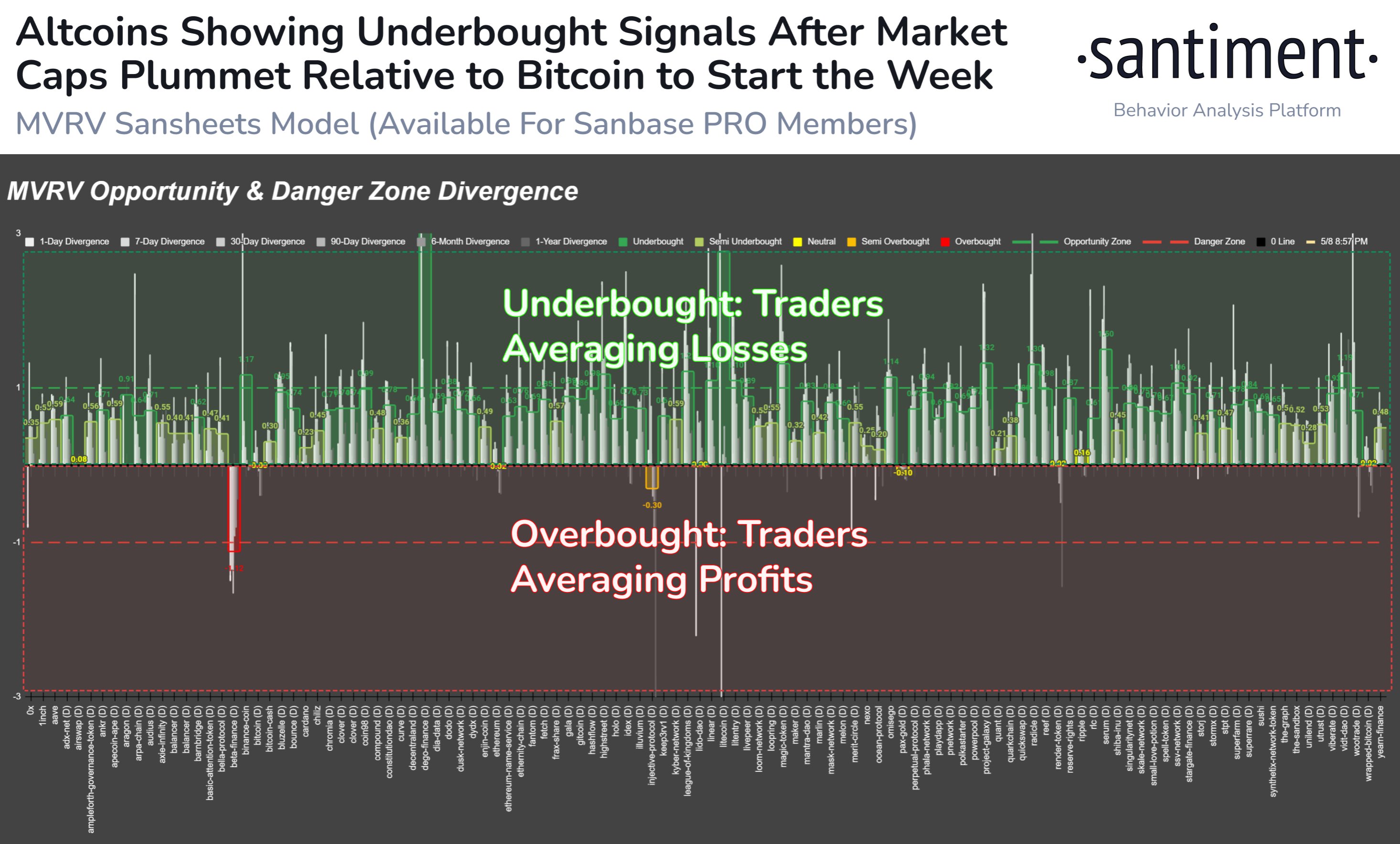

According to data from the on-chain analytics firm Santiment, some altcoins, including Litecoin, are showing underbought signals after the recent price decline. The “MVRV” (Market Value to Realized Value) is an indicator that measures the ratio between the market cap of a given asset and its realized cap.

The realized cap here refers to a sort of “true” value model that says the actual value of any token in the circulating supply is the price at which it was last moved on the blockchain, and not whatever the current price of the asset is.

The MVRV compares the market cap (that is, the current price) with this realized cap to estimate whether the cryptocurrency is undervalued or overvalued at the moment.

When the value of this indicator rises above 1, it means the given coin may be becoming overpriced. On the other hand, a decline below this line implies underbought conditions for the asset.

Santiment has defined its own “opportunity” and “danger” zones for the MVRV on the respective sides of the 1 mark, after entering which the asset attains a higher probability of bottoming/topping out.

Now, here is a chart that shows the divergence of the MVRV indicator from these zones for various cryptocurrencies in the sector:

The way that Santiment has defined the divergence (that is, the distance from the zones) has made it so that a buying signal occurs when an asset’s MVRV divergence crosses 1, while a selling signal takes place below -1 (this orientation is the opposite of what’s usually the case in the MVRV ratio; this flip is done with the intention to make the metric more intuitive).

From the chart, it’s visible that most of the assets in the market are in the positive region currently, suggesting that they are close to being underbought. A few of these, like Litecoin, have outright entered into the opportunity zone, meaning that this may be a good time to buy the asset.

Litecoin has entered into this zone as its value has slipped below the $80 mark for the first time since March and has put the average investor into a state of loss.

Historically, the more investors have been in a state of loss, the closer the price of the cryptocurrency has come to a bottom. This is the reason why the aforementioned opportunity zone has provided ideal points for buying into the asset.

In the case of Litecoin, a bullish narrative in the form of its halving, an event where its mining block rewards will be cut in half, is also right around the corner now, so there is an increased probability that the price could bottom out and rebound soon. It’s uncertain, however, whether the bottom is already here or if there is still some drawdown to go.

LTC Price

At the time of writing, Litecoin is trading around $79, down 1% in the last week.